TLDR

- AERO gained 4% in 24 hours while the broader crypto market dropped 4%, making it the top performer

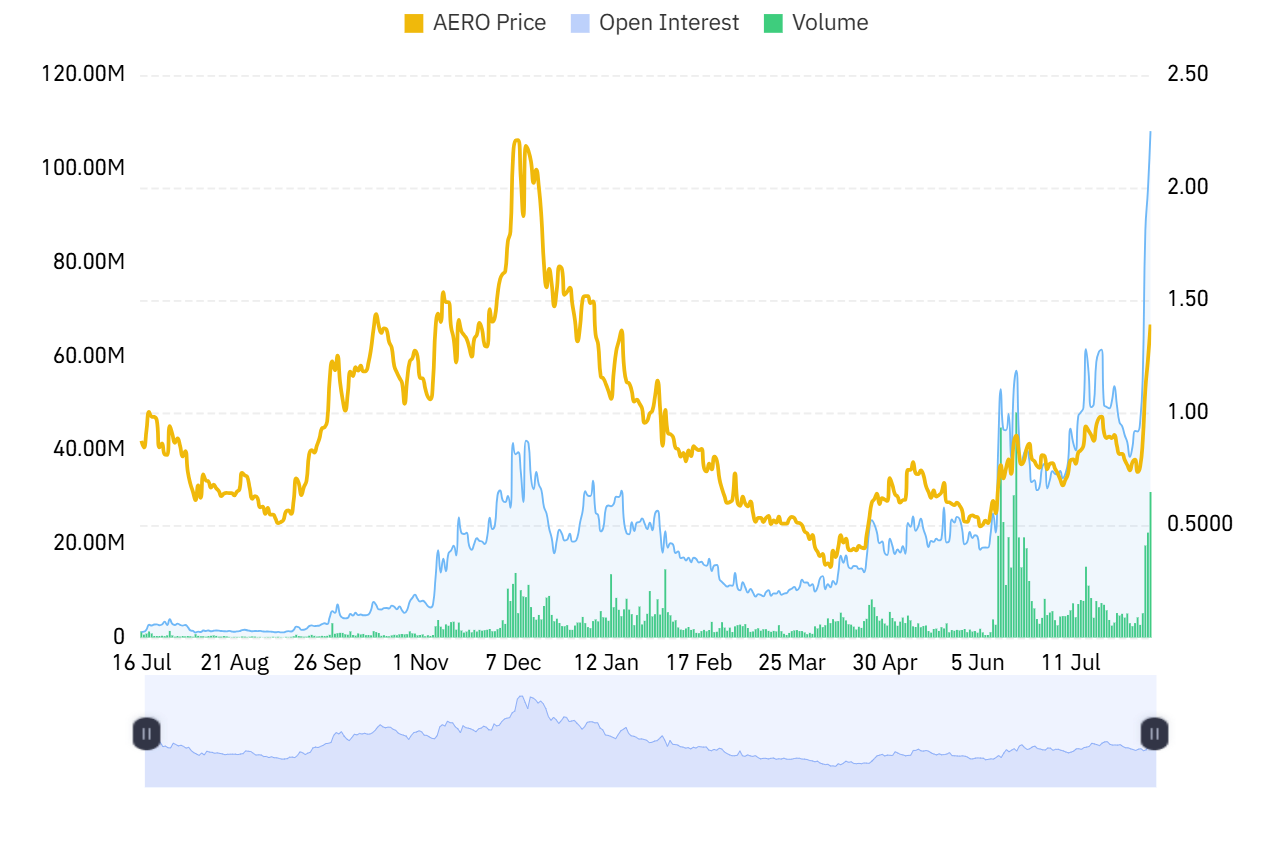

- Trading volume fell 23% to $162.41 million despite the price increase, creating a negative divergence pattern

- Futures open interest declined 16% to $97 million, showing reduced trader conviction in the rally

- Token broke $1.12 resistance after Coinbase Base network integration but now faces key support at $1.32

- Large holders are accumulating AERO while exchange reserves drop, providing some price support

