It’s been a wild start to the week for crypto traders. Bitcoin’s now hovering around $112,000, 24-hour spot trading volumes are nearing $500 billion, and altcoins are starting to recover after Friday’s crash. That’s led to big players – banks, brokers, and institutions that once rolled their eyes at crypto – starting to make moves.

JPMorgan’s decision to step into crypto trading is one of those moves. For years, the bank kept crypto at arm’s length, but now it’s preparing to offer clients direct access.

Whenever traditional finance (or TradFi) inches closer to crypto, it tends to boost bullish sentiment. Retail traders start looking for smaller, faster-moving coins – the kind that can explode 50x or even 100x.

So, if you’re watching the crypto market this week, a few names stand out as potential winners. Here’s a closer look at the JPMorgan news and three of the best altcoins to buy right now as TradFi and crypto start to overlap.

JPMorgan’s Crypto Trading Plans Could Change Everything

JPMorgan just confirmed it’s building out crypto trading services for its clients – though custody isn’t on the table yet. The bank’s taking what it calls an “and” approach: give clients exposure to crypto while outsourcing the trickier part (asset storage) to established custodians.

It’s a smart, low-risk entry point that lets JPMorgan test the waters without diving in headfirst. Once the trading side proves successful, custody could follow – that’s usually how banks scale into new markets.

JUST IN: JPMorgan confirms on CNBC that they will allow clients to trade #Bitcoin and crypto but not yet launch custody services 👀 pic.twitter.com/N2oYWPwwhL

— Bitcoin Magazine (@BitcoinMagazine) October 13, 2025

Ultimately, it’s not about creating hype – it’s about building solid infrastructure. And with partnerships already live between the bank and CEXs like Coinbase, it’s clear this is the start of a longer-term strategy.

For crypto traders, that’s massive. When a bank the size of JPMorgan builds trading infrastructure for crypto, it tells the rest of Wall Street that digital assets aren’t a fad anymore. It’s now a market they can’t ignore.

3 Best Altcoins to Buy as JPMorgan Plans Crypto Trading Services

With institutions like JPMorgan leaning more and more into crypto, conditions are becoming increasingly bullish. These three altcoins are already benefiting from that bullishness – each in their own way:

1. Maxi Doge (MAXI)

Maxi Doge (MAXI) is the latest meme coin to catch everyone’s attention, and it’s trying to offer more substance than most. Still in presale, MAXI mixes meme coin culture with actual utility through weekly trading competitions (with crypto prizes), leaderboards, and integrations with leverage platforms.

The idea is to make holding the MAXI token fun – and profitable – for an audience that loves volatile markets. That’s why the Maxi Doge presale has already pulled in $3.6 million, with tokens on offer for just $0.000263 each.

All that early investment has turned MAXI into one of the best altcoins to buy for investors willing to take a risk on an early-stage meme coin project. Crypto expert Borch Crypto thinks that’s a good move – telling his subscribers not to miss out on this opportunity.

Ultimately, whether Maxi Doge has staying power will come down to the success of its upcoming DEX listing and whether the team achieves their roadmap. But with this much early interest, it’s safe to say momentum is on MAXI’s side. Visit Maxi Doge Presale.

