TLDR

- Nvidia maintains 85-90% market share in AI chips and recently invested $5 billion for a 5% stake in Intel

- Meta has invested $14.8 billion in Scale AI and committed $600 billion for US data centers through 2028

- China banned its tech companies from using Nvidia AI chips due to US tensions

- Quantum computing combined with AI could create a $10 trillion industry over coming decades

- Alphabet’s Google Quantum division develops Willow processors and Cirq software framework for quantum applications

Leading technology companies continue investing heavily in artificial intelligence while positioning for the quantum computing revolution. Recent developments show both progress and challenges across the sector.

The AI sector continues outperforming traditional markets in 2025. The Morningstar Global Next Generation Artificial Intelligence Index gained 37% compared to the S&P 500’s 13% increase through September 19. The global AI market is projected to grow at 29% annually through 2032.

Industry experts project quantum computing combined with AI could create trillions in economic value over coming decades. This emerging technology represents the next phase of computing evolution beyond current AI capabilities.

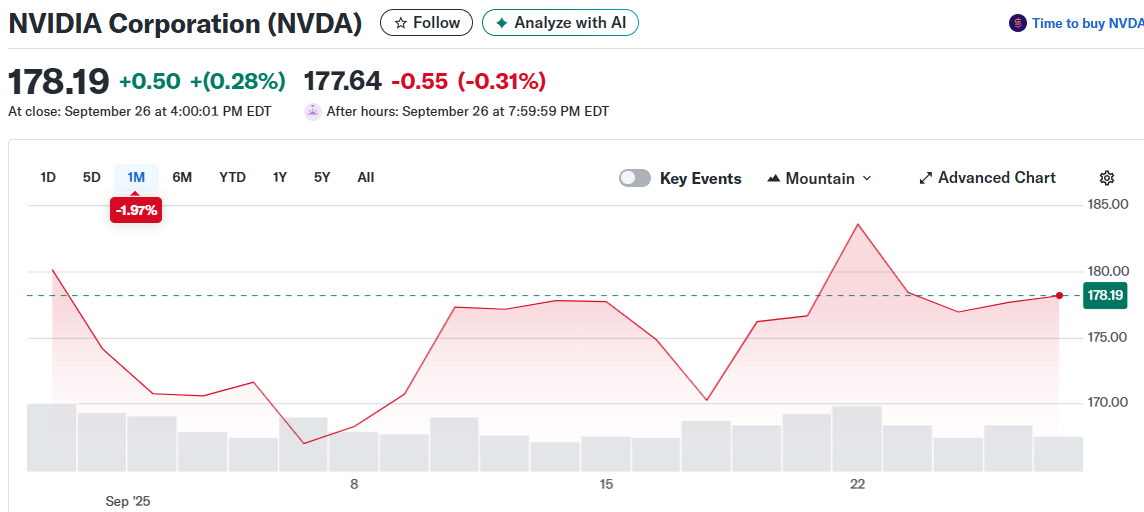

Nvidia Dominates Chip Market Despite China Restrictions

Nvidia remains the dominant force in AI hardware with an estimated 85% to 90% share of the AI chip market. The company has beaten earnings expectations for nine consecutive quarters with revenue growing more than 50% year over year.

Most revenue comes from data center sales as tech companies invest in Nvidia graphics processing units for AI model training and inference. The company reached a $4 trillion market cap, becoming the first to achieve this milestone.

The chip maker recently made a strategic move by investing $5 billion for roughly 5% of Intel. This partnership allows Nvidia to expand beyond graphics processing units into complete data center solutions. Intel will manufacture custom CPUs for Nvidia under this arrangement.

However, Nvidia faces new obstacles in international markets. China reportedly banned its tech companies from using Nvidia AI chips due to ongoing US-China tensions. This restriction cuts off access to a major market, though trade talks between the countries continue.

Nvidia also positions itself for quantum computing through its CUDA quantum platform. This software connects classical computing systems with quantum research applications. Academic institutions and developers like IonQ and Rigetti Computing already use this technology.

