TLDR

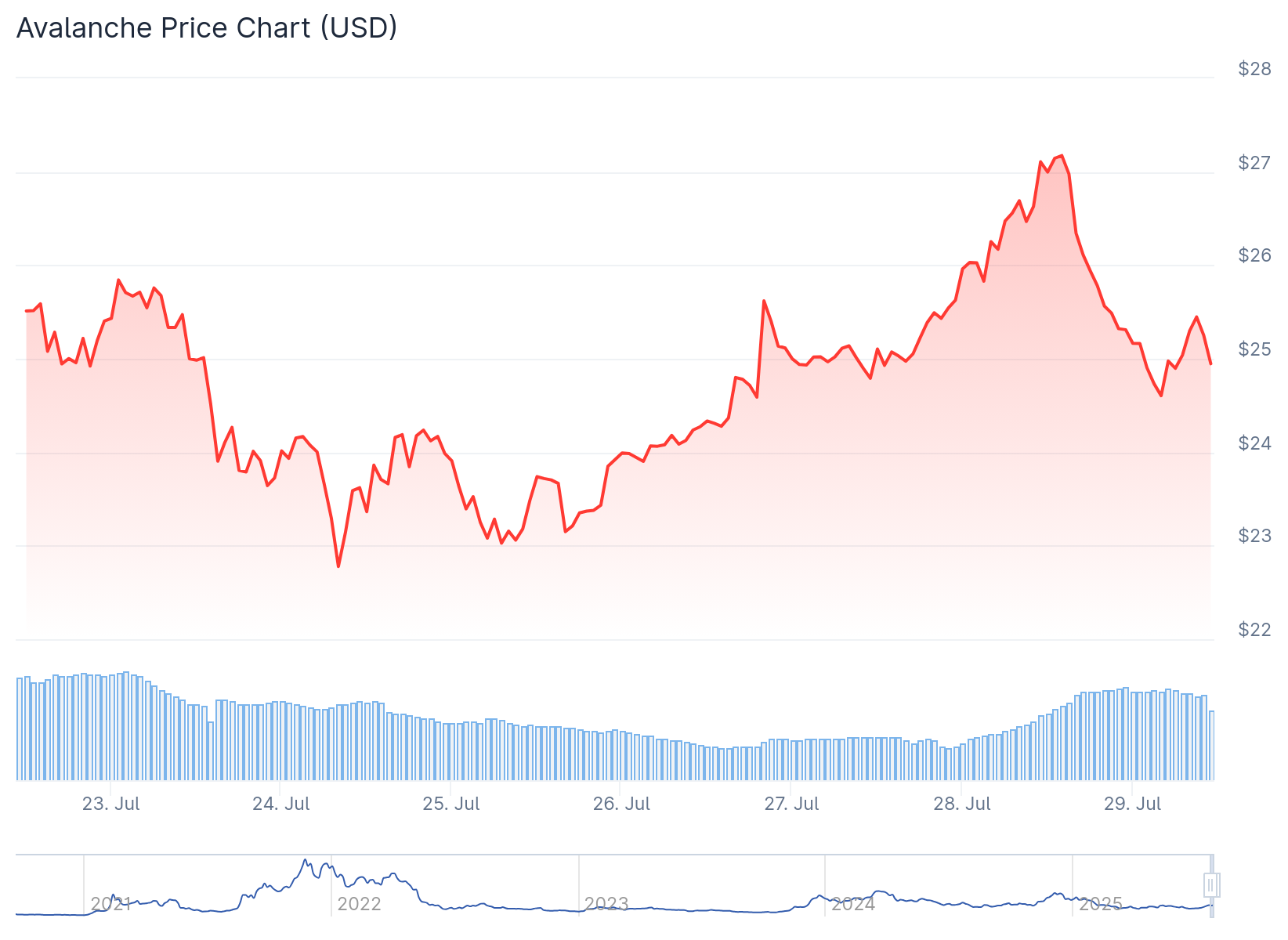

- AVAX price rises 5.71% to $26.42 with trading volume of $1.16 billion in 24 hours

- DeFi total value locked jumps nearly 40% to $1.5 billion after Octane upgrade

- Open Interest increases 15% to $835.44 million showing growing trader confidence

- Technical analysts target $126.03 price level based on breakout patterns

- Network activity shows mixed signals with falling new addresses despite price gains

Avalanche’s native token AVAX has gained 5.71% in the past 24 hours, reaching $26.42 with a market cap of $11.16 billion. The price movement comes alongside strong trading volume of $1.16 billion.

The recent Octane upgrade has driven significant growth in Avalanche’s DeFi ecosystem. Total value locked surged nearly 40% quarter-over-quarter to reach $1.5 billion.

This upgrade improved transaction speeds and reduced fees while creating a better user experience. The Octane update cut C-Chain transaction costs by 42.7% through a dynamic fee model.

Open Interest in AVAX derivatives has climbed over 15% in the past week to $835.44 million. This increase shows greater capital allocation into AVAX trading positions.

The growing Open Interest reflects rising speculative interest among traders. This metric often indicates confidence in the asset’s price direction.

Technical Analysis Points to Breakout Potential

AVAX recently completed a double bottom pattern and broke through its descending trendline. The price now tests the $26-$28 resistance zone.

Technical analyst Javon Marks sees potential for AVAX to reach $126.03 based on current breakout patterns. He notes AVAX has already surged nearly 200% since breaking its consolidation pattern.

The AVAX/BTC pair shows a rounding bottom formation on the 3-day chart. This pattern typically signals a trend reversal when it appears at market lows.

$AVAX (Avalanche) remains here well broken out and up nearly +200% since breaking out with a target at the $126.03 level that is in play!

With this target, prices of AVAX could climb another nearly +375% to reach it, resulting in a close to 5X from here… https://t.co/5sLcHOkECr pic.twitter.com/icP7oTxoia

— JAVON⚡️MARKS (@JavonTM1) July 27, 2025

A breakout above the current resistance could lead to the next level between 0.00092 and 0.00100 BTC. The rounded pattern suggests sustainable upward movement rather than a sharp recovery.

Network Metrics Show Mixed Signals

Despite price gains, network activity presents a different picture. New addresses dropped 33.93% while active addresses fell over 10% in the past week.

These metrics contrast with the rising price and TVL figures. The data suggests the rally stems more from capital rotation than new user growth.

Social dominance for AVAX declined to 0.419%, showing reduced discussion around the token. However, Weighted Sentiment improved slightly to +0.115, indicating modest optimism.

$AVAX Weekly Chart: Swing Long Idea 📈

Lots of upside potential this cycle…

🔹Entry – $21-$22

🔹Stop – $15

🔹 TP1 – $37 ➡️ TP2 – $55

🔹 R:R – 1:4 pic.twitter.com/a7I9S23yDN— Trader Edge (@Pro_Trader_Edge) July 26, 2025

The disconnect between price performance and social attention may limit the rally’s reach. Broader retail interest has not yet matched trader confidence.

Future upgrades like Avalanche9000 and ACP-194 aim to push network capacity beyond 1 million transactions per second. These developments target improved scalability for the platform.

AVAX formed partnerships including a collaboration with Neo Tokyo in May to support Web3 game development. This positions Avalanche as infrastructure for blockchain gaming projects.

The combination of technical upgrades and DeFi growth has created current momentum for AVAX, though network activity remains below recent price performance levels.