TLDR

- Aptos Foundation proposes a 2.1 billion token hard cap — APT currently has no supply ceiling

- Annual staking rewards would be cut from 5.19% to 2.6%

- Gas fees set to increase 10x, with fees burned to reduce supply

- 210 million APT tokens would be permanently locked for staking, never sold

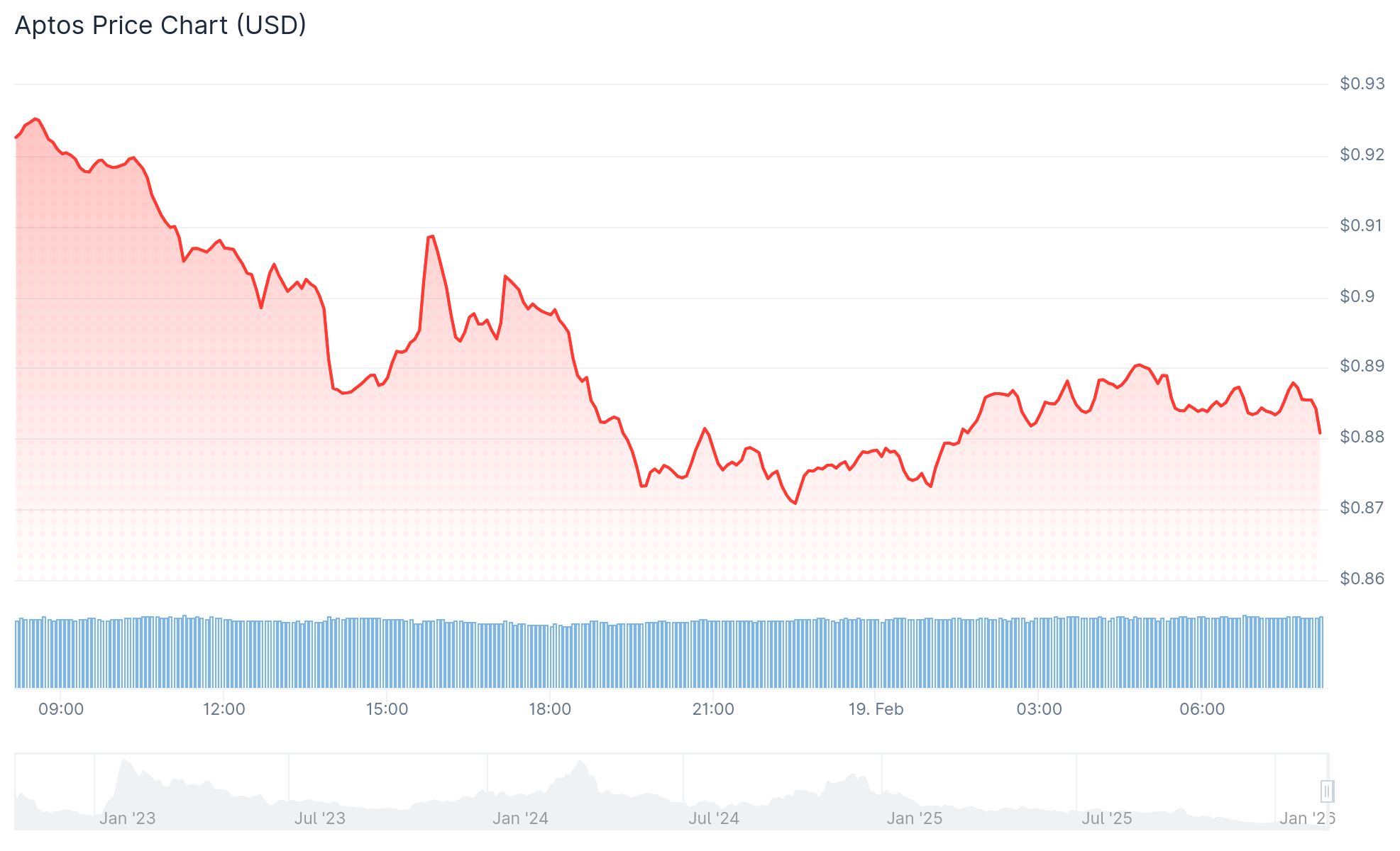

- APT is trading near $0.88, down ~4.5% on the day

The Aptos Foundation announced a sweeping set of tokenomics proposals on February 19, aiming to shift the network away from open-ended token emissions toward a supply-capped, performance-driven model.

— Aptos (@Aptos) February 18, 2026

APT is currently trading near $0.88, down roughly 4.5% on the day. The token has lost more than half its value from late-2025 highs.

The proposals were shared in an X post by the Aptos Foundation, which said it plans to submit formal governance proposals to the network.

At the center of the plan is a hard supply cap of 2.1 billion APT. Right now, Aptos has no maximum token supply. There are currently 1.196 billion APT in circulation.

The foundation says the current model continuously mints new tokens to fund development, grants, and staking rewards. It argues this needs to change as the network matures.

“Without reform, emissions continue indefinitely with no hard ceiling, no performance requirements, and no connection between issuance and network activity,” the team said.

Staking Rewards and Gas Fee Changes

The foundation is proposing to cut annual staking rewards from 5.19% to 2.6%. Longer staking commitments would receive relatively higher yields under a redesigned framework.

A 10x increase in gas fees is also on the table. Since gas fees paid in APT are burned, this would directly reduce circulating supply over time.

Even after the increase, the team says stablecoin transfers would cost around $0.00014, which it claims would still be the lowest in the world.

The foundation also plans to permanently lock and stake 210 million APT tokens. These would never be sold or redistributed, removing them from liquid supply while continuing to support network security.

Unlock Cycle and Institutional Context

A key inflection point is coming in October 2026, when a four-year token unlock cycle for early investors and core contributors ends. The foundation says this will cut annualized supply unlocks by roughly 60%.

Grant distributions are also set to fall by more than 50% year over year between 2026 and 2027.

The foundation pointed to institutional deployments from BlackRock, Franklin Templeton, and Apollo as evidence the network has matured beyond its bootstrap phase.

Stricter KPIs for grant recipients and a possible token buyback program are also being explored.

Despite the scale of the proposals, market reaction has been muted. APT charts show persistent lower highs and weak momentum heading into mid-February 2026.

APT is currently trading near $0.88.