TLDR

- ABTC stock fell 15% to $6.83, dropping below its $6.90 IPO price just one day after its Nasdaq debut

- The company is 80% owned by Hut 8 and 20% by Trump family members Donald Jr. and Eric Trump

- American Bitcoin holds 2,443 bitcoin worth approximately $269 million at current prices

- The company filed for an at-the-market equity raise of up to $2.1 billion to expand bitcoin holdings

- Bitcoin treasury companies have fallen out of favor with investors due to high premiums over their bitcoin holdings

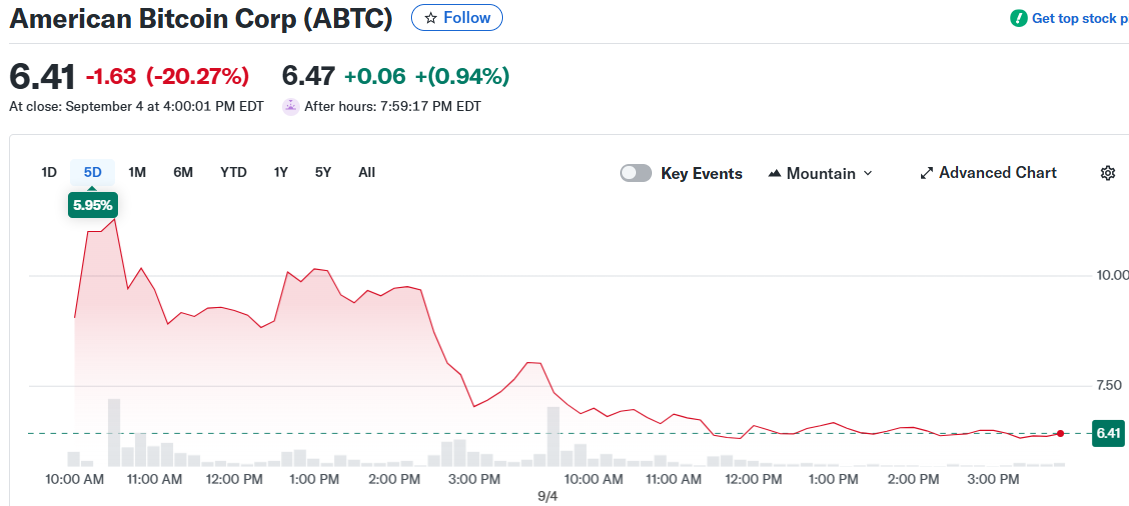

American Bitcoin made its public debut on Wednesday with high expectations, but reality hit hard just 24 hours later. The bitcoin mining company saw its stock price tumble 15% to $6.83 on Thursday, falling below its initial public offering price of $6.90.

The drop came after ABTC shares soared to $14.65 during morning trading hours before crashing in the afternoon. This volatility mirrors the typical price discovery phase that many newly public companies experience in their first days of trading.

American Bitcoin completed its public listing through a reverse merger with Gryphon Digital Mining. The company’s ownership structure includes 80% held by Hut 8 and 20% owned by Donald Trump Jr. and Eric Trump.

On the same day as its debut, the company filed paperwork for an at-the-market equity raise of up to $2.1 billion. These funds will be used to continue building the company’s bitcoin treasury holdings.

Bitcoin Treasury Strategy Under Pressure

The company currently holds 2,443 bitcoin worth approximately $269 million at bitcoin’s current price of around $110,128. American Bitcoin combines traditional mining operations with a treasury strategy focused on accumulating and holding bitcoin long-term.

This approach aims to create a financial cushion that helps smooth out the sharp revenue swings that come from mining alone. By stockpiling bitcoin, companies can benefit when prices rise while maintaining their mining operations.

Marathon Digital uses a similar strategy but has also seen its shares decline 3% over the past 24 hours. The broader bitcoin mining sector faced pressure on Thursday as bitcoin itself dropped 2% in 24 hours.

Bitcoin mining has become an increasingly competitive industry where survival depends on razor-thin margins. Power costs consume half or more of the revenue from each coin mined.

Hardware manufacturers continue flooding the market with new mining rigs, adding pressure even when demand slows. This forces miners to secure ultra-cheap energy sources and maintain highly efficient operations.

Market Sentiment Turns Cold

Bitcoin treasury companies have fallen out of favor with investors recently. MicroStrategy’s stock has dropped over 30% from its highest point this year despite its large bitcoin holdings.

Metaplanet, often called Japan’s MicroStrategy, has plunged 61% from its year-to-date high. These companies trade at high premiums to their actual bitcoin holdings, creating valuation concerns.

MicroStrategy currently has a $38 billion gap between its bitcoin holdings and enterprise value. Metaplanet shows a similar pattern with a gap exceeding $4 billion.

The bitcoin treasury industry has become saturated with over 100 public companies now holding close to 1 million bitcoin combined. This saturation makes it harder for individual companies to stand out.

American Bitcoin attempts to differentiate itself by using mined bitcoin rather than purchasing coins on the open market. This approach should result in lower acquisition costs compared to companies buying bitcoin directly.

Trump-associated investments have shown a poor track record recently. Trump Media shares are down over 68% from their October 2024 peak.

The Official Trump token has fallen over 90% from its January high. World Liberty Financial WLFI, launched earlier this week, has already dropped 50% from its Monday peak.

ABTC’s market capitalization currently stands at approximately $6.2 billion. This creates a valuation gap when compared to its bitcoin holdings worth $267 million.

The company will need to prove its mining operations and treasury strategy can justify this premium. Early trading patterns suggest investors remain skeptical about the business model and Trump association.