TLDR

- BitMEX co-founder Arthur Hayes predicts Bitcoin will reach $1 million if the Fed implements yield curve control

- Stephen Miran was confirmed to the Federal Reserve Board by a 48-47 Senate vote on September 16

- Tether minted $1 billion USDT while new whale wallets accumulated 5,817 Bitcoin worth over $680 million

- Money market funds hold $7.5 trillion in cash that could flow into risk assets during Fed rate cuts

- Hayes sees Miran’s “third mandate” discussion as preparation for aggressive monetary expansion policies

The confirmation of Stephen Miran to the Federal Reserve Board has triggered bold predictions from crypto industry leaders. BitMEX co-founder Arthur Hayes now sees a path to $1 million Bitcoin based on potential Fed policy changes.

With Fed board member Miran now confirmed, the MSM is preparing the world for the Fed's "third mandate" which is essentially yield curve control. LFG!

YCC -> $BTC = $1m pic.twitter.com/jlPQZJ0cHm

— Arthur Hayes (@CryptoHayes) September 16, 2025

The U.S. Senate confirmed Miran to the Federal Reserve Board by a narrow 48-47 vote on September 16. His appointment has sparked discussions about a possible shift in Fed monetary policy approach.

Miran previously expressed support for Bitcoin in a 2023 post where he wrote “Bitcoin fixes this” about traditional financial system problems. The economist has also discussed the Fed’s responsibility for “moderate long-term interest rates” as a potential third mandate.

Bitcoin fixes this https://t.co/XjsRuA3mXE

— Stephen Miran (@SteveMiran) January 9, 2022

Hayes connected Miran’s confirmation to his theory about yield curve control implementation. This policy would allow the Fed to set specific targets for long-term interest rates by purchasing government bonds.

“With Fed board member Miran now confirmed, the MSM is preparing the world for the Fed’s ‘third mandate,’ which is essentially yield curve control,” Hayes wrote on social media. He added that this policy could drive Bitcoin to $1 million.

Market conditions appear to support increased liquidity flows into crypto assets. Tether minted $1 billion USDT overnight, providing fresh dollar-pegged liquidity for crypto exchanges.

A newly created wallet purchased 5,817 Bitcoin from exchanges, worth over $680 million at current prices. Analysts identified this as institutional-level buying rather than retail activity.

Fed Policy Changes Could Drive Liquidity Surge

Money market funds in the US currently hold $7.5 trillion in assets. This cash typically stays in short-term bonds for safety but could seek higher returns if interest rates decline.

The CME FedWatch tool shows a 96% probability of a 25 basis-point rate cut at the next Fed meeting. Lower rates traditionally push investors toward risk assets including Bitcoin.

Hayes argues that yield curve control would create liquidity surges beyond traditional quantitative easing programs. The policy forces borrowing costs down regardless of bond market conditions.

Government debt levels and fiscal pressures could eventually force the Fed to implement such measures. When central banks become the primary buyers of government debt, currency debasement accelerates.

Bitcoin Shows Strength Ahead of Policy Decisions

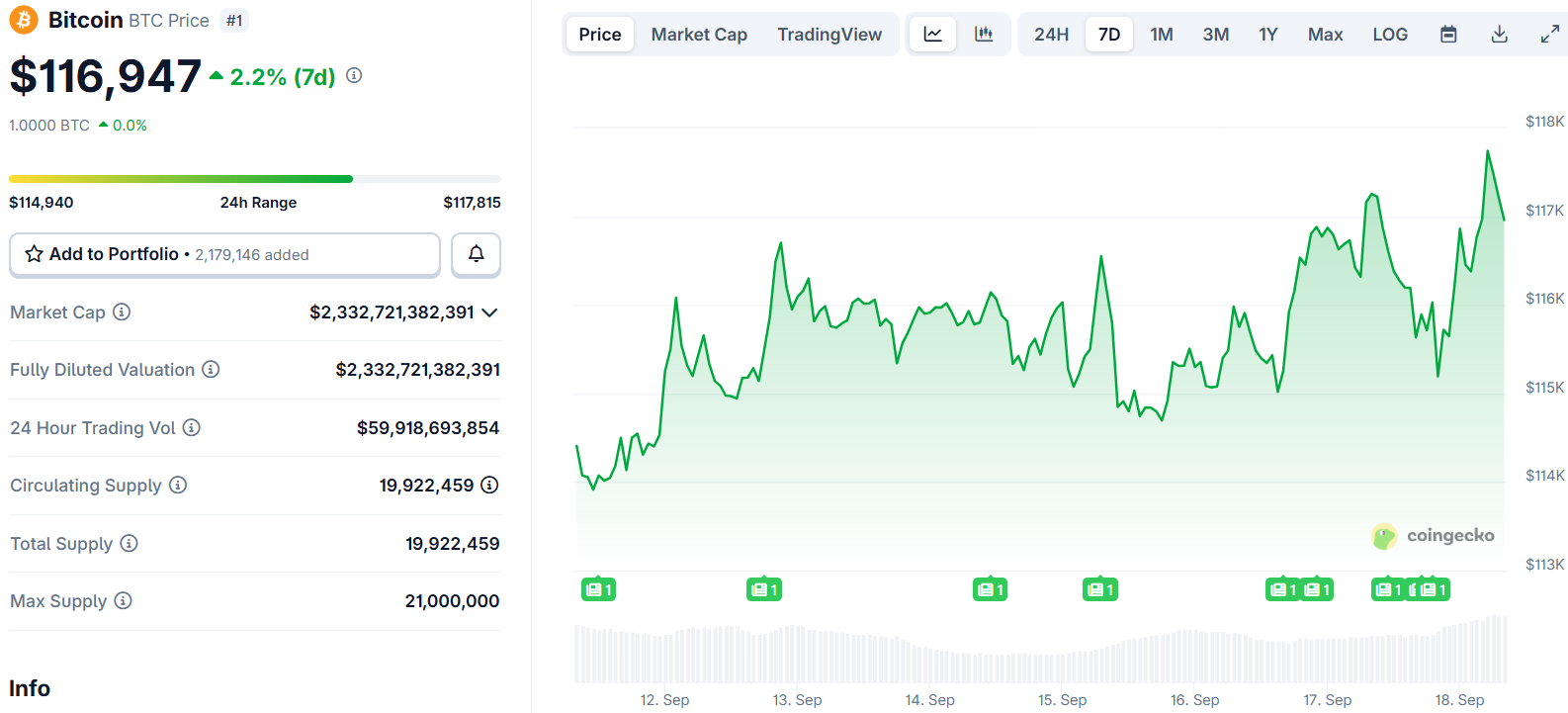

Bitcoin has gained 5.1% over the past seven days, trading above $117,000. The cryptocurrency sits just 5.6% below its all-time high of $124,457 set on August 14.

Exchange reserves continue declining as institutional buyers move Bitcoin to cold storage. On-chain data shows whale wallets expanding their holdings during recent market volatility.

The convergence of potential Fed policy changes and institutional adoption creates conditions Hayes believes will drive extreme price appreciation. His prediction assumes yield curve control implementation will debase fiat currencies.

Bitcoin’s current strength comes as traditional markets await Fed decisions on interest rates. The cryptocurrency has gained 5.9% over two weeks despite modest monthly gains of 1.7%.

Miran’s Fed appointment represents a potential shift toward more accommodative monetary policy. Whether this translates to Hayes’ $1 million Bitcoin prediction remains to be determined by future Fed actions.