TLDRs;

- Berkshire Hathaway stock closes at $472.84, up 0.2%, ahead of Q2 earnings release.

- Investors brace for Kraft Heinz writedown impact after $3.76 billion markdown announcement.

- Buffett’s cautious market stance continues, with Berkshire selling more stocks than it buys.

- Berkshire’s cash pile swells to $344.1B, reflecting wariness amid volatile economic conditions.

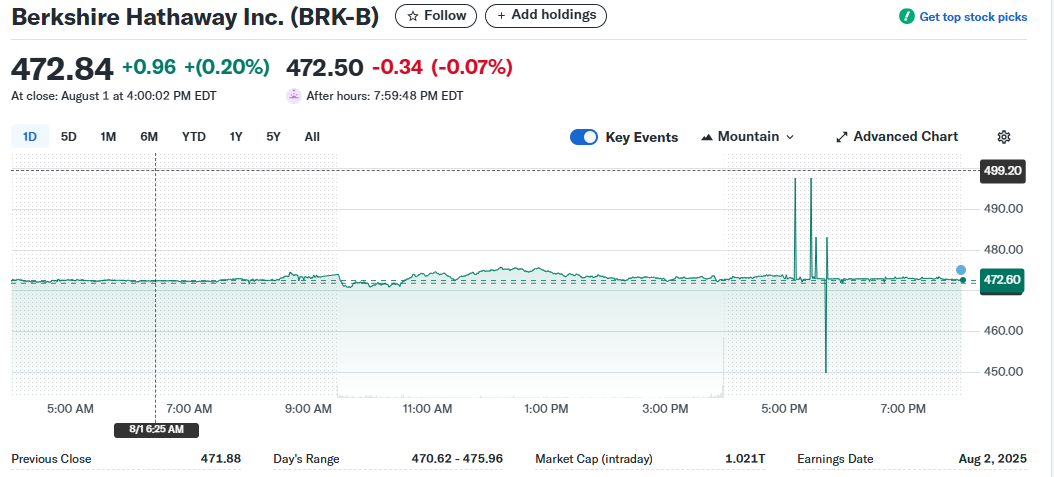

Berkshire Hathaway Inc. (NYSE: BRK-B) shares rose slightly on Thursday, closing at $472.84, a 0.2% gain on the day.

The modest uptick came just ahead of the company’s anticipated second-quarter earnings report, released on Saturday, August 2. After-hours trading saw a slight dip, with the stock down 0.07% to $472.50, reflecting cautious investor sentiment as markets await clarity on the impact of key investment decisions.

The performance follows a volatile day marked by muted investor action and a tight trading range between $470.62 and $475.96. Despite turbulence in individual holdings like Kraft Heinz, overall market confidence in Warren Buffett’s conglomerate remains intact.

Kraft Heinz Writedown Looms Over Earnings

A central concern heading into Berkshire’s earnings release is the recent $3.76 billion after-tax writedown on its 27.4% stake in Kraft Heinz. The adjustment came after Kraft Heinz announced it was exploring strategic alternatives in response to ongoing underperformance.

Berkshire had been holding the food company at above-market value on its books. However, with economic headwinds and strategic uncertainty, Buffett’s team classified the valuation gap as “other-than-temporary,” triggering the writedown.

This marks the second major hit Berkshire has taken on Kraft Heinz, following a $3 billion write-down in 2019. Buffett had previously acknowledged overpaying in the 2015 merger that created the current company. The repeated markdowns cast a shadow over one of Berkshire’s most high-profile consumer goods bets.

Berkshire’s Market Strategy Stays Cautious

Beyond Kraft Heinz, Berkshire continues to signal caution about overall market conditions. The company ended the quarter with a near-record $344.1 billion in cash, highlighting its reluctance to aggressively deploy capital.

This aligns with an 11-quarter streak of selling more stocks than buying. In fact, Berkshire hasn’t repurchased any of its own stock since May 2024, suggesting that Buffett and his lieutenants see few attractive opportunities at current valuations.

Despite holding a 28.1% stake in Occidental Petroleum that is valued $5.3 billion above fair value, Berkshire declined to record a writedown, citing confidence in the oil giant’s long-term outlook, a stark contrast to the handling of Kraft Heinz.

$BRK Berkshire Hathaway Q2 FY25.

• Net profit $12.5B.

• Operating margin 14% (flat Y/Y).

• Large write-down of $KHC $3.8B.

• Investment gains (unrealized) $6.4B.

• Cash and short-term securities $344B. pic.twitter.com/4vfJ3J8fWc— App Economy Insights (@EconomyApp) August 2, 2025

Investors Eye Buffett’s Broader Strategy

As Berkshire Hathaway prepares to report earnings, shareholders and analysts alike are looking for deeper insights into Buffett’s long-term strategy in today’s uncertain climate.

Operating income for the previous quarter fell 4% year-over-year to $11.16 billion, while net income plunged 59% to $12.37 billion largely due to lower investment gains and the Kraft Heinz writedown.

Buffett has long advised investors to ignore short-term gains and losses tied to stock price fluctuations in long-held investments. But with the market reacting more sensitively than ever, Berkshire’s report could carry broader implications for investor confidence in mega-conglomerates during economic shifts.