Crypto presales in 2026 have left the old patterns behind. Investors now demand transparency, practical functionality, and regulatory awareness.

The projects that stand out offer real-world use and a clear plan for their tokens. IPO Genie $IPO stands out in this environment, not through hype, but through its approach to bridging traditional finance with blockchain infrastructure. To see why some presales get serious attention, look past the hype. Focus on the team’s roadmap and how the project fits in the market.

IPO Genie’s Strategic Positioning in 2026

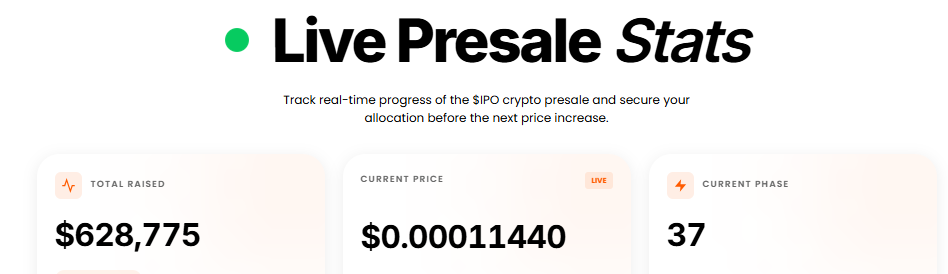

This project bridges the gap between traditional IPOs and crypto. Retail investors often cannot access early-stage IPOs. Tokenized exposure lets anyone join these opportunities. The main idea is simple: make growth-stage companies more accessible.

The Development plan focuses on following regulations, which sets it apart from purely speculative projects. Smart contracts handle token distribution. Rates may fluctuate; no returns are promised. This appeals to investors who want functional value, not just hype.

The token has a capped supply. Team tokens are locked with vesting to help reduce sudden sell-offs. Initially, users can stake tokens, with rewards currently up to 20%, depending on network activity. Nothing is guaranteed, but the structure is built with long-term use in mind. Independent audits add trust, though readers should always review official reports themselves.

IPO Genie gives everyday investors access to pre-IPO opportunities usually reserved for accredited participants. Early pricing may offer advantages; returns are not guaranteed. On top of that, its compliance-first approach keeps demand steady and makes it appealing to both retail and institutional investors.

Why IPO Genie Leads the 2026 Presale Landscape

- Market positioning: Opens retail access to pre-IPO deals usually limited to big investors.

- Existing demand: Leverages an already huge market instead of creating something new.

- Infrastructure advantage: Provides the tools for tokenized pre-IPO access, not just one deal.

- Network effects: Gains value as more companies explore blockchain fundraising.

- Regulatory awareness: Builds compliance into the platform from day one.

- Reduced risk: Early focus on rules lowers chances of future enforcement problems.

- Tokenomics structure: Capped supply and team vesting signal long-term planning.

- Sustained rewards: Staking incentives favor long-term users over short-term speculation.

- Execution matters: Strong positioning exists, but success depends on team and market follow-through.

Community Governance and Investor Participation

Beyond access to pre-IPO opportunities, IPO Genie empowers token holders through its governance features. Users can vote on platform upgrades, token utility changes, and new investment opportunities. This creates a direct line between the community and the project’s development, giving investors more say in how the platform evolves. For investors, this means your voice can help shape features and priorities while supporting sustainable growth.

Comparing Alternative High-Potential Presales

DeepSnitch AI ($DSNT)

Offers analytics tools for blockchain transparency. Their platform tracks whale movements and audits smart contracts using AI models. The benefit is clear right away: traders and developers get useful data insights. Unlike many AI blockchain projects, DeepSnitch already has working tools. Staking mechanisms reward data contributors, creating network effects. However, the competitive landscape includes established analytics platforms.

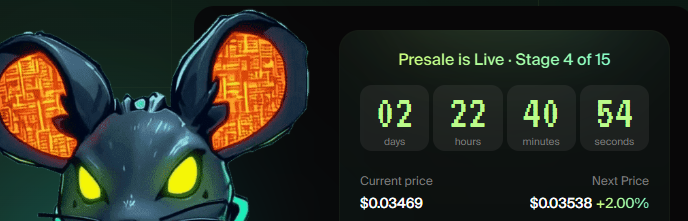

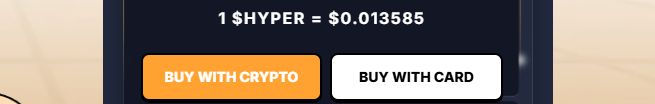

Bitcoin Hyper (BTHY)

Tackles Layer-2 scaling on the Bitcoin infrastructure. Their SDK attracts developers seeking Bitcoin’s security with better speed and lower costs. The best return presale opportunities often come from infrastructure plays with broad reach. First-round backers gain access below the anticipated mainnet launch pricing. Yet execution risk remains high. Layer-2 projects face technical challenges and adoption hurdles.

