TLDRs;

- Apple stock traded flat Friday as a UK tribunal ruled it abused App Store dominance.

- The court found Apple overcharged developers between 2015–2020, inflating app prices for consumers.

- Damages could reach £1.5 billion ($2 billion), with Apple set to appeal.

- CMA oversight may force Apple to open its App Store to alternative payments and sideloading.

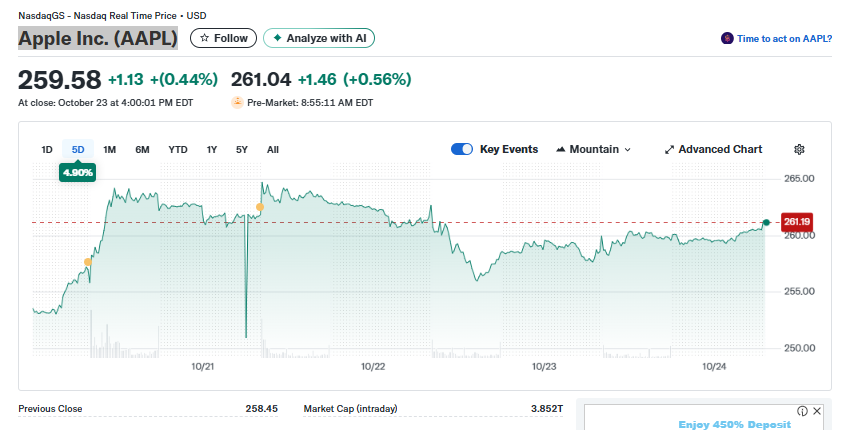

Apple Inc. (NASDAQ: AAPL) stock traded relatively flat on Friday, closing at $259.58 (+0.44%) and inching slightly higher to $261.35 (+0.68%) in pre-market trading, according to Nasdaq Real Time Price data.

The modest movement comes as the tech giant grapples with a major legal defeat in the United Kingdom, where a London tribunal ruled that Apple abused its dominant market position through excessive App Store fees.

The ruling by the UK’s Competition Appeal Tribunal (CAT) could expose Apple to as much as £1.5 billion ($2 billion) in damages, marking one of the largest antitrust judgments ever handed down against the company in Europe. The case, brought on behalf of millions of iPhone and iPad users, found that Apple’s long-standing 30% App Store commission unfairly inflated prices for both developers and consumers.

Apple has vowed to appeal the decision, maintaining that its App Store practices are fair, transparent, and vital to supporting a competitive digital economy.

Tribunal Finds Unfair Overcharges to Developers

The CAT determined that between October 2015 and December 2020, Apple overcharged app developers by applying a commission rate significantly above a fair benchmark of 17.5%. According to the tribunal, about half of these excess costs were passed down to consumers, resulting in inflated app and subscription prices across Apple’s ecosystem.

This benchmark figure, combined with a 50% “pass-through rate”, will guide how damages are calculated in the next phase of the proceedings. A follow-up hearing scheduled for November will establish the compensation method and hear Apple’s appeal motion.

Legal analysts say the ruling represents a landmark moment for competition law in digital markets, signaling that regulators are ready to challenge dominant platform operators on pricing practices once thought untouchable.

CMA Oversight Could Transform App Store Rules

The timing of the ruling coincides with a broader regulatory shift in the UK. On October 22, 2025, the Competition and Markets Authority (CMA) granted Apple “Strategic Market Status (SMS),” placing it under stricter oversight for app store operations.

The CMA will consult on new conduct rules starting in autumn 2025, potentially requiring Apple to enable alternative payment methods and sideloading, similar to the European Union’s Digital Markets Act (DMA).

Fintech and developer tool companies are expected to benefit from these changes, as the new framework promotes interoperability and consumer choice. With the UK’s fintech sector attracting more than £18 billion in investment over the past three years, analysts suggest this could open new opportunities for third-party payment providers and software platforms.

Global Implications for Big Tech Regulation

Apple’s defeat in the UK is the latest in a growing wave of global regulatory challenges. European and U.S. authorities have both accused the company of leveraging its App Store to stifle competition. Should Apple’s appeal fail, it could set a precedent for damages claims and regulatory reforms in other major markets.

The case adds to mounting pressure on Apple and Google, both of which now carry the UK’s Strategic Market Status designation. Experts believe this marks the beginning of a more open digital ecosystem, one that could see reduced commissions, expanded payment options, and greater freedom for developers.

Despite its legal headwinds, Apple remains financially strong, with a market capitalization approaching $4 trillion and continued demand for its flagship products. Investors, however, are watching closely to see whether the company’s legal troubles will impact long-term profitability and App Store revenue streams.