TLDR

- Ethereum perpetual futures volume dominance has overtaken Bitcoin for the first time since 2022

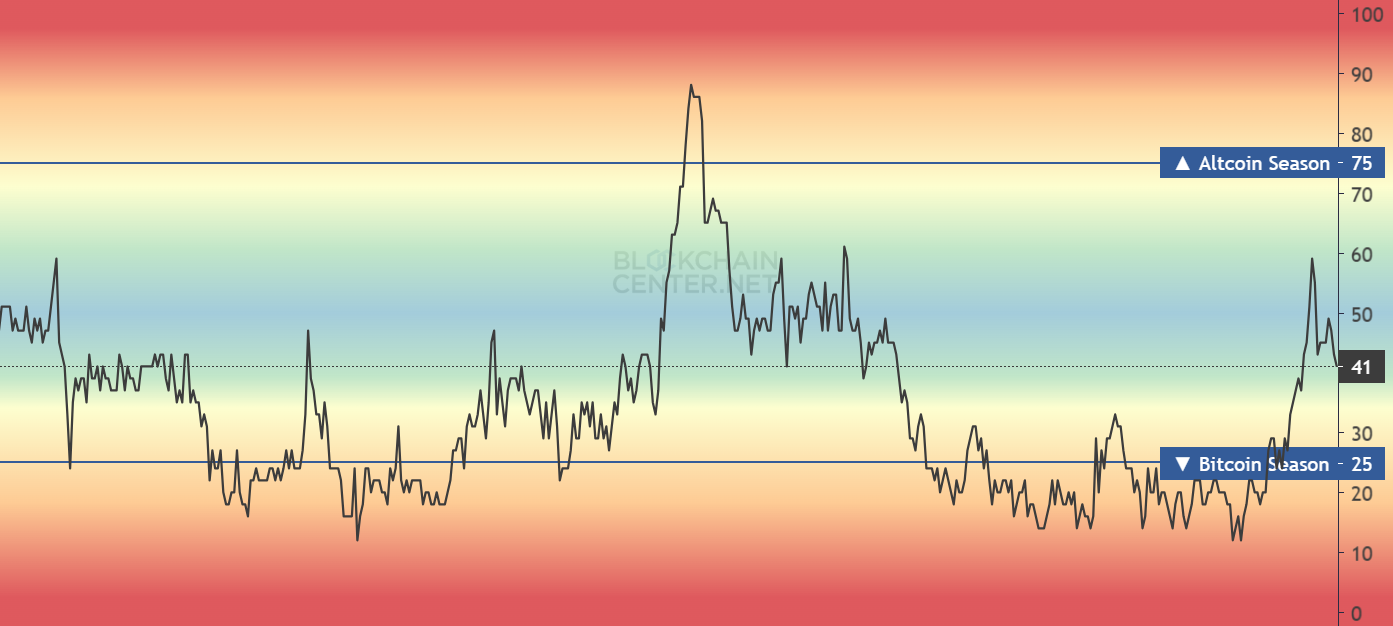

- 41% of top 50 altcoins are now outperforming Bitcoin, halfway to official altcoin season

- Ethereum has surged 55% this month while BNB gained 7.4% in the past week

- USDT transfers on Tron network show capital flowing into altcoin markets

- Stablecoin reserves on exchanges dropped from $45 billion to $36 billion

The crypto market is showing clear signs of a shift toward altcoins as Ethereum and other alternative cryptocurrencies gain momentum against Bitcoin. Data from multiple sources reveals this transition is already underway.

Ethereum perpetual futures volume dominance has surpassed Bitcoin for the first time since 2022. Glassnode calls this the largest volume skew in ETH’s favor on record.

This shift confirms a rotation of speculative interest toward the altcoin sector. Ethereum’s open interest dominance has climbed to nearly 40%, the highest level since April 2023.

The crypto market currently sits at 41% of the top 50 cryptocurrencies outperforming Bitcoin. An official altcoin season is declared when this figure reaches 75%.

Ethereum has gained 55% since the start of the month, approaching the $4,000 mark. This represents a 70% outperformance compared to Bitcoin during the same period.

The price surge stems from capital shifting from Bitcoin to Ethereum as investors seek higher returns. Regulatory developments in the United States have opened doors for institutional liquidity to flow toward Ethereum.

Growing Altcoin Activity

Onchain data shows sharp increases in USDT transfers on the Tron network. Binance drives this flow, accounting for 62% of all TRON-based USDT transfers.

Daily volumes range between $2.5 to $3 billion. These large stablecoin movements typically precede periods of elevated market volatility.

The growing concentration of stablecoin liquidity on Tron and Binance suggests these platforms remain preferred infrastructure for high-volume trading. This liquidity appears to be entering the altcoin market.

BNB has climbed 7.4% over the past week, outperforming Bitcoin. This positions BNB as another leading indicator of the market’s shift toward altcoins.

Nasdaq-listed Nano Labs recently disclosed a $105 million BNB treasury totaling 128,000 tokens. This marks a strategic move to diversify into digital assets.

Market Dynamics Shifting

Binance’s stablecoin reserves continue to decline, signaling that idle capital is being redeployed into the market. Overall USDT reserves on exchanges have dropped to $36 billion from $45 billion in February 2025.

This divergence between falling stablecoin reserves and rising altcoin prices suggests renewed risk appetite. The shift indicates increased buying pressure in the altcoin space.

Bitcoin’s dominance recently started to regain pace following a 6.1% decline earlier this month. The drop in Bitcoin dominance was initially seen as a signal that altcoin season might be approaching.

Analysts expect coins providing utility within the Ethereum ecosystem to thrive. These include Aave, Optimism, Celestia, and Arbitrum as Ethereum continues its upward momentum.

The positive momentum around Ethereum is expected to push its price toward $4,000 and potentially beyond. With continued capital flow from Bitcoin, Ethereum could reach new highs in the coming days.