Crypto prices remain lower after last week’s flash crash, with Bitcoin down 8.9% over the past seven days, Ethereum down 8.7%, BNB down 6.3%, and XRP leading the losses with a 14.4% decline.

Two key drivers appear to be fueling the sell-off: fear and uncertainty following tens of billions in mass liquidations, and concerns about potential further developments in the US-China trade war. However, many experts believe the crypto market is about to regain bullish momentum soon.

Factors such as the Russell 2000 Index (which signals retail risk-on sentiment) being at all-time highs, the Nasdaq and S&P 500 steadily recovering from last week’s crash, and macroeconomic factors such as dovish comments from SEC chair Jerome Powell indicate that the crypto market is primed to bounce.

That’s also not to mention crypto-specific catalysts, like upcoming altcoin ETF deadlines and a growing appetite for altcoin treasuries among publicly listed companies. With that in mind, the current opportunity might prove to be an excellent entry point to buy the dip. So, let’s explore the four top picks of the best crypto to buy.

Bitcoin Hyper

Look at the top ten cryptocurrencies by market capitalization, and you’ll see that they are mostly blockchain infrastructure projects; many of the top 30 are as well.

That’s because infrastructure tends to generate the most fees and can adapt more effectively to changing market conditions, allowing these projects to rally higher and remain relevant longer. This is why Bitcoin Hyper is our top choice, as it’s developing a Bitcoin Layer 2 blockchain to address the network’s long-standing issues of slow speeds and limited features.

Bitcoin Hyper is built using ZK-rollups and Solana Virtual Machine tools, creating a unique setup that enables it to process thousands of transactions per second while supporting smart contracts, all without compromising Bitcoin’s security.

The best part is that HYPER is currently available through a presale, having already raised $23.8 million. That’s a huge amount for a new project, but it also leaves plenty of room for growth once it hits the open market, especially if it compares favorably to existing top infrastructure projects. Visit Bitcoin Hyper.

Tron

Tron is another infrastructure play with strong potential right now. There are two main reasons it stands out currently. First is its relative strength, up 1.5% today, while most top cryptocurrencies are in the red. It also experienced a softer selloff in the past week, dropping only 5%, which makes it one of the best-performing top 30 cryptos by market cap.

Another reason is its huge stablecoin market cap, now at $86 billion, which has increased over 30% since early 2025. This highlights strong institutional adoption and provides the ecosystem with additional dry powder that can be used to purchase TRX or other tokens as interest rates decline and the dollar’s appeal weakens.

For context, Tron has the second-largest stablecoin market in crypto, only behind Ethereum. If these stablecoins shift into risk assets, there’s real potential for TRX’s price to surge much higher, making this a catalyst to watch closely.

For context, Tron has the second-largest stablecoin market in crypto, only behind Ethereum. If these stablecoins shift into risk assets, there’s real potential for TRX’s price to surge much higher, making this a catalyst to watch closely.

