TLDR

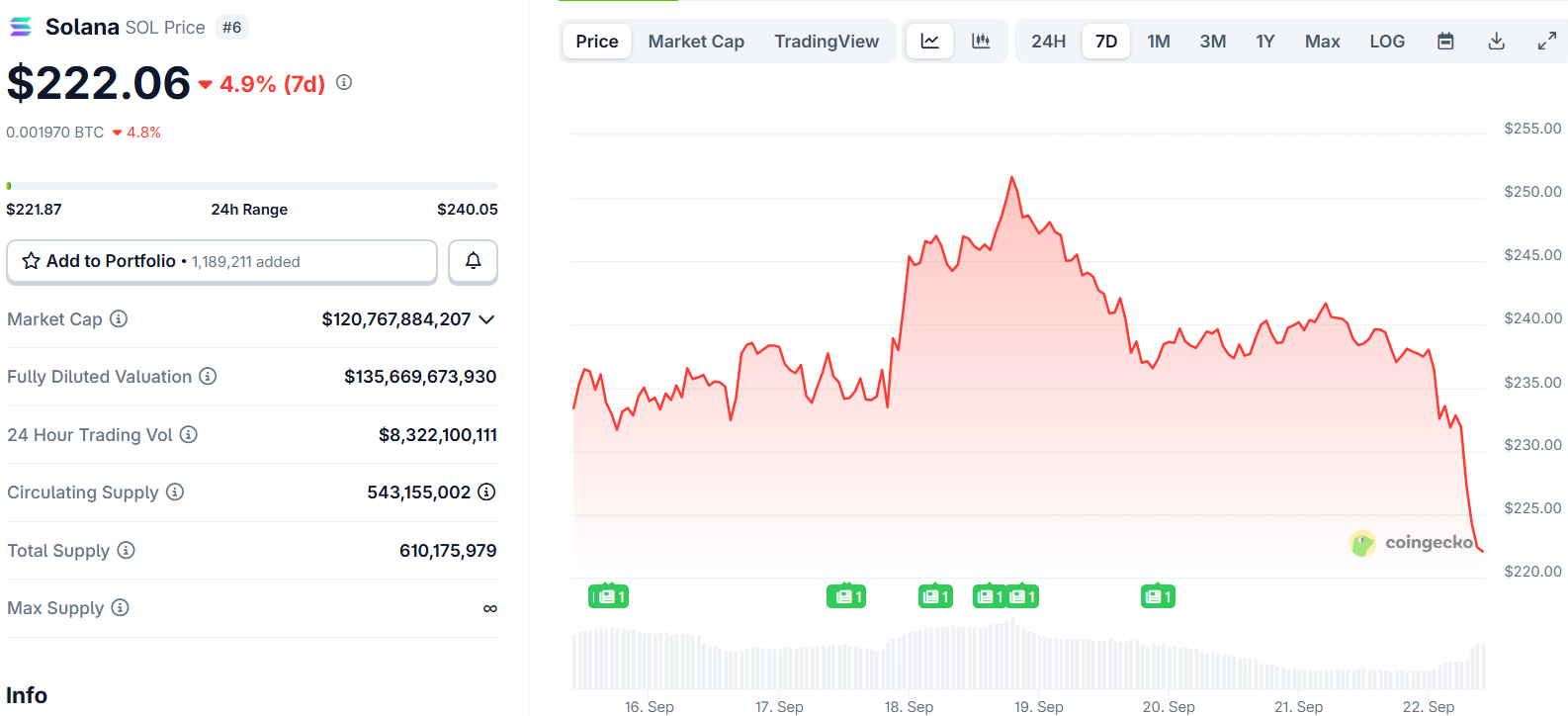

- Solana (SOL) trades at $222 on September 22, 2025

- Galaxy Digital injected $306 million into Solana treasury last week, locking up 17.1 million SOL tokens

- Technical analysis shows support levels at $242 and $240, with potential targets at $294 if $250 resistance breaks

- Broader crypto market declined $77 billion in market cap, with Bitcoin and Ethereum also weakening

- Trading volumes increased 61% in 24 hours despite price consolidation and cooling memecoin activity

Solana enters Monday trading at $222, showing a 15% decline from Thursday’s high. The cryptocurrency has pulled back from levels above $245 reached earlier this month.

This movement comes after a strong rally that saw SOL break above $250 resistance before entering consolidation.

Trading volumes have increased 61% over the past 24 hours despite the price pullback. Market data shows the RSI has dropped below the neutral 50 level on hourly charts.

The hourly MACD indicator has also lost momentum according to technical analysis. These signals suggest bulls are taking a pause after recent gains.

Technical Levels in Focus

Key support levels are emerging at $210 and $200 for near-term price action. Analysts are watching the 50% Fibonacci retracement level from the recent $232 to $253 move.

A break below current support could target $232 and potentially $220. These levels would represent deeper retracement from recent highs.

On the upside, clearing $250 resistance remains the key technical hurdle. A decisive break above this level could open paths toward $294 and higher targets.

Weekly charts show an ascending triangle pattern forming. Some analysts also identify a potential cup and handle formation that could support further gains.

Institutional Investment Drives Confidence

Galaxy Digital’s $306 million treasury injection last week continues to support market confidence. This investment locked up 17.1 million SOL tokens, representing nearly 3% of total supply.

🚨JUST IN: According to @lookonchain Galaxy Digital has purchased nearly 5M $SOL ($1.16B) in the past 3 days, moving 4.72M $SOL ($1.11B) to Coinbase Prime for custody. pic.twitter.com/srUrwftGZP

— SolanaFloor (@SolanaFloor) September 13, 2025

The institutional backing has reinforced beliefs in Solana’s long-term prospects. Professional traders maintain focus on the blockchain’s expanding ecosystem.

ETF flows and stablecoin adoption on Solana remain key discussion points. DeFi use cases continue growing across the network.

Social media activity around Solana stays elevated among crypto traders. The combination of technical setups and institutional support maintains interest.

Market participants are closely watching for additional institutional moves. Treasury activities often precede price movements in either direction.

The supply reduction from locked tokens creates potential scarcity dynamics. This factor supports longer-term bullish scenarios among analysts.

Solana’s memecoin trading has cooled compared to earlier 2025 activity. Traders are shifting toward utility-focused projects and stable growth opportunities.

The broader cryptocurrency market declined $77 billion in total market capitalization today. Bitcoin led the selloff with sharp losses from recent levels.

Ethereum also weakened alongside other major cryptocurrencies. XRP joined Solana in testing lower support areas during the session.

Despite the market-wide decline, Solana’s relative performance remains stable. The cryptocurrency has maintained better resilience compared to some peers.

Current forecasts suggest SOL may trade around $239 average for the week. ETF approval prospects and macroeconomic developments could influence direction.

Galaxy Digital’s treasury backing and ecosystem growth provide fundamental support at current levels.