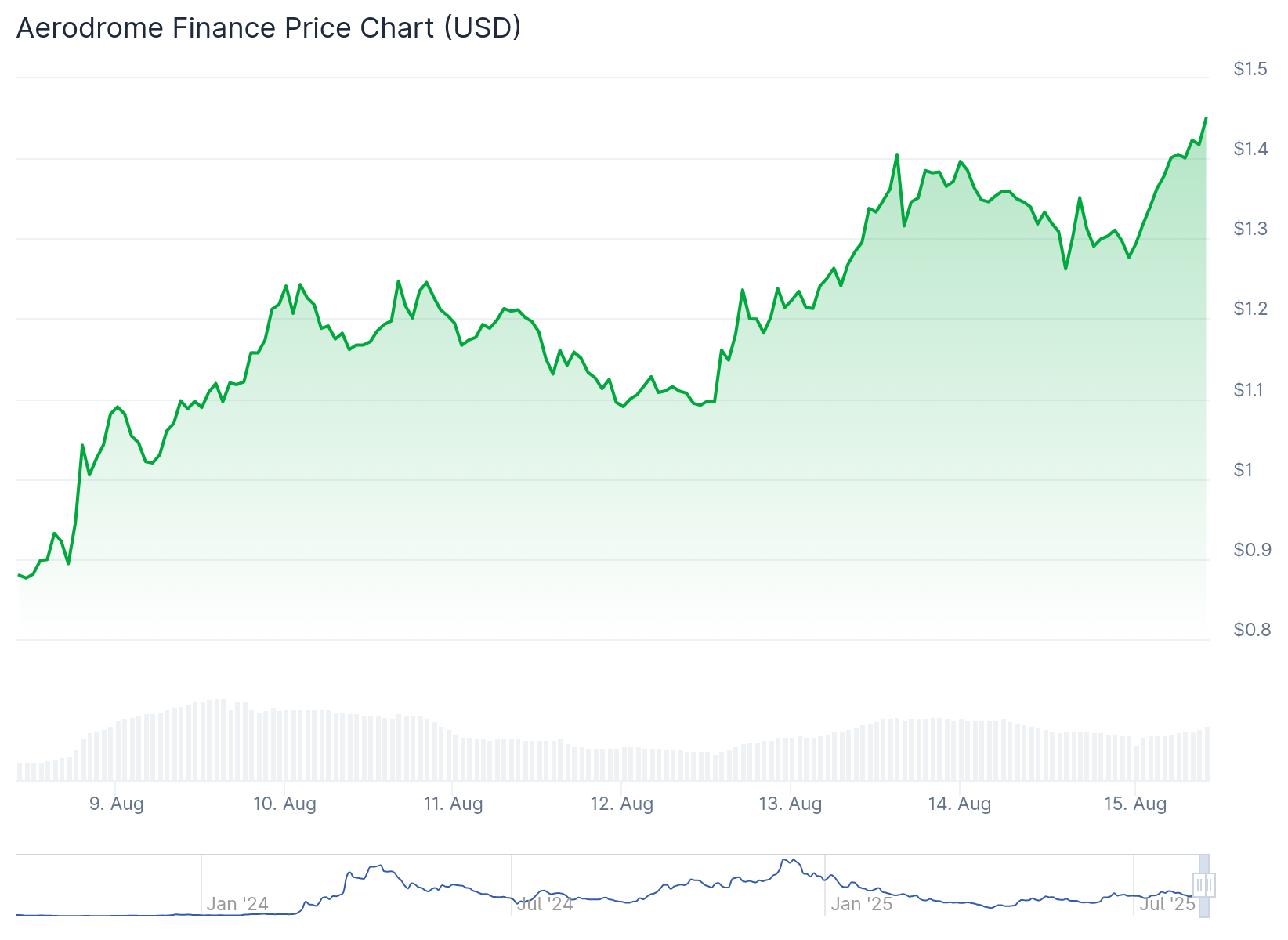

Aerodrome Finance’s AERO token posted a 4% gain during Thursday’s trading session, standing out as the market’s top performer while most cryptocurrencies declined. The token currently trades at $1.42, maintaining its position above the $1.31 support level.

The price action comes after a recent integration with Coinbase’s Base network that initially drove the token up 15% earlier in the week. AERO reached $1.35 following the Base network announcement, with 24-hour volume hitting $246.57 million at that time.

However, current trading patterns show some concerning trends beneath the surface gains. Trading volume dropped 23% to $162.41 million during Thursday’s rally, creating what analysts call a negative divergence.

This divergence occurs when price rises but volume declines. It typically indicates that fewer participants are supporting the upward movement.

In healthy rallies, increasing volume usually accompanies price gains. This shows strong buying interest and broad market conviction.

The current pattern suggests AERO’s recent gains may be driven more by short-term speculation than genuine demand. This leaves the token more vulnerable to sudden reversals if selling pressure emerges.

Futures Market Shows Declining Interest

Additional data from derivatives markets supports the cautious outlook. AERO’s futures open interest fell 16% to $97 million over the past 24 hours.

Open interest measures the total value of outstanding futures contracts that haven’t been settled. When open interest rises alongside price increases, it signals new money entering the market.

The opposite pattern seen with AERO suggests traders are closing positions rather than opening new ones. This indicates reduced confidence in the current rally’s sustainability.

Despite these warning signs, some positive factors remain in play. Large holders continue accumulating AERO tokens, causing exchange reserves to drop.

This accumulation pattern has historically provided price support during market downturns. The reduction in available supply on exchanges can help limit selling pressure.

Technical Levels and Outlook

From a technical perspective, AERO faces key levels in both directions. The token must hold above $1.31 support to maintain its current uptrend.

A break below this level could trigger deeper declines toward $1.06. This represents a potential 25% drop from current levels.

On the upside, bulls need to push AERO above $1.56 resistance to extend the rally. A successful break could open the path toward $1.85.

The token’s recent performance has been impressive over longer timeframes. One analyst noted AERO has risen 45% since late July.

$AERO

"update"The price has increased by %45 since my AERO twit on July 24th ✅

Although I changed my micro EW count due to last price actions, there is no change in my macro expectation.

Wave 3rd is the next major stop and promises 3x … https://t.co/XF7cCK5vcp pic.twitter.com/DxugWMosb3

— Sarper Önder (@sarper_onder) August 13, 2025

The Coinbase Base integration represents a fundamental catalyst for the project. DEX tokens on major networks often benefit from increased usage and attention.

Trading activity metrics show mixed signals for near-term direction. While current volume has declined, earlier surge patterns reached $656 million daily volume.

The OI-weighted index currently sits at 0.0133%, indicating recent price moves are supported by some derivative activity.

Market participants are watching whether AERO can maintain momentum into the weekend. Cryptocurrency markets often see reduced activity during weekends.

AERO’s current market capitalization stands at approximately $1.18 billion, making it a mid-cap altcoin within the DeFi sector.