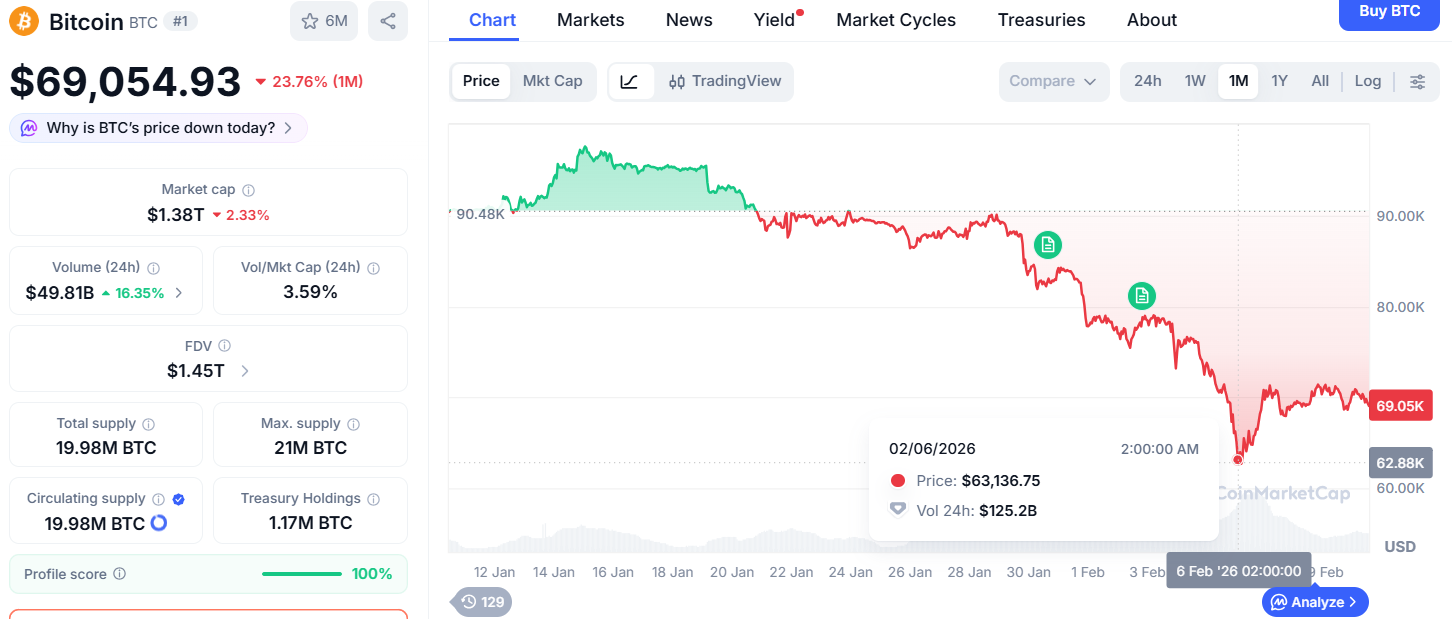

13th February 2026: The crypto market just hit a major bump in early February 2026. Bitcoin (BTC) dropped sharply by 13%, falling to $63,083. This wiped out months of progress and left traders staring at red screens. Social media was full of panic, with long-term holders wondering if the crypto winter had returned.

But while Bitcoin struggled, IPO Genie didn’t just survive the dip, it thrived. During the same week, $IPO was considered to be one of the top crypto presales and gained huge momentum. It attracted thousands of wallets and has raised over $1 million, steadily building a strong investor base.

Many crypto analysts have seen these cycles before. They say this isn’t a loss; it’s a clear signal that the market is shifting toward projects with real token utility and early crypto presale opportunities for long-term investors in 2026.

The Bitcoin Crisis: A Wake-Up Call for 2026

The crash on February 5, 2026, was a reality check. It wasn’t just a small dip; it was a massive exit of speculative money.

- The Loss: Over $1 trillion was erased from the Nasdaq 100 in three days.

- The Big Players: Strategy Inc, one of the largest Bitcoin holders, reported a $12.4 billion loss this quarter. Their CEO, Phong Le, tried to calm everyone down by saying they are safe unless Bitcoin hits $8,000, but investors are still nervous.

