TLDRs:

- Alibaba shares rise 3.36% pre-market on AI and cloud growth optimism.

- Analysts boost price targets, citing stronger AI and cloud prospects.

- Investors flock back as September sees best monthly performance since 2019.

- Nvidia partnership and Qwen3-Max AI model drive renewed investor confidence.

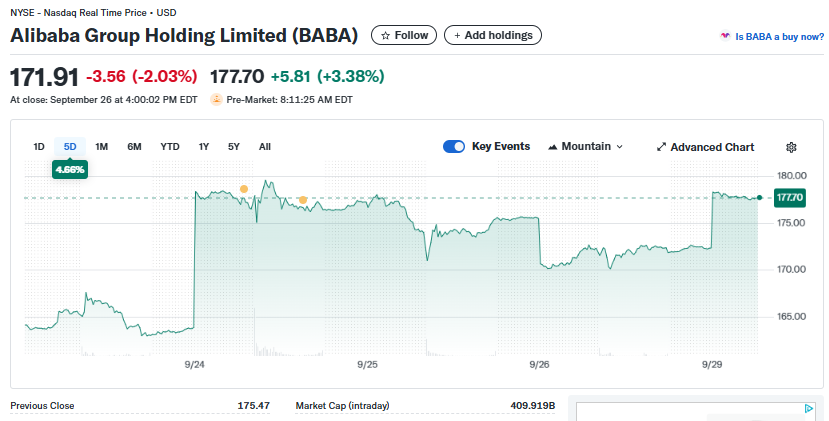

Alibaba Group Holding Limited (NYSE: BABA) saw its shares climb over 3% in pre-market trading on Monday, September 29, as enthusiasm around its artificial intelligence (AI) initiatives and cloud growth bolstered investor sentiment.

The stock, which closed at $171.91 on September 26, rose to $177.66 in early pre-market trading, representing a 3.36% rebound.

The surge comes after a week of heightened activity and positive developments for the Chinese tech giant. Analysts at Morningstar raised their fair value estimate for Alibaba’s shares in both the US and Hong Kong markets by nearly 50%, citing the company’s strengthened position in AI and cloud infrastructure.

Morgan Stanley followed suit, increasing its price target for Alibaba American Depositary Receipts (ADRs) by 21% to $200 and highlighting the firm’s expanding cloud capabilities and recent partnership with Nvidia.

Pre-Market Gains Reflect AI Optimism

Investor excitement around Alibaba’s AI investments has positioned the company as one of China’s leading AI enablers.

Morgan Stanley analysts attending the firm’s recent AI conference in Hangzhou described Alibaba’s flagship Qwen3-Max model as one of the top three AI systems globally, surpassing competing platforms such as GPT-5 and Claude Opus 4.

This recognition helped fuel a renewed buying spree among both institutional and retail investors, particularly in China, where Alibaba’s Hong Kong-listed shares saw HK$61 billion in net purchases in September alone.

Analysts Raise Price Targets

Following these developments, financial analysts have grown increasingly bullish on Alibaba. The company reported strong quarterly results, driven in part by better-than-expected cloud sales and growth in AI-related products.

Analysts note that Alibaba is no longer perceived solely as an e-commerce platform but as a significant player in AI and cloud infrastructure, a shift that has captured the market’s attention.

13/ $BABA | Alibaba

One name that's not often associated with AI is Alibaba. $BABA has a strong market position and is heavily investing in their cloud infrastructure.Alibaba Cloud is the largest cloud computing provider in China. Just like Amazon's AWS is the engine for the… pic.twitter.com/TErsPfXK51

— TacticzHazel – Value Investing (@TacticzH) August 29, 2025

Investors Eye Cloud Expansion

The partnership with Nvidia and plans to increase AI spending signal Alibaba’s commitment to becoming a dominant force in the AI and cloud sectors.

Fund managers, including Cathie Wood’s Ark Investment Management, have reopened positions in Alibaba’s US-listed shares after a four-year hiatus, reflecting confidence in the company’s strategic direction.

Options traders are also increasingly bullish, as the cost of contracts on Hong Kong-listed shares reached the highest level since 2022 relative to the Hang Seng Tech Index.

September Marks Strong Turnaround

September has proven to be a transformative month for Alibaba. The company’s Hong Kong-listed shares have surged approximately 50%, making it the best-performing stock on the Hang Seng Tech Index.

This marks a notable turnaround following months of muted investor interest, initially driven by concerns over price competition in China’s food-delivery market. Valuations remain attractive compared with global peers, trading at roughly 20 times estimated forward earnings versus nearly 25 times for Amazon and over 30 times for Microsoft.

Overall, Alibaba’s pre-market rise underscores investor confidence in its AI and cloud strategies. With sustained momentum, the company is on track to deliver its strongest monthly performance since its 2019 Hong Kong listing, highlighting its growing influence in the global technology and AI landscape.