TLDRs;

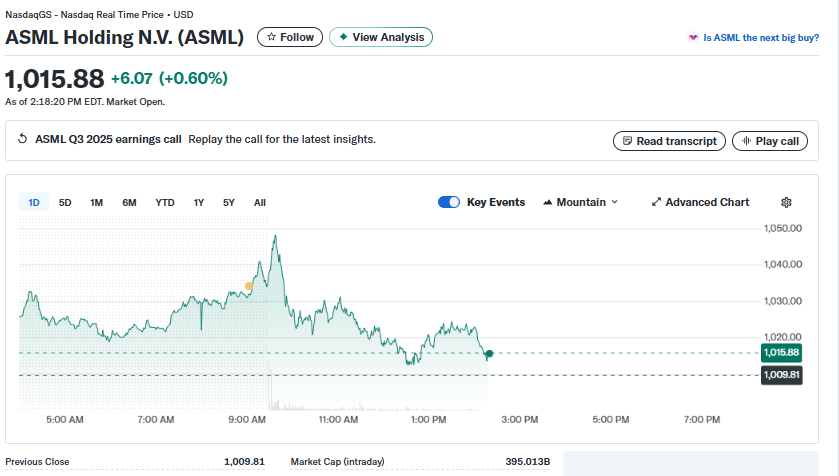

- ASML shares rise 0.66 % as Q3 orders hit $6.3B, exceeding analyst forecasts.

- Extreme ultraviolet lithography machines remain in high demand from AI chipmakers.

- Front-loaded orders from China may boost short-term bookings amid export limits.

- Geopolitical supply chain concerns drive growth in magnet recycling and non-Chinese suppliers.

ASML Holding N.V. (NASDAQ: ASML) saw its shares climb 0.66% on Thursday, fueled by strong third-quarter demand for its semiconductor equipment.

The Dutch tech giant reported Q3 orders of €5.4 billion (approximately $6.3 billion), surpassing analyst expectations of €4.9 billion ($5.32 billion). This surge reflects the growing global investment in artificial intelligence infrastructure, as chip manufacturers ramp up production to meet the skyrocketing need for AI processors.

ASML holds a unique market position as the sole producer of extreme ultraviolet (EUV) lithography machines, which are essential for manufacturing the most advanced AI chips. Major clients, including Taiwan Semiconductor Manufacturing Co. (TSMC) and Samsung Electronics, have contributed significantly to the order surge, further reinforcing ASML’s pivotal role in the AI supply chain.

China Pull-Forward Boosts Near-Term Sales

A substantial portion of ASML’s Q3 orders, around 42%, originated from China. Analysts suggest that this reflects a front-loading effect, where customers accelerate purchases in anticipation of tighter export controls imposed by Beijing on rare earth materials.

While these early bookings lift near-term revenue, they may obscure the long-term growth trajectory, as future demand could normalize once the pull-forward effect subsides.

This dynamic highlights the complex interplay between AI-driven demand and geopolitical factors. The €3.6 billion in EUV-specific bookings may not entirely indicate new capacity expansion but rather a hedge against potential export restrictions. As a result, investors are carefully weighing ASML’s short-term success against its longer-term growth outlook.

BREAKING: $ASML reports €7.5 billion total net sales and €2.1 billion net income in Q3 2025.

Full-year 2025 expected total net sales growth of around 15% with gross margin around 52%. https://t.co/yIntFIYrD2

— ASML (@ASMLcompany) October 15, 2025

Geopolitical Risks Fuel Supply Chain Innovation

ASML is also navigating broader geopolitical challenges, particularly China’s newly imposed export licensing for medium to heavy rare earth elements like dysprosium and terbium.

These materials are critical for magnets used in semiconductor equipment and other high-tech applications. In response, non-Chinese suppliers, including MP Materials, Neo Performance Materials, and VAC Group, are ramping up production in the US and Europe to secure long-term contracts with automakers and wind-turbine manufacturers.

Recycling initiatives are emerging as another strategic solution. Hydrogen-based short-loop recycling technologies, such as those planned by HyProMag USA, allow for the recovery of rare metals from magnets without the environmental cost of traditional chemical processes. These efforts not only reduce embedded carbon by more than 88% but also reinforce supply chain resilience amid growing geopolitical uncertainties.

Strong Fundamentals Amid Market Volatility

Despite a 30% decline in market value since its peak last year, ASML’s fundamental position remains robust. Its EUV monopoly ensures continued high margins and strong revenue growth, with machines selling for roughly $200 million each.

Analysts expect annual sales between €44 billion and €60 billion by 2030, with gross margins between 56% and 60%. The Q1 2025 results already demonstrated 46% revenue growth and a 93% increase in earnings per share, underscoring the company’s resilience even in a volatile market.

ASML’s performance serves as a reminder that, in the semiconductor sector, a combination of technological monopoly, strategic customer demand, and proactive supply chain management can sustain growth even amid geopolitical and market uncertainties.