BTC prices fell by 6 percent on Sunday to $8,620 within five minutes.

The bitcoin market downturn had a domino effect on 20 of the most popular digital currencies. The prime digital currency traded at just over $9,000 before the semi-momentous plunge. It was the steepest decline this year, but the bulls appear to be regaining control.

So, What Caused The Sudden Price Dip?

Liquidation of overleveraged long positions is believed to have caused the bloodbath. Bitcoin prices had risen by over 20 percent in the preceding weeks due to bullish market sentiment, but the mini-rally hit a snag due to price inflation.

Liquidation typically occurs when a sudden price decline dissolves long overleveraged market positions. Once the liquidation limit is reached, traders are forced to sell digital assets put up as collateral.

About $110 million was liquidated on BitMEX alone during the price decline.

There was likely more liquidation at Binance, Deribit, and Kraken. A few analysts had warned that the recent price escalation lacked key drivers and feared that a pullback within the month was imminent.

Bitcoin prices are generally expected to skyrocket in the coming months as traders and hodlers anticipate the blockchain halving episode. It leads to a 50 percent decrease in mining rewards, thereby causing a scarcity of coins. The low supply subsequently precipitates a surge in demand.

The event is set to take place in May, but until then, the more conservative approach is short-term bearish but medium-term bullish.

Current Bitcoin Prices More Psychological Than Technical

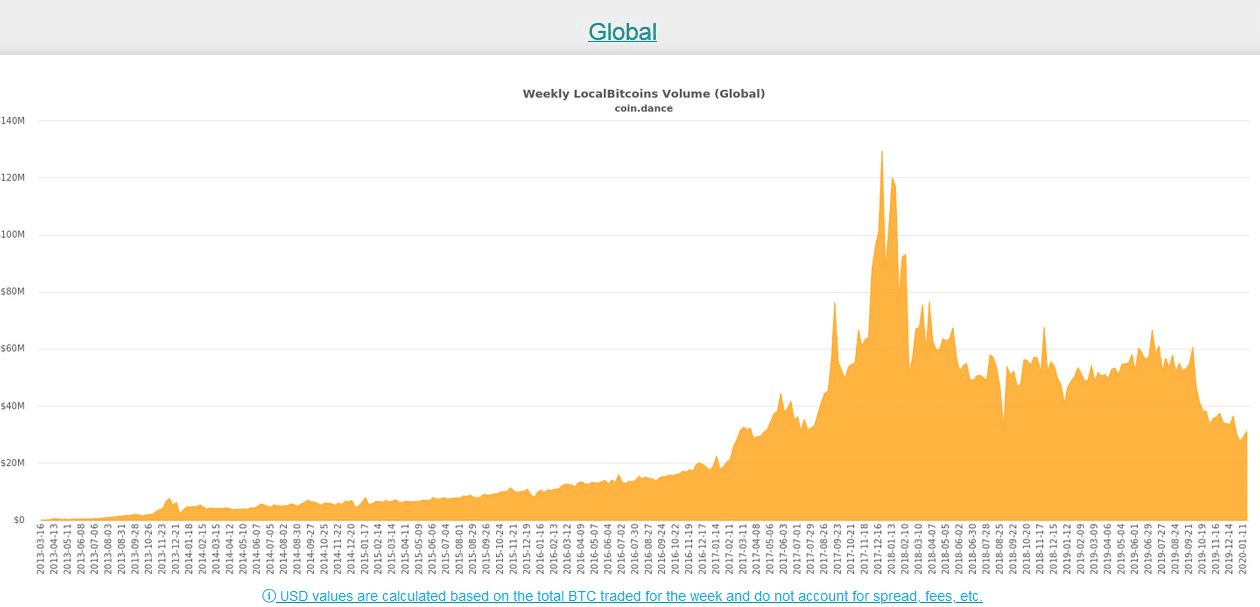

Right now, BTC trade volumes are down globally as compared to last year. They match mid-2017 figures. It is probable that users are choosing to hold rather than trade in their cryptocurrency stash.

In a nutshell, the current market movement seems to be more psychological than technical as there doesn’t seem to be a direct correlation to demand.

(Featured Image Credit: Pixabay)

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.