TLDR

- Crypto liquidations reached $1.7 billion within 24 hours, with Ethereum, Ripple, and Solana experiencing significant losses.

- Overleveraged long positions were the primary trigger for the massive liquidation event in the crypto market.

- Ethereum saw $483 million in liquidations while Bitcoin faced $276 million during the downturn.

- Recession fears and weak global economic data contributed to the volatility and subsequent sell-off in the crypto space.

- Analysts pointed to low liquidity as a key factor that intensified the rapid market shifts and liquidation spikes.

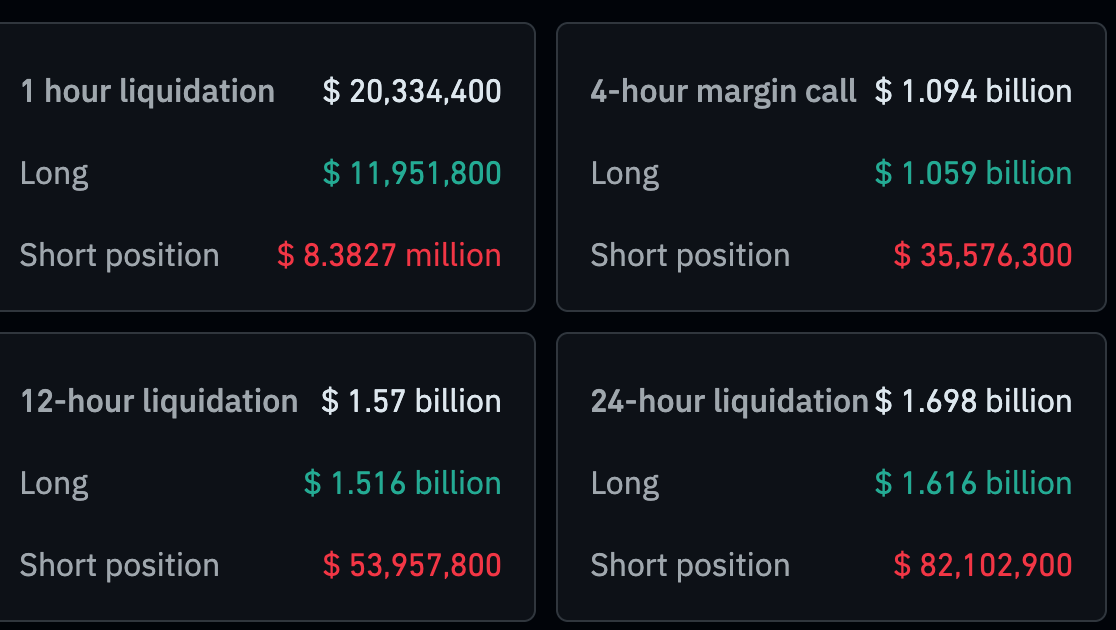

The crypto market experienced a significant downturn, with liquidations reaching nearly $1.7 billion in just 24 hours. Ethereum, Ripple (XRP), and Solana saw sharp declines of around 8%, while Bitcoin briefly posted double-digit losses. A combination of factors, including high leverage and low market liquidity triggered the rapid sell-off.

Why Crypto Liquidations Spiked So Fast

Several key factors contributed to the sharp increase in crypto liquidations. Recession fears and weak global economic data put pressure on risk assets. Low liquidity in the market amplified volatility, making it more vulnerable to sudden shifts. The liquidation cascade began when leveraged long positions in major coins were forced out, causing further declines.

Ethereum led the way with $483 million in liquidations within 12 hours. Bitcoin followed with $276 million liquidated during the same period. According to Coinglass, a total of $1.7 billion was wiped out, with $1.615 billion of that in long positions.

- Source: Coinglass

Some analysts speculated that the timing of this liquidation wave may have been connected to rumors surrounding a major crypto announcement. These rumors influenced market sentiment, possibly prompting traders to react more swiftly. “The liquidation wave intensified due to high leverage and the market’s fragile state,” said one market analyst.

On-Chain Data Signals Weakening Market Activity

On-chain data highlights a trend of weakening market momentum, with trading volume thinning in recent weeks. Analysts had warned that leverage levels were unsustainable, increasing the risk of further liquidations. Each price rally has been short-lived, quickly replaced by consolidation phases, signaling an unstable market environment.

The latest liquidation event has raised concerns about systemic risk in the crypto space. With many traders exiting positions, Bitcoin and stablecoins may become safer bets for investors. The broader market also faces uncertainty due to ongoing macroeconomic pressures.

Central bank policy decisions, especially the Federal Reserve’s, will play a crucial role in shaping the market’s next phase. These decisions, alongside any major announcements, will likely dictate whether the market stabilizes or faces another downturn. For now, investors await further developments to gauge the future direction of crypto markets.