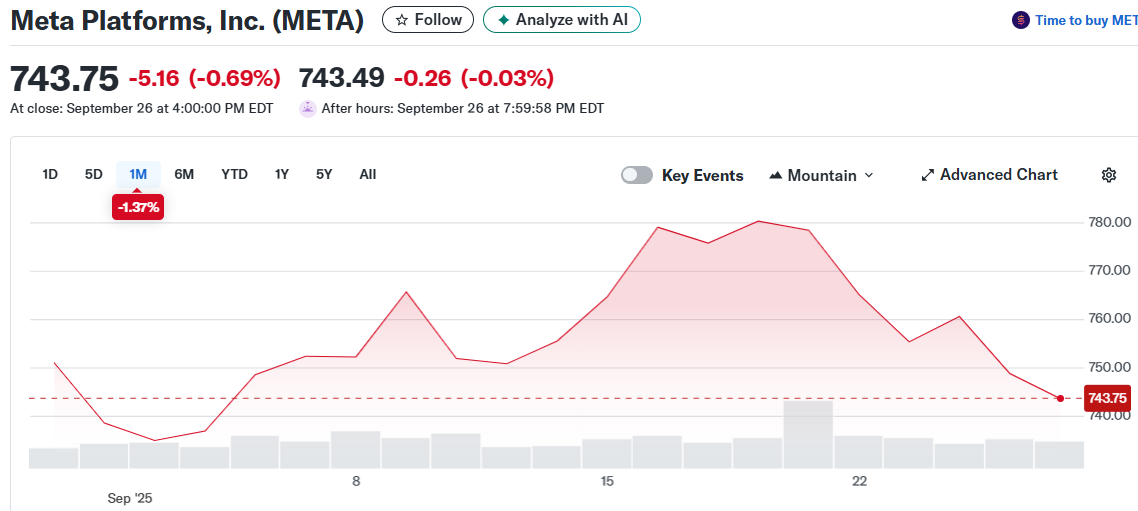

Meta Commits Massive Resources to AI Development

Meta Platforms has committed heavily to AI development across multiple business areas. The company generated $179 billion in trailing 12-month revenue, with 98% coming from advertising. This revenue stream supports major AI investments.

CEO Mark Zuckerberg hired top AI talent from rival companies to form Meta Superintelligence Labs. Some pay packages reportedly reached $300 million for leading researchers. The company also invested $14.8 billion for a 49% stake in Scale AI, a data labeling startup.

Meta committed at least $600 billion for US data centers and infrastructure through 2028. This investment supports the company’s expanding AI operations and services. Meta also generated $50 billion in free cash flow over the last 12 months.

The company integrates AI throughout its product ecosystem. Meta launched a Meta AI assistant and added generative AI tools to Messenger and WhatsApp. Meta Glasses received upgrades to become AI smart glasses, though recent live demos experienced technical failures.

Meta also offers AI advertising tools to enhance and optimize campaigns for businesses. The company trades at 28 times forward earnings, making it less expensive than some tech competitors.

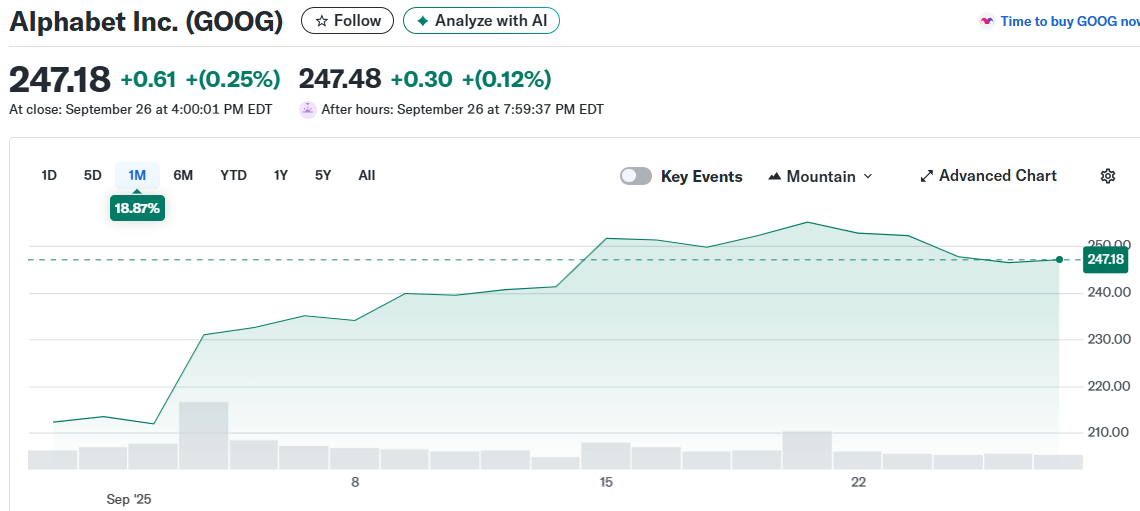

Alphabet takes a different approach to quantum computing through its Google Quantum division. The company developed Willow processors designed to scale quantum workloads more efficiently. Google also created Cirq, an open-source software framework for quantum algorithm development.

The company’s DeepMind research lab adds another dimension to quantum development. This internal facility allows Alphabet to test quantum technologies and refine them faster than external partnerships would allow.

Alphabet weaves quantum efforts into a vertically integrated technology stack. The company’s hardware, software, and research converge within a single ecosystem. This approach helps emerging services like Google Cloud and Gemini compete against rivals like Microsoft Azure and Amazon Web Services.