Read our Advertising Guidelines Here

Many analysts believe altcoins still have a chance for a rally this October, despite the crypto market’s recent crash. Investors are scanning the charts, looking for tokens that could deliver serious ROI if the rebound happens. Among the buzz are Cardano (ADA), BONK, and a rising star, Paydax Protocol (PDP), each offering unique opportunities in a volatile market.

Meet The Contender That Could Outperform Other Altcoins

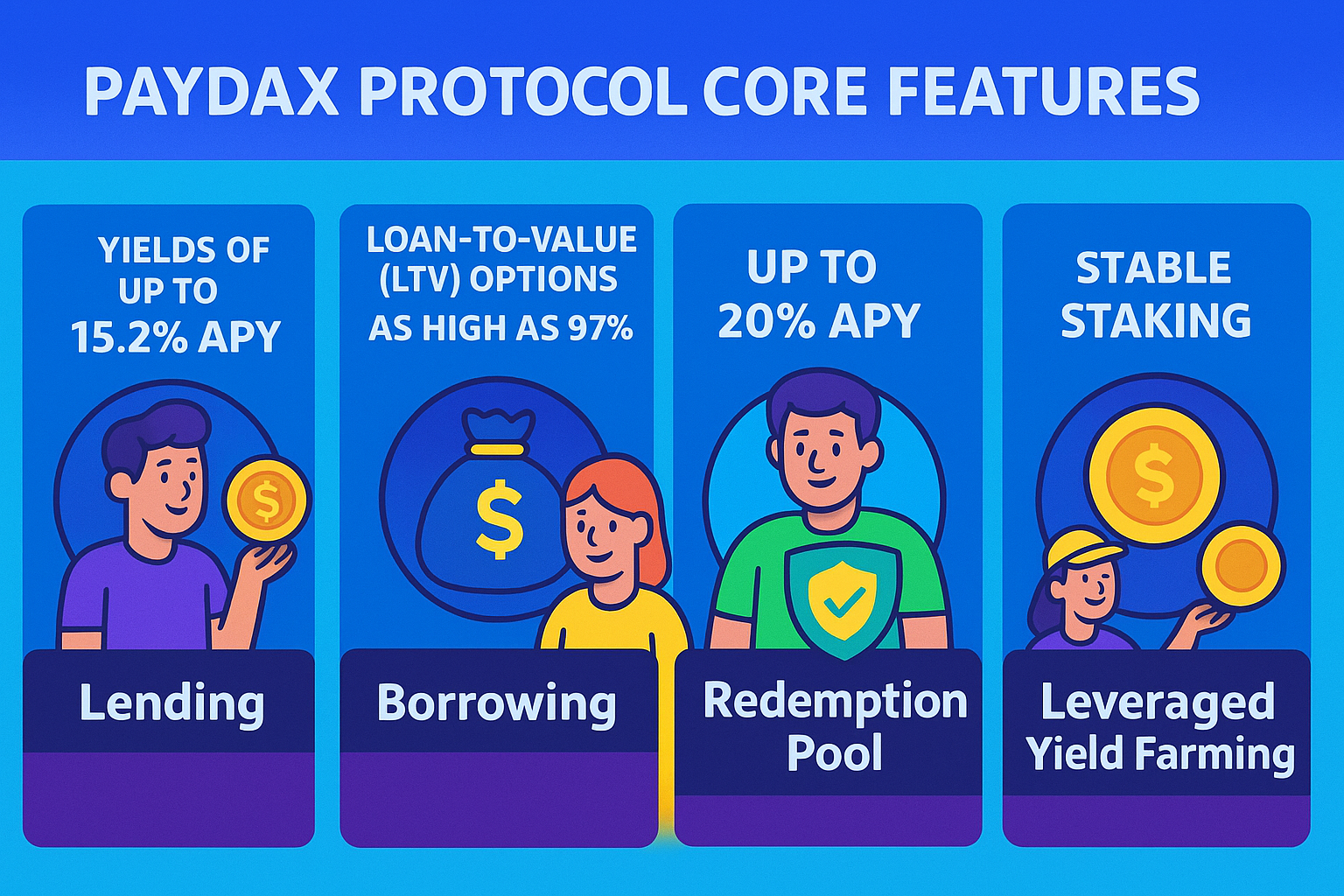

If you’re hunting for altcoins that could deliver massive ROI this October, forget the usual names — because Paydax Protocol (PDP) is stealing the spotlight from giants like Cardano (ADA) and BONK. It’s not just another token; it’s a next-gen DeFi powerhouse combining staking and real-world asset lending into one ecosystem.

