TLDR

- Bitcoin currently trades around $115,800, up from $63,000 in late 2024

- Technical indicators like MVRV Ratio at 2.1 suggest pre-euphoria stage before potential rallies

- Stock-to-Flow ratio jumped to 426, indicating tightening supply dynamics

- Q4 historically Bitcoin’s strongest quarter with 40-60% gains possible

- Community sentiment remains bullish with 82% of 4.8 million votes optimistic

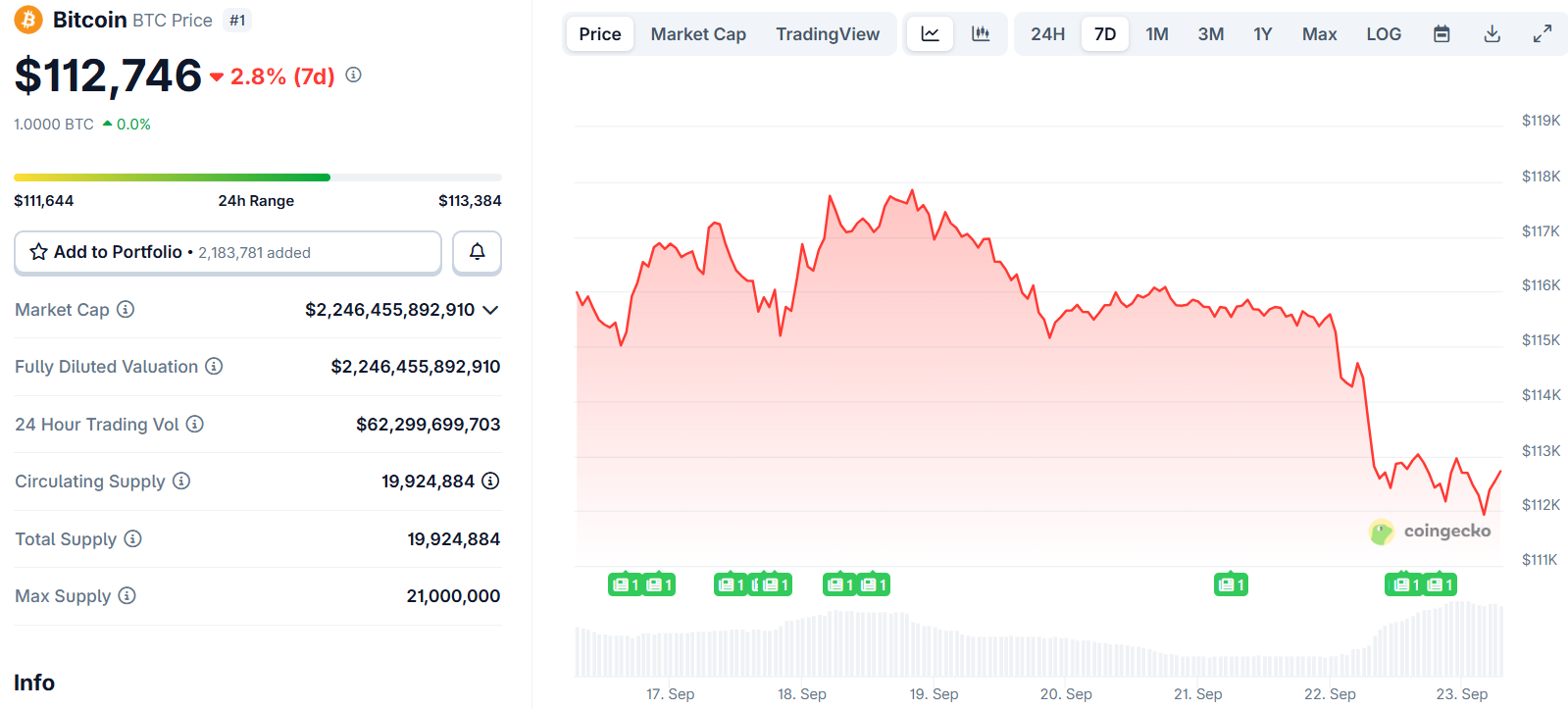

Bitcoin trades at approximately $115,800, showing a decline of 0.25% at press time. The digital asset has climbed from around $63,000 in late 2024 to current levels.

This represents nearly a doubling in value over less than one year. The price movement follows historical patterns that have characterized previous Bitcoin market cycles.

Data from Crypto Rank shows Bitcoin’s steady climb throughout 2025. September performance has been particularly strong, with predictions suggesting continued growth.

The current price level places Bitcoin near yearly highs. Momentum appears to be building as the fourth quarter approaches.

Technical analysis reveals several key indicators pointing to potential continued growth. The MVRV Ratio currently sits at 2.1, which historically marks a pre-euphoria zone.

This metric has preceded parabolic rallies in past market cycles. The ratio compares market value to realized value, providing insight into market sentiment.

Supply Dynamics Point to Scarcity

Bitcoin’s Stock-to-Flow Ratio has surged to 426, indicating tightening supply conditions. This metric compares circulating supply against new issuance rates.

Historical data shows that spikes in this ratio typically precede major upward price movements. The current trajectory mirrors earlier cycles where growing scarcity fueled rallies.

Lower sell pressure from long-term holders reinforces Bitcoin’s scarcity narrative. This behavior pattern has supported price stability during recent market tests.

The Network Value to Transactions Ratio has spiked to 759. This means Bitcoin’s market value currently outpaces its transaction volume.

Such surges historically signal investor confidence in holding positions. Price appreciation is outpacing network activity, suggesting accumulation behavior.

Market Sentiment Remains Positive

Community sentiment data from CoinMarketCap reveals strong optimism. Out of 4.8 million votes, 82% of participants remain bullish on Bitcoin.

Only 18% expect a price decline, suggesting widespread confidence. This sentiment persists despite recent short-term volatility.

Funding rates on Binance have remained mostly positive throughout recent trading sessions. Positive rates indicate traders are willing to pay premiums for leveraged long positions.

This demonstrates strong speculative demand for upward price movement. Occasional negative dips have helped flush weaker positions from the market.

Fourth quarter performance historically favors Bitcoin price growth. Past data shows October through December often adds 40-60% gains.

Bitcoin is already up approximately 25% in 2025. If seasonal patterns repeat, the asset could see continued strength through year-end.

JUST IN: 📈 SkyBridge Capital founder Anthony Scaramucci, maintains his $150,000 #Bitcoin price, by year end. pic.twitter.com/anZqFyv163

— Bitcoin.com News (@BTCTN) September 22, 2025

Current price predictions from Coincodex suggest Bitcoin could reach $126,000 by the end of September. Daily growth patterns show consistent upward movement through the month.

#BITCOIN ENTERS A HUGE BULL RUN. pic.twitter.com/6STkmGzwM8

— AO (@AO_btc_analyst) September 21, 2025

Chart analysis indicates potential for Bitcoin to reach the $130,000-$150,000 range by year-end. Even bearish scenarios suggest support levels around $90,000-$100,000.