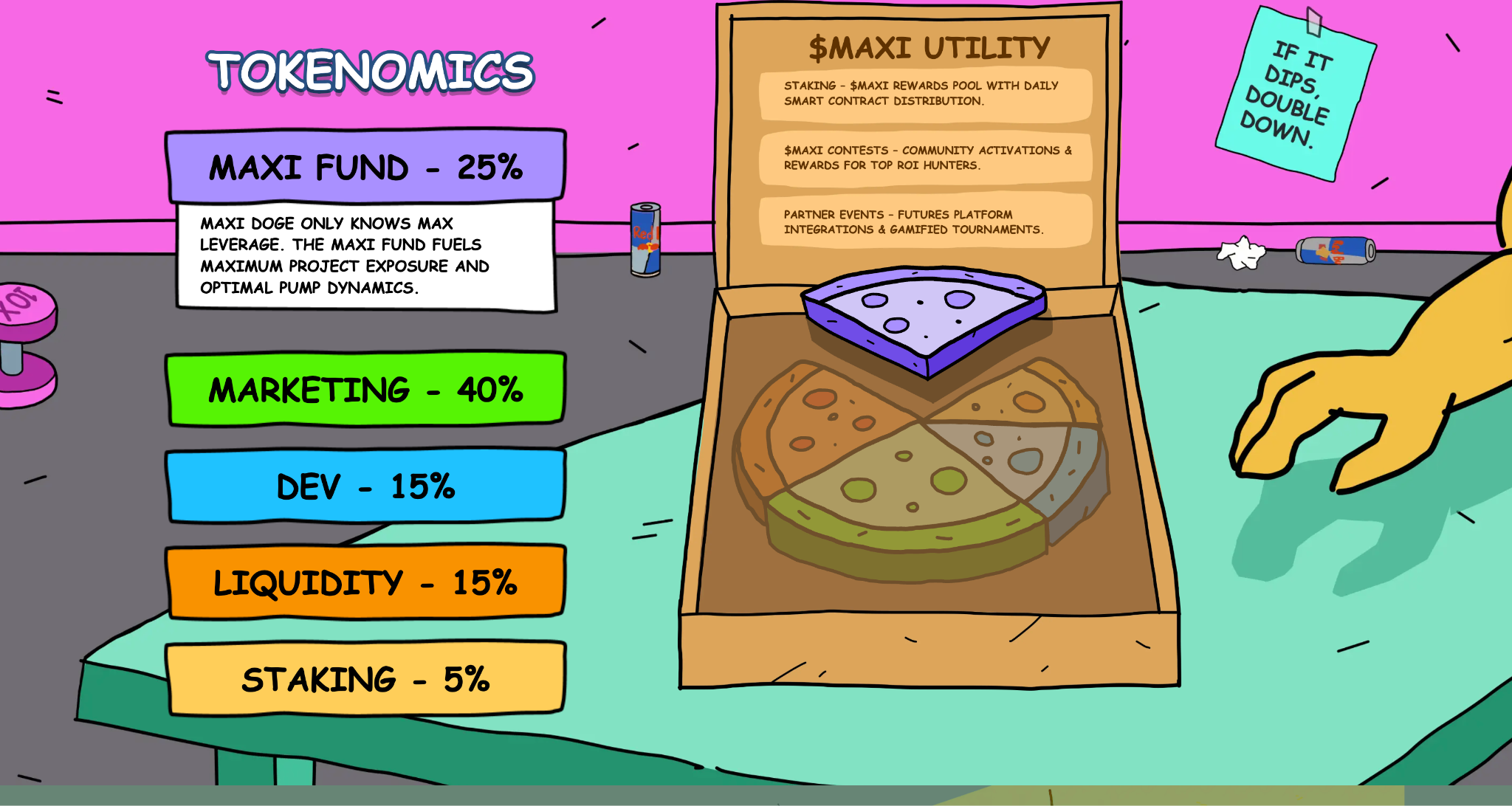

Maxi Doge

Maxi Doge is a Dogecoin-themed meme coin on the Ethereum blockchain. But it’s not just here to spread the message of “do only good every day” like the original Dogecoin. Maxi Doge is created for degen futures traders who want to go all in.

The project’s mascot, Maxi the dog, is portrayed as a bodybuilding, 1000x leverage trading crypto bro who lives on a strict diet of caffeine and “MAXITREN.” However, what’s interesting is how the team turns this meme-heavy branding into real utility.

They plan to integrate the MAXI token into futures trading platforms, enabling users to trade with leverage and engage in high-risk, high-reward strategies. It will also feature weekly trading competitions where winners earn MAXI and USDT rewards, adding a competitive and engaging element that could boost adoption.

They plan to integrate the MAXI token into futures trading platforms, enabling users to trade with leverage and engage in high-risk, high-reward strategies. It will also feature weekly trading competitions where winners earn MAXI and USDT rewards, adding a competitive and engaging element that could boost adoption.

Maxi Doge is also in the presale phase and has raised $3.6 million so far. This indicates strong community interest and potential for massive demand once it reaches exchanges. Visit Maxi Doge.

Solana

While Solana’s meme coin sector hasn’t disappeared, the network is rapidly evolving into something much bigger.

Now, users can trade perpetual futures contracts directly from the Phantom wallet dashboard; there are dozens of real-world asset (RWA) apps that enable users to trade tokenized versions of stocks through platforms like Backpack; and the network also boasts an expanding DeFi ecosystem that offers countless innovative ways for users to generate yield.