One of its biggest differentiators is capital efficiency. Instead of staked, governance, or LP tokens sitting idle, it lets users unlock liquidity from them—turning dormant assets into working capital. This is a game-changer in DeFi, where billions of dollars often sit locked and unproductive. Paydax also bridges traditional and decentralized finance. Users can borrow against tokenized gold, real estate, and collectibles, expanding collateral options beyond most DeFi platforms.

This approach democratizes access to liquidity while attracting institutional interest by linking crypto to tangible value. While Cardano (ADA) continues to build on its reputation and BONK thrives on meme-driven hype, Paydax Protocol (PDP) focuses on utility and transparency. This is where innovation meets income, and it’s what makes Paydax one of the most promising altcoins to deliver massive ROI for October.

Why Paydax Stands Tall In A Market Full Of Noise To Outpace Cardano (ADA) And BONK

In the fast-paced world of altcoins, sudden spikes in investors’ activity can quickly put a token in the spotlight. BONK is a clear example — it recently led all meme tokens in whale inflows over the past 30 days, according to Sunflow. While that surge proves its popularity, BONK still struggles with long-term value since it offers no real utility beyond trading and community hype.

Paydax Protocol (PDP), on the other hand, is built on participation, not speculation. PDP token powers the entire ecosystem by lowering borrowing costs for active users, securing the network through staking, and stabilizing liquidity pools. Holders don’t just wait for ROIs; they stake, validate, and govern.

Validators also use the PDP token to perform ID checks and maintain compliance, ensuring transparency and trust across the system. This is where Paydax Protocol (PDP) outshines hype-driven altcoins like BONK. It isn’t chasing trends but building sustainable ROI through real use cases.

When Others Partner With Institutions, Paydax Partners With The People

Cardano (ADA) is now in compliance with new global banking standards, a move that could soon link its blockchain directly with major financial systems. While this could strengthen Cardano’s (ADA) position in global finance, it still leaves room for centralized authority. True decentralization doesn’t rely on institutions; it removes them entirely.

That’s where Paydax Protocol (PDP) stands apart. By replacing banks and middlemen with transparent smart contracts, Paydax eliminates hidden fees, biased decisions, and outdated gatekeepers. Every transaction is visible on-chain, governed by the community, and backed by trusted verification partners like Onfido, Brinks, and Sotheby’s.

Audited by Assure DeFi, Paydax ensures secure, immutable contracts where terms can’t be altered — not even by the protocol itself. This isn’t just another DeFi platform; it’s The People’s DeFi Bank, a borderless system where borrowers, lenders, and insurers control the market. While Cardano (ADA) aims to connect with traditional finance, Paydax Protocol (PDP) is building a future where people are the bank.

Early Investors Are Already Winning — It’s Your Turn To Catch The ROI Wave

In a market flooded with promising altcoins, Paydax Protocol (PDP) is quickly proving to be the one investors can’t afford to overlook. Cardano (ADA) and BONK may hold potential, yet Paydax offers something far more powerful: real utility, real yield, and the kind of transparency today’s DeFi space has been missing.

With over $1 million already raised in its presale at just $0.015 per PDP token, momentum is building fast. The platform’s liquidity providers are lining up to contribute assets to vaults for yield, and early buyers are locking in APY returns ranging from 6% to 41% before launch. Add in the ongoing 25% presale bonus with promo code PD25BONUS, and it’s clear why Paydax is becoming one of the most talked-about altcoins of 2025.

Every stage of the presale brings a higher token price — meaning the best ROI potential belongs to those who act now. With exchange listings and infrastructure partnerships already on the horizon, Paydax Protocol (PDP) isn’t just preparing for the next bull cycle — it’s building it. Don’t wait for hindsight to show where the biggest ROI came from — the opportunity is live right now.

How To Join The Paydax Protocol (PDP) Presale Today:

Website: https://pdprotocol.com/

Telegram: https://t.me/PaydaxCommunity

X (Twitter): https://x.com/Paydaxofficial

Whitepaper: https://paydax.gitbook.io/paydax-whitepaper

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above. Read our Advertising Guidelines Here.