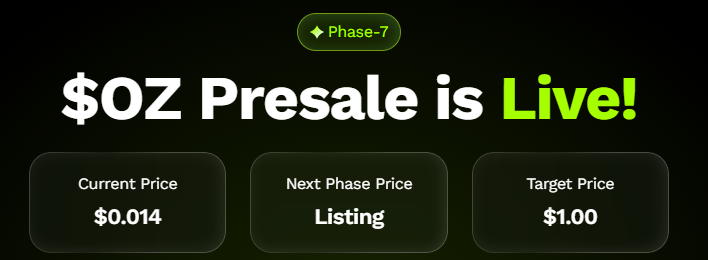

Ozak AI ($OZ)

Blends AI compute markets with blockchain coordination. They’re building decentralized infrastructure for AI model training and prediction markets. The thesis is compelling: AI needs trustless coordination layers. Their presale attracted significant attention. Tokenomics include governance rights for compute allocation decisions.

SUBBD

Connects creators with audiences through tokenized engagement and micropayments. Staking rewards incentivize platform participation rather than passive holding.

How Do These Projects Address Real Market Gaps?

| Project | Market Focus | Presale Status |

| IPO Genie | Pre-IPO tokenization | Active, $2.3M raised |

| DeepSnitch | AI analytics | Phase 2 |

| Bitcoin Hyper | Layer-2 scaling | Testnet live |

| Ozak AI | AI compute | Oversubscribed |

| SUBBD | Creator economy | Early phase |

These choices aren’t random, they show real gaps in the market.The difference between a successful presale and a failed one is whether the team can deliver on their plans. Milestone plan, team backgrounds, and audit transparency offer clues. Still, primary-stage risk persists across all presales regardless of planning quality.

Due Diligence Essentials for Presale Evaluation

Research begins with team verification. Anonymous founders raise immediate red flags. Check LinkedIn profiles, past projects, and industry reputation. Audit reports matter, but understand what they cover. Security audits examine code vulnerabilities, not business model viability. Look at how tokens are distributed over time and how inflation may affect value, these details reveal the project’s planning quality. Vesting periods under 12 months often indicate cash-grab intentions.

Projects that follow regulations and engage their communities build more trust. Clear docs and active discussions show real interest, not just hype.

Where does IPO Genie fit among these considerations?

Their regulatory-first approach and traditional finance integration offer differentiation. The benefits are clear, but investors should know it might take a while before everything rolls out. Pre-sale pricing may provide advantages if the platform gains traction.

Understanding Risk in Early-Stage Opportunities

Presales can grow fast, but they come with challenges. Teams may face delays, technical issues, or changing regulations. Token prices can swing, and selling too early can be tricky. Spread your investments to reduce risk, and only use money you can afford to lose. Focus on projects with real use and clear plans. These best return presale characteristics take time to materialize.

Practical Tips for Investors

These are a few tips for beginners to be cautious.

- Research token rules and vesting schedules carefully.

- Check team histories and professional backgrounds.

- Look for verified audits and code reviews.

- Monitor community engagement on Telegram or Discord.

- Compare multiple high-potential presales before committing.

According to cryptsy there are few more tips to consider – Demystifying Tokenomics: A Guide to Crypto Presales

Smart Research, Real Rewards: How to Spot the Best 2026 Crypto Presales

Crypto presales in 2026 reward careful research and patience. The market emphasizes utility-driven crypto tokens and transparent execution.

A high ROI presale requires more than presale pricing. Check team credibility, plan clarity, tokenomics, audits, and community activity. Diversify investments to reduce exposure.

By following these principles, investors can spot the best return presale opportunities. Projects that focus on real-world use and regulatory compliance will likely perform better than hype-driven tokens.

Frequently Asked Question

What is token vesting?

Token vesting means your tokens are released little by little over time, not all at once. This helps teams and investors stay committed and avoids sudden sell-offs.

Source to verify and learn more on Token vesting

What Is a Crypto Presale?

A crypto presale happens when a project sells tokens before they reach public exchanges. This helps fund early development. Prices are usually lower than launch prices. But returns are never guaranteed. Every presale carries risk, so research is essential.

How to Evaluate a Presale Safely?

- Understand the token rules – Check total supply, vesting schedules, and release timings.

- Research the team – Look at their past projects, experience, and credibility.

- Verify audits and security – Ensure smart contracts have been reviewed and audited.

- Watch the community – Active discussions on Telegram, Discord, or social media show authentic engagement.

- Compare multiple presales – Don’t rush; see which projects have the clearest utility and roadmap.

- Check regulatory compliance – Confirm the project follows relevant laws for safer investment.

- Invest responsibly – Only allocate amounts you can afford to lose.

For deeper guidance, see this guide on spotting legit presale projects.

Official Channels:

Website URL & Whitepaper | Telegram | X – Community

Disclaimer: This content is for informational purposes only and does not constitute financial advice. Always research before investing in digital assets.