TLDR

- Aster (ASTER) was delisted from DeFiLlama on October 5 after the platform’s founder questioned the accuracy of its trading volume data, which appeared to mirror Binance’s perpetuals market.

- Whale wallets holding over $1 million in ASTER reduced their holdings by 12% following the delisting, while smart money investors cut their exposure by 37%.

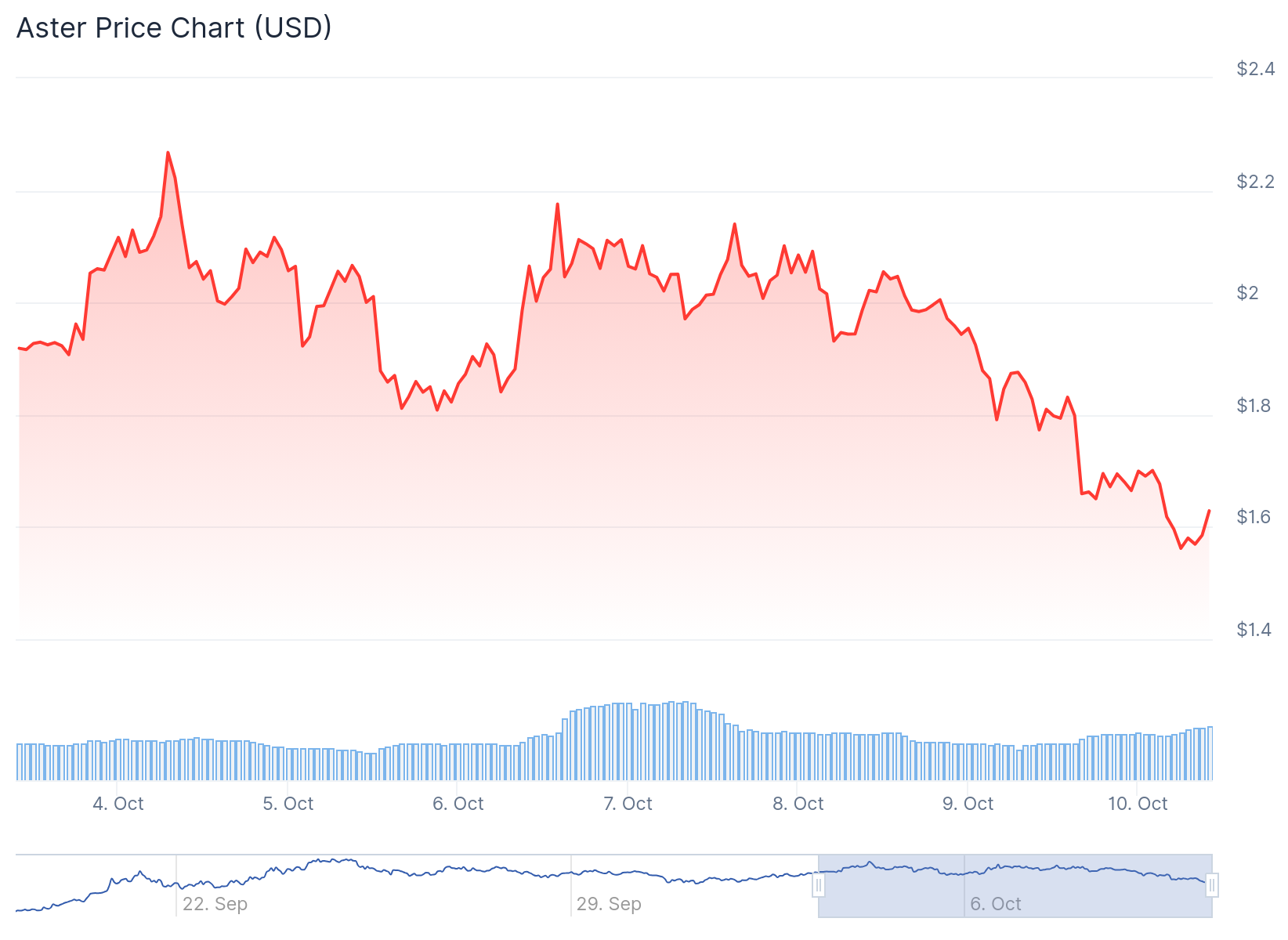

- ASTER currently trades around $1.86-$2.03 and is testing a triangle pattern support level near $1.77, with the token down 4% recently.

- The token faces immediate resistance at $1.92 (50-period moving average), and a successful breakout above the triangle could target $2.88, representing a potential 56% gain.

- If ASTER loses its triangle support with high volume, it could fall toward $1.50-$1.55, with analysts warning of a potential crash to $1.30 or lower due to a liquidity vacuum below $1.50.

Aster has entered a critical period as its native token tests key support levels. The altcoin faces mounting pressure after being removed from a major crypto analytics platform.

On October 5, DeFiLlama founder 0xngmi announced the platform would delist Aster. The decision came after questions arose about the accuracy of Aster’s reported trading volumes. According to the announcement, Aster’s volumes appeared to mirror those of Binance’s perpetuals market.

We've been investigating aster volumes and recently their volumes have started mirroring binance perp volumes almost exactly

Chart on the left is XRPUSDT on aster, you can see the volume ratio vs binance is ~1

Chart on the right is XRP perp volume on hyperliquid, where there's… pic.twitter.com/MwVD7rRyEn

— 0xngmi is hiring (@0xngmi) October 5, 2025

The delisting has triggered a wave of selling from large holders. Whale wallets containing more than $1 million in ASTER have reduced their holdings by 12% since the announcement. Smart money investors have cut their positions even more sharply, reducing exposure by 37%.

ASTER currently trades around $1.86 to $2.03, down 4% from recent levels. The token is testing a triangle pattern on the 4-hour chart. This formation typically signals a period of balance between buyers and sellers before a decisive move.

The lower boundary of the triangle sits near $1.77. This level represents the ascending support line where buyers have been defending their positions. The token remains under pressure from the 50-period moving average at $1.92, which acts as immediate resistance.

Technical Picture Shows Two Possible Paths

If ASTER maintains support above the triangle’s lower boundary, a bullish scenario could develop. A confirmed close above the 50-hour moving average would open the path toward the descending resistance of the triangle. This resistance currently sits around $2.10 to $2.15.

A breakout above the triangle’s upper resistance would target $2.88. This represents a potential gain of approximately 56% from current prices. The level corresponds to a historical resistance zone on higher timeframes.

The bearish case involves a loss of the triangle’s lower support with high volume. This would invalidate the bullish setup and could push ASTER toward $1.50-$1.55. Technical analysis shows a liquidity vacuum below $1.50, which could accelerate selling pressure.

Volume and Investor Behavior Remain Critical

Volume will be key to validating any breakout from the triangle pattern. Analysts suggest a bullish breakout would require volume at least 50% higher than recent session averages. This would confirm buyer conviction.

The Relative Strength Index sits in neutral territory around 45-50. This leaves room for movement in either direction before reaching overbought or oversold conditions. A correction into oversold territory on the 4-hour timeframe remains possible.

Market structure also plays a role in ASTER’s outlook. The token shows correlation with Bitcoin and Ethereum. Bitcoin recently hit a new all-time high of $126,000 in early October before pulling back to around $122,000. Ethereum trades near $4,450.

A recovery in broader crypto sentiment would support a bullish breakout for ASTER. However, continued correction in major cryptocurrencies would likely pressure altcoins further. The crypto market is currently in a consolidation phase following Bitcoin’s recent peak.

ASTER trades at $2.03 at press time, with support at this level proving crucial for near-term direction.