2. Humanity Protocol (H)

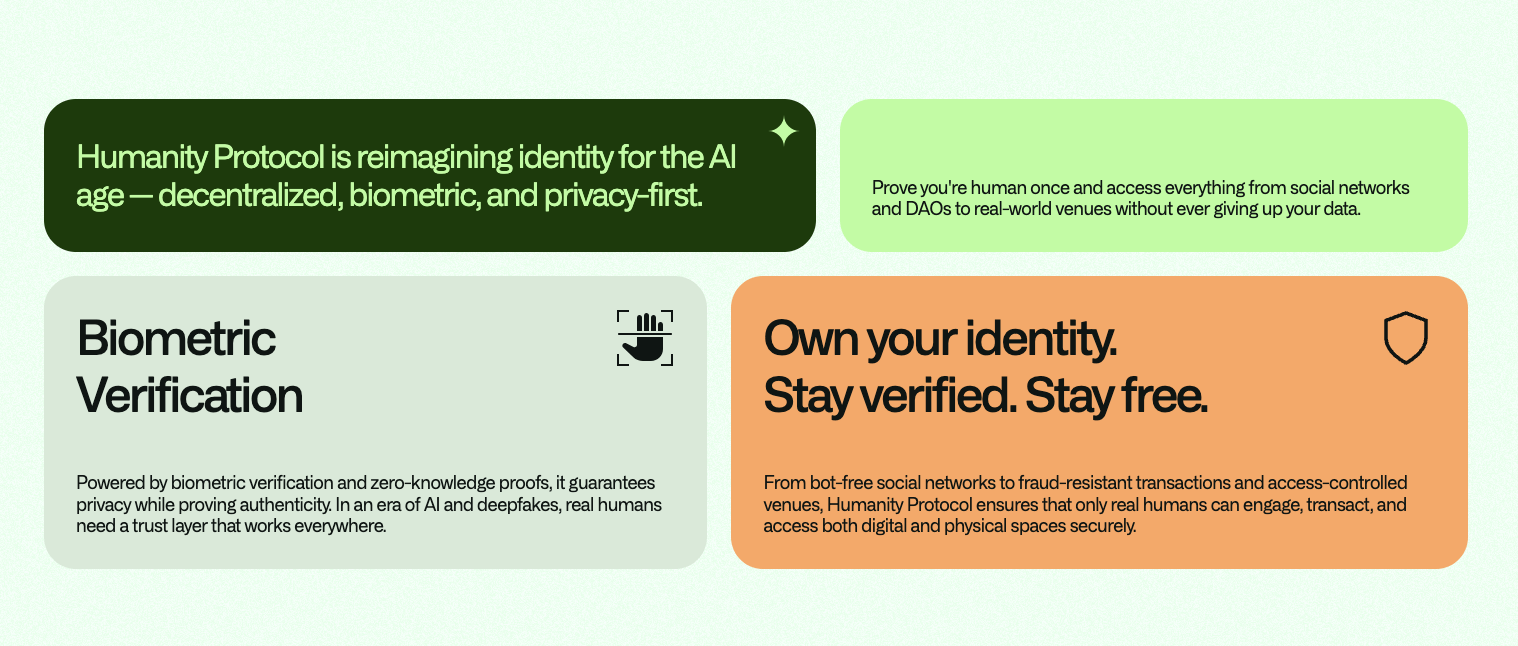

Humanity Protocol (H) is in one of crypto’s most interesting niches – the fight to prove you’re human. It’s building a decentralized identity layer powered by zero-knowledge tech and palm-recognition-style verification, letting users confirm they’re real people without exposing their personal data.

Lately, Humanity Protocol has been getting attention thanks to a surge in coverage around “Proof-of-Humanity” projects. With deepfake tech and bots making online identity more chaotic than ever, Humanity Protocol’s use case feels especially timely.

Still, it’s early days. The H token isn’t available on many top-tier CEXs and faces plenty of hurdles around adoption and regulation. But if you’re looking to back a forward-thinking identity project, it’s one of the best altcoins to buy right now.

Still, it’s early days. The H token isn’t available on many top-tier CEXs and faces plenty of hurdles around adoption and regulation. But if you’re looking to back a forward-thinking identity project, it’s one of the best altcoins to buy right now.

