TLDRs;

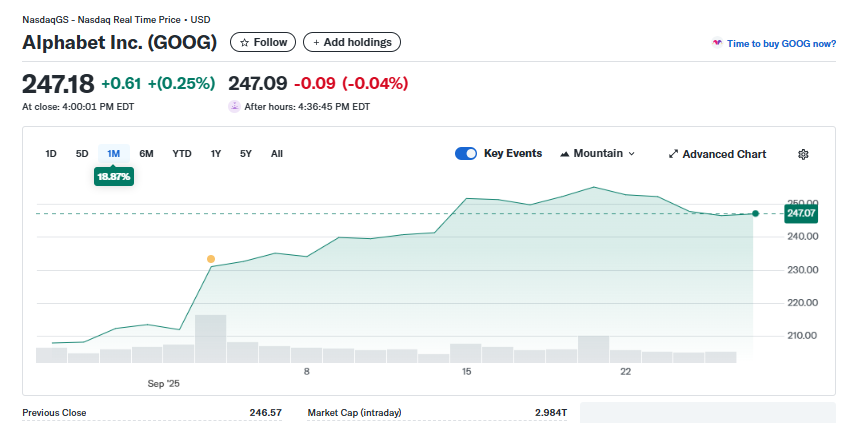

- Alphabet shares have surged about 29% in 2025, outpacing the Nasdaq 100 Index’s 17% rise.

- Investor optimism grows amid Alphabet’s AI product launches and multimodal search innovations.

- A favorable antitrust ruling and eased regulatory risks pushed Alphabet’s market cap near $3 trillion.

- Analysts raise price targets, citing Alphabet’s diversified business and leadership in generative AI.

Alphabet Inc. (GOOG), the parent company of Google, has seen its stock climb around 29% in 2025, significantly outperforming the Nasdaq 100 Index, which rose around 17% over the same period.

Investor confidence has been fueled by Alphabet’s growing influence in artificial intelligence, particularly its advances in multimodal search and generative AI products. These technological innovations are positioning the company as one of the leading AI-driven firms globally.

Alphabet’s latest quarterly earnings report highlighted surging demand for its AI-powered solutions. Since April 2025, shares have risen roughly 70%, reflecting strong market appetite for the company’s AI offerings.

Market Cap Approaches $3 Trillion

Mid this month, Alphabet briefly crossed the $3 trillion market capitalization threshold, joining the exclusive club of tech giants alongside Nvidia, Microsoft, and Apple.

The milestone was driven in part by a favorable antitrust ruling that alleviated shareholder concerns. The U.S. Department of Justice had sought severe penalties, including forcing Google to divest its Chrome browser. However, Judge Amit Mehta ruled against the harshest measures, giving Alphabet’s stock a significant boost.

Analysts Lift Price Targets on AI Leadership

Michael Nathanson of MoffettNathanson recently raised his price target for Alphabet to $295, citing both the company’s AI leadership and its diversified business model.

Investors are increasingly viewing Alphabet as a strong long-term play, with its portfolio spanning search, cloud computing, advertising, and AI products. The company’s Gemini AI suite, in particular, has been central to its strategy to dominate the next wave of artificial intelligence innovations.

CEO Sundar Pichai, who assumed the role in 2019, has steered Alphabet through the dual challenges of fierce AI competition and regulatory scrutiny. Competitors such as OpenAI and Perplexity have intensified the AI race, but Alphabet’s investments in generative AI and multimodal search have kept it ahead. The company’s regulatory resilience, aided by favorable court rulings, further reinforces its market position.

Sustaining AI Momentum

Alphabet’s future growth hinges on its ability to scale AI solutions while navigating regulatory landscapes in the U.S. and Europe. Analysts remain optimistic that its diversified business, combined with technological leadership, will continue to drive market performance.

With a market cap approaching $3 trillion and strong investor backing, Alphabet is set to remain a key player in both AI development and the broader technology sector.

The combination of strong AI demand, regulatory wins, and strategic diversification has made 2025 a landmark year for Alphabet. As investors watch closely, the company’s stock trajectory reflects both confidence in its technological edge and anticipation of continued growth in the AI space.