TLDRs;

- JPMorgan lifts Alibaba price target to $30.85 by 2026, forecasting a 36% upside driven by AI momentum.

- Alibaba’s Hong Kong shares surged 53% in September, making it the best-performing stock on the Hang Seng Index.

- CEO Eddie Wu commits to expanding AI spending beyond $53B, while partnering with Nvidia on advanced AI projects.

- Analysts remain split with some seeing Alibaba overvalued, while others argue its low P/E ratio suggests hidden upside.

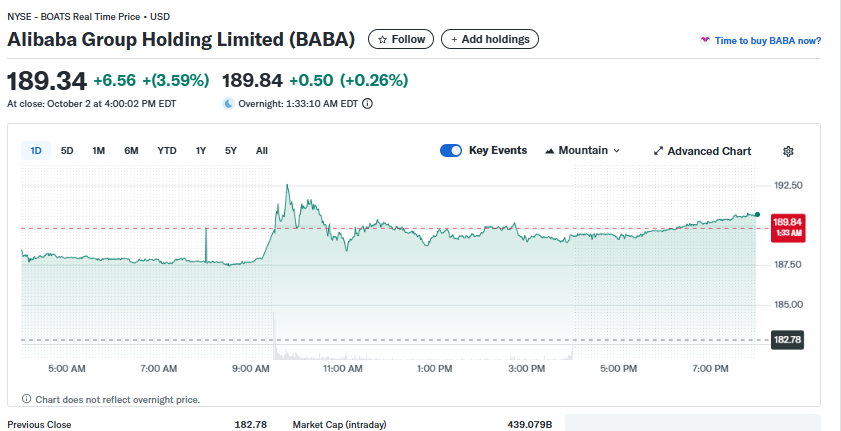

Alibaba Group Holding (NYSE: BABA) is once again in the spotlight after a major upgrade from JPMorgan Chase sent its shares climbing.

The bank’s analysts, led by Alex Yao, raised their price target for Alibaba’s Hong Kong-listed shares to HK$240 (US$30.85), implying a potential 36% upside from the company’s most recent closing price.

This projection, the most optimistic among analysts tracked by Bloomberg, reflects growing confidence in Alibaba’s artificial intelligence (AI) strategy and the increasing integration between its cloud computing and ecommerce divisions.

The move comes at a time when Alibaba is aggressively doubling down on AI. CEO Eddie Wu recently announced a ramp-up in AI-related investment, surpassing the company’s already staggering US$53 billion commitment. Coupled with a high-profile partnership with Nvidia on AI and humanoid robotics, the announcements have reignited investor enthusiasm after years of regulatory headwinds and market skepticism.

Alibaba Leads Hang Seng Index in September

Investor momentum has been palpable. In September, Alibaba’s Hong Kong shares surged by 53%, making the company the best performer on the Hang Seng Index. Much of the rally was driven by its AI announcements and increasing signs that cloud revenue growth is accelerating again.

According to JPMorgan, this combination of AI momentum, cloud expansion, and ecommerce dominance positions Alibaba for renewed long-term growth.

This optimism marks a stark reversal from 2022, when JPMorgan briefly labeled Chinese internet stocks “uninvestable” due to an editorial misstep. Now, with sentiment shifting, Alibaba is being reframed as a growth leader capable of riding the AI wave both domestically and globally.

Bold AI Bets and Nvidia Partnership

The turning point has been Alibaba’s willingness to position itself as a heavy spender in AI. Beyond its headline-making US$53 billion investment pledge, the company has revealed that AI-related products have already posted triple-digit growth for seven consecutive quarters.

The Nvidia collaboration is equally significant. By aligning with the world’s most valuable semiconductor company, Alibaba gains access to advanced computing power essential for training large-scale AI models and scaling cloud services.

Analysts argue this partnership could cement Alibaba’s role as a global AI contender while providing a competitive edge in ecommerce personalization and business-to-business solutions.

Overpriced or Undervalued?

Despite the bullish forecast, debates over Alibaba’s valuation remain intense. Research from Simply Wall St suggests the fair value of Alibaba’s stock could be closer to US$107.09 per share, well below recent market levels. That would imply the stock is significantly overpriced at its current valuation.

On the other hand, Alibaba’s price-to-earnings (P/E) ratio of 19.6x remains lower than both the global industry average (21.7x) and peers in the sector (47.8x). Supporters argue this points to potential undervaluation, suggesting the market may still be underestimating the company’s earnings potential, especially if AI-driven revenue continues to accelerate.

Ultimately, the bullish JPMorgan call, combined with investor excitement around AI, has injected fresh optimism into Alibaba’s growth story. However, lingering risks remain, including unpredictable US-China trade tensions and potential regulatory scrutiny from Beijing.