3. Bitcoin Hyper (HYPER)

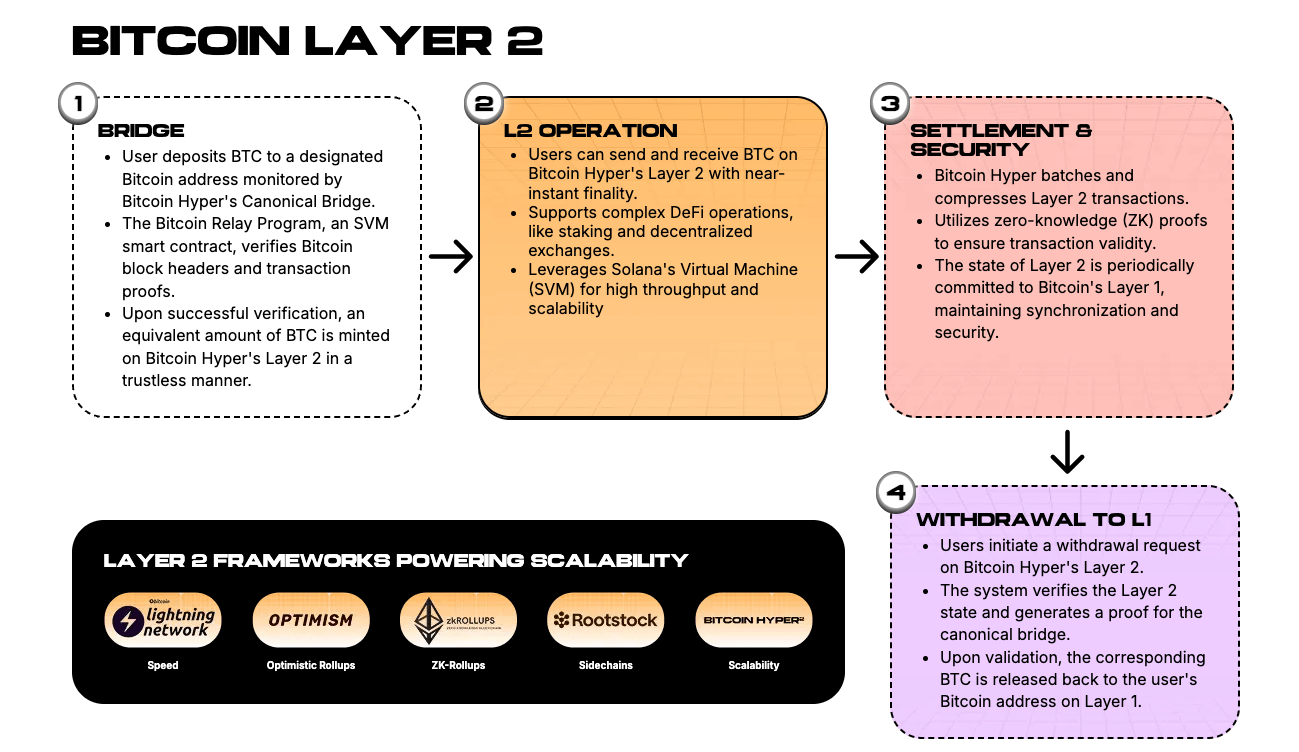

Bitcoin Hyper (HYPER) is pitching itself as a way to make Bitcoin faster. It’s a Layer-2 network designed to boost throughput and slash transaction fees while opening the door for things like DeFi, NFTs, and meme coins – all built on Bitcoin’s blockchain.

The price of the HYPER token in presale sits at $0.013115, with staking rewards designed to keep early investors engaged until the DEX launch. Add in third-party code audits from Coinsult and SpyWolf, and it’s clear that Bitcoin Hyper has managed to separate itself from hype-driven projects.

But what’s really drawing attention is its narrative: scaling Bitcoin without changing the chain. Investors see Bitcoin Hyper as a way to tap into the world’s most trusted blockchain, but with modern flexibility. Many believe it could completely reshape how Bitcoin is used.

But what’s really drawing attention is its narrative: scaling Bitcoin without changing the chain. Investors see Bitcoin Hyper as a way to tap into the world’s most trusted blockchain, but with modern flexibility. Many believe it could completely reshape how Bitcoin is used.

More than 15,300 people now follow Bitcoin Hyper on X (Twitter) – proof that interest is building fast ahead of the mainnet launch. If the team delivers, this could be a major leap forward for Bitcoin’s usability.

Visit Bitcoin Hyper Presale.

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.