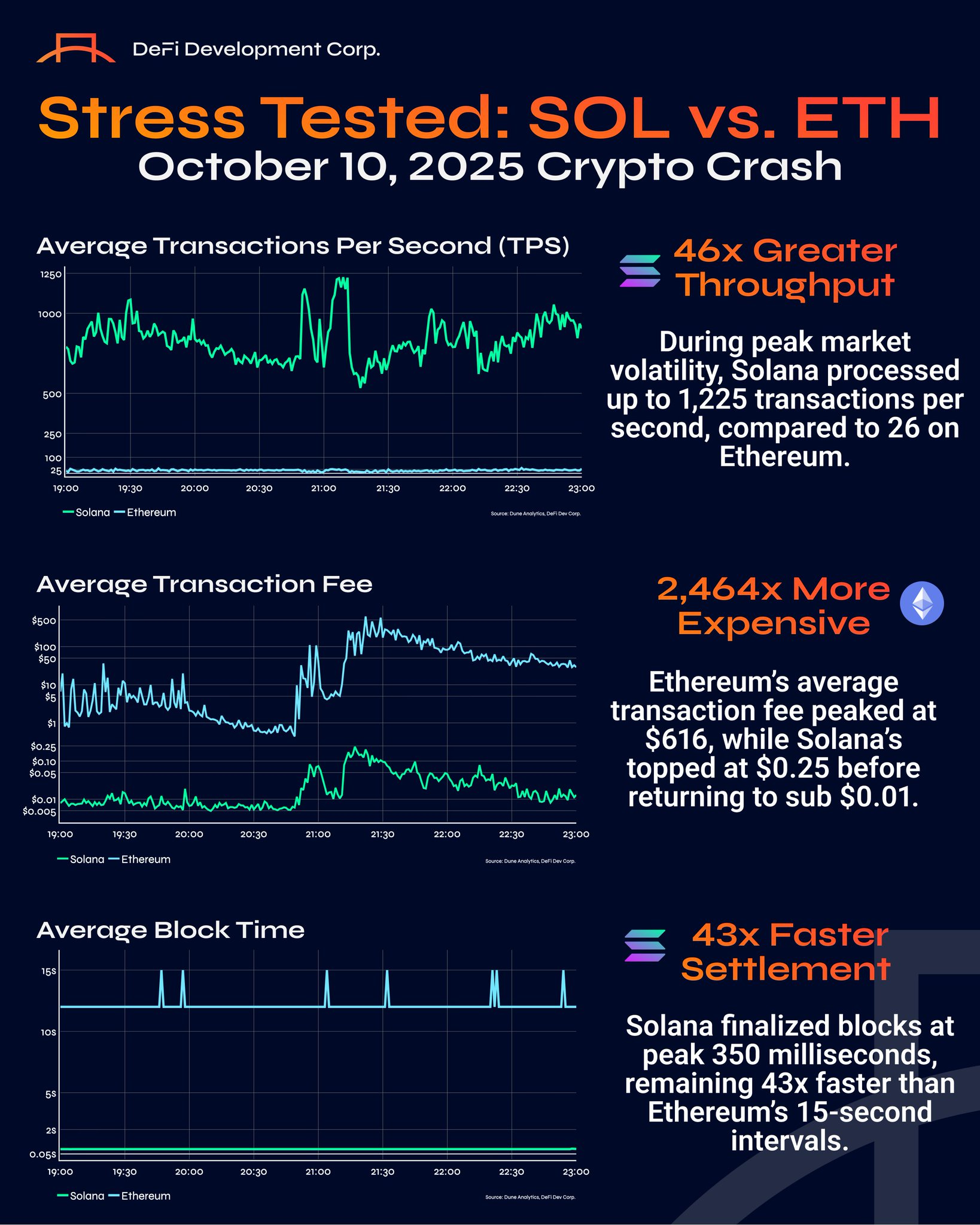

Additionally, last week’s flash crash served as a proving ground for decentralized infrastructure, and Solana passed with flying colors. DeFi Development Cop noted that Solana sustained 1,225 TPS and saw average fees peak at just $0.25 before quickly dropping below $0.01. Meanwhile, it wrote that many Ethereum users were “priced out” and could not execute transactions.

This combination of a growing ecosystem and strong infrastructure cements Solana’s long-term potential and could help it outperform in the months ahead.

This combination of a growing ecosystem and strong infrastructure cements Solana’s long-term potential and could help it outperform in the months ahead.

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.