- The Ripple Effect: Coinbase stock fell 30%, and even Gemini Space Station Inc. had to cut 25% of its staff.

When the market’s largest asset declines sharply When the market’s largest asset declines sharply it forces people to ask: Why am I holding this? For many, the answer led them to diversify into presale crypto for long-term investors, specifically projects like IPO Genie that offer more than just a fluctuating price tag.

Why IPO Genie is Defying the Market

Usually, when Bitcoin drops, other coins follow like dominoes. But IPO Genie $IPO broke that pattern. It solves a problem that has troubled everyday investors for decades: access to private market investing.

The $3 Trillion Problem:

Before, investing in pre-IPO startups like Uber, Airbnb, or SpaceX required:

- $250,000 minimum investment

- Accredited investor status

- Connections to insiders

The IPO Genie Way: Using the token utility model, IPO Genie lets investors start with as little as $10. By opening the $3 trillion private equity market, IPO Genie gives the $IPO token real value, independent of Bitcoin’s price movements.

A Best System is Built on Proof, Not Promises

Hype doesn’t work in 2026. Investors want results. IPO Genie demonstrated this when Redwood AI Corp listed on the Canadian Securities Exchange. Its AI system flagged the deal as high-potential before the listing, proving the platform can identify early-stage crypto presale opportunities with data, not guesses.

How the $IPO Token Actually Works

The reason IPO Genie is considered as one of the top crypto presales for long-term investors is its structured ecosystem. It’s not a pump and dump coin; it’s a tool.

| Feature | What it means: |

| Sentient AI Agents | Scan global markets to find high-potential startup deals |

| Tiered Access | More $IPO held = better deals (See image for details) |

| Verified Security | Audited by CertiK and SolidProof; Fireblocks handles funds |

| Supply Control | Buyback-and-burn mechanisms create scarcity |

The Shift to Real Utility

The market in 2026 is different from 2021 or 2024. In the past, people bought “dog coins” for fun. Now, investors are moving into early crypto presale projects in 2026 with real utility. They want tokens that are backed by businesses that make money.

IPO Genie has four ways it generates revenue:

- Management Fees: 2% of assets and 5% of profits from successful deals.

- Trading Fees: Small fees on its own secondary market.

- Licensing: Selling its technology to other funds for up to $50,000.

- Subscriptions: Premium analytics for serious traders.

The money the platform makes helps the token keep its value. This makes it safer than holding only Bitcoin. The whitepaper shows how they use money to buy back tokens and make fewer of them.

Is it Risk-Free?

No investment is completely risk-free. Every crypto project can fail, startups are risky, and regulations can change. IPO Genie is transparent about these risks, and its whitepaper clearly explains how investors could lose money.

However, in a world where Bitcoin can drop 13% without warning, many investors prefer the calculated risk of a platform with real-world assets over the “pure gamble” of a coin that moves only on hype or tweets.

Final Thoughts: What Will You Hold?

Bitcoin’s February crash acted like a filter. It shows which projects are just noise and which are building the future of finance.

Right now, in Stage 51 of its presale, the $IPO token costs $0.0001217 (at the time of writing). More than 20,000 people have joined. They aren’t just buying a coin, they are getting a ticket to a private market that used to be only for the richest 1%.

Bitcoin will probably go back up, as it usually does. But in 2026, you don’t have to just watch your portfolio lose value while the big investors make all the money in private deals.

Official Channels:

IPO Genie Presale Link | Telegram | X – Community

Disclaimer: Cryptocurrency investments carry significant risk, including potential loss of principal. This article is for informational purposes only and does not constitute financial advice. Always conduct thorough research and consult with financial professionals before investing.

Frequently Asked Questions

1. Why did Bitcoin drop in February 2026?

Bitcoin fell about 13% after big investors sold and markets turned negative. Fear spread quickly, causing more people to sell.

2. What makes IPO Genie different from other crypto projects?

IPO Genie focuses on real startup access and token utility, not hype. It uses AI tools and a structured system to support long-term value.

3. Is investing in a crypto presale safe?

Crypto presales are risky and prices can change fast. Always research carefully and only invest what you can afford to lose.