The cryptocurrency market is known for delivering returns that are almost impossible to find elsewhere. Currently, traditional finance (TradFi) is in disbelief due to gold’s ‘parabolic’ rise – it has achieved a 49% annual return.

That’s extraordinary for gold; it also far surpasses the typical stock market return. But in crypto, investors don’t blink at those kinds of gains. An asset can soar 49% or more in a single day – in fact, this happens quite often. Today, two tokens have done just that: Enzyme rallied 60% and BC Game Coin gained 50%. Meanwhile, STBL comes in slightly lower with a 45% surge.

Cryptocurrency prices can rally so strongly because they benefit from strong community backing and lower market capitalizations. The latter characteristic is a significant advantage over assets like gold, which is currently valued at a jaw-dropping $29 trillion.

So, what is the best crypto to buy now for huge profits? We’ve pinpointed four gems showing signs of community support, robust use cases, and potential for huge long-term gains. Let’s take a look.

Bitcoin Hyper

Traditionally, Bitcoin has been used for storing and transferring monetary value. However, this use case is starting to feel more dated as new on-chain use cases emerge, such as RWAs and DeFi. This is where Bitcoin Hyper comes in, creating a smart contract-enabled Bitcoin Layer 2 blockchain with far faster speeds and lower fees.

Think of Bitcoin Hyper like a portal that transforms Bitcoin from a static store of value into a fully programmable financial hub. It uses ZK-rollup and Solana Virtual Machine (SVM) technology, meaning it retains Bitcoin-grade security while introducing Solana-grade performance – talk about the best of both worlds.

Currently, Bitcoin Hyper is in its presale, having raised over $24 million so far. This illustrates massive investor appeal, but with a use case that unlocks new potential for a $2.2 trillion asset, it’s easy to see how HYPER could grow significantly in the months and years ahead.

Visit Bitcoin Hyper.

Sei

Sei is a Layer 1 blockchain focused on speed and low fees. According to its website, the project has a maximum theoretical throughput of 200,000 transactions per second (TPS). For comparison, Solana, which is known for its speed, has a maximum of 65,000 TPS, although some researchers claim it has reached 100,000 TPS in recent months.

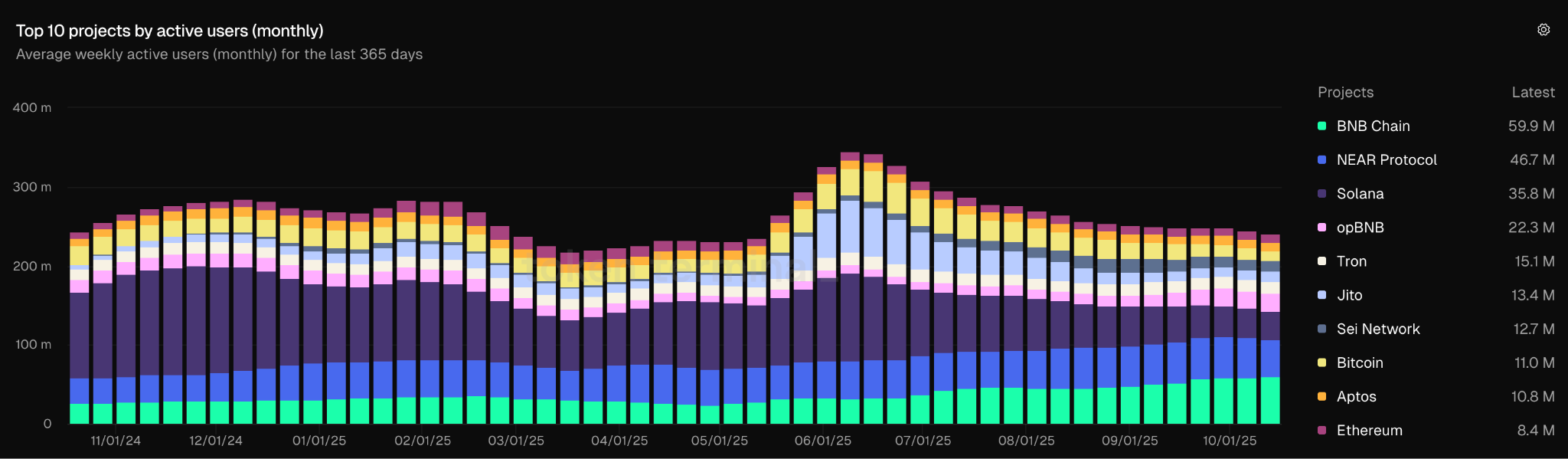

Beyond speed, one reason Sei might be significantly undervalued is that it currently has 12.7 million active monthly users, while its market cap is only $1.2 billion. In comparison, Aptos has 10.8 million monthly users and a market cap of $2.3 billion, nearly double Sei’s.

Furthermore, Tron has 15 million monthly users, only slightly more than Sei, but its valuation stands at $30 billion, leaving room for a 25x gain to catch up.

Active users are a primary consideration for valuing price potential since they indicate actual adoption rather than just sentiment or hype. While hype can cause short-term price swings, true adoption allows for steady growth over time.

Active users are a primary consideration for valuing price potential since they indicate actual adoption rather than just sentiment or hype. While hype can cause short-term price swings, true adoption allows for steady growth over time.

PEPENODE

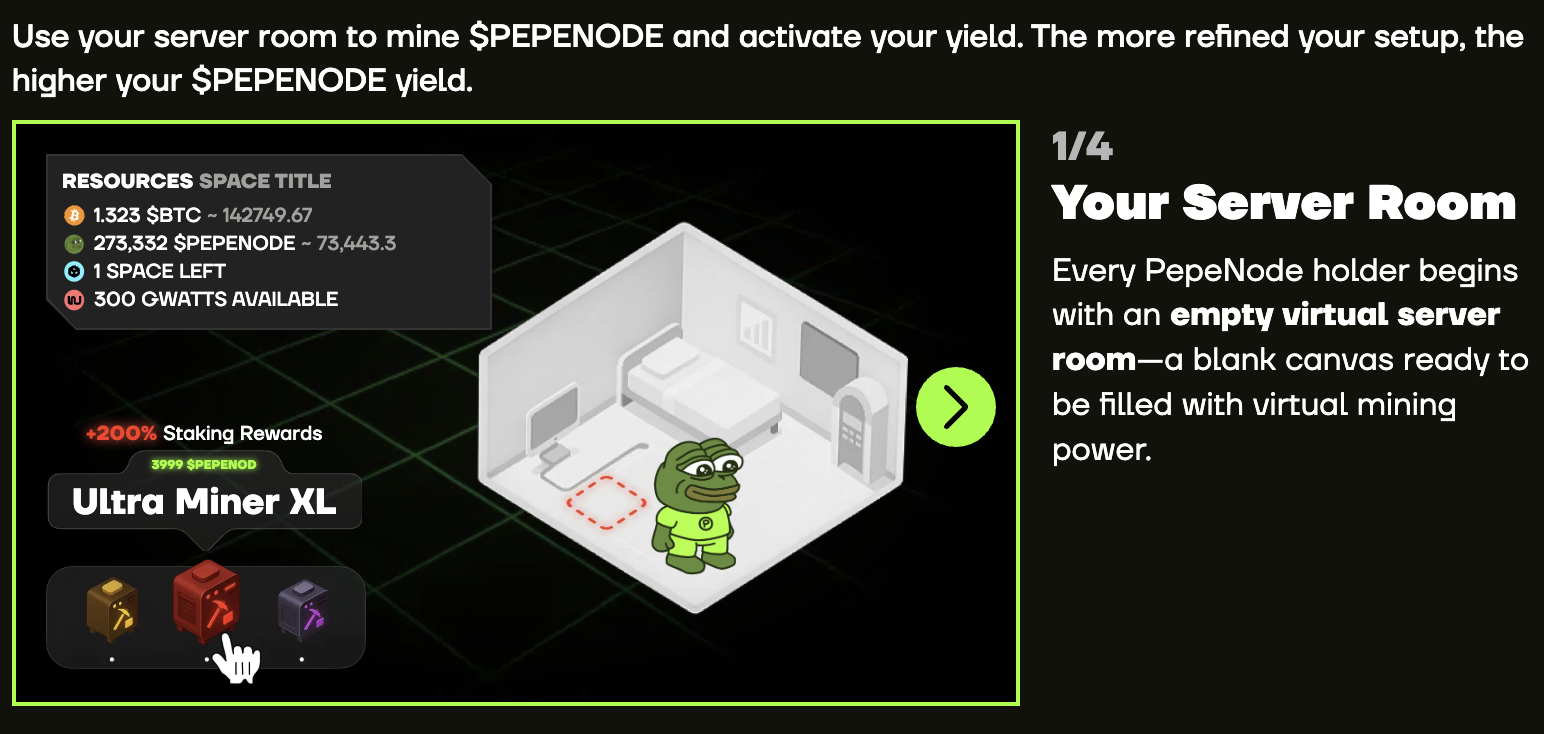

PEPENODE is a new trending meme coin that introduces a concept called Mine-to-Earn, which is like a gamified version of crypto mining, allowing users to earn real rewards without the usual headaches.

Here’s how it works: users start with an empty server room, then spend PEPENODE tokens to fill it with Miner Nodes and generate mining power. The more power they generate, the more PEPENODE tokens they will earn.

The project will also burn 70% of PEPENODE tokens spent in the store, creating strong deflationary pressure that could help the price grow over time.

The project will also burn 70% of PEPENODE tokens spent in the store, creating strong deflationary pressure that could help the price grow over time.

PEPENODE is also undergoing a presale, where it has raised $1.8 million so far. That’s an impressive amount, but it also means it’s still early days for the project and could, therefore, indicate substantial upside potential ahead, especially as word spreads about its innovative approach to user rewards and deflationary tokenomics.

Visit PEPENODE.

Ondo

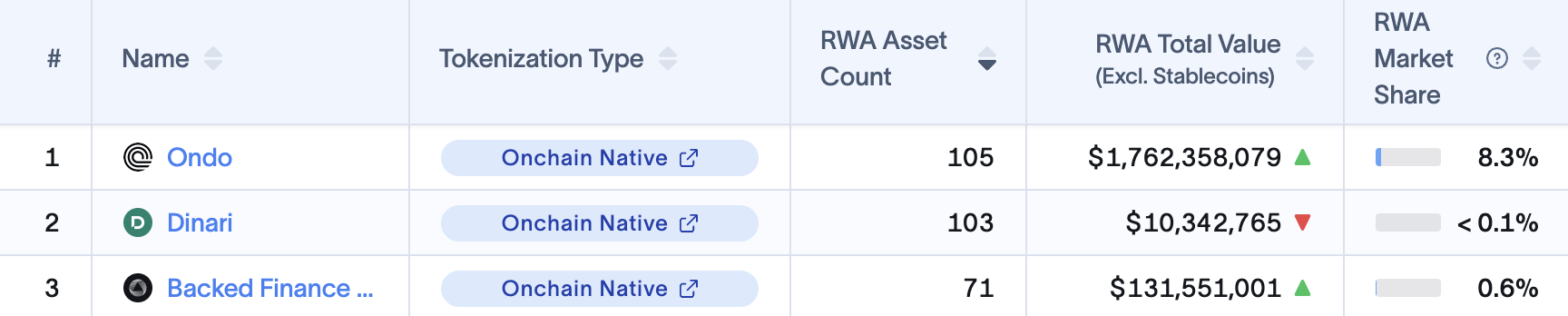

Ondo is a tokenized real-world asset (RWA) protocol focused on bringing traditional financial products on-chain. It provides infrastructure that is regulatory-compliant and grants investors access to assets like stocks, bonds, and commodities.

According to data from RWA.xyz, Ondo holds $1.7 billion in tokenized assets outside of stablecoins and offers 105 different assets on its network, making it one of the largest RWA projects by all counts.

However, Standard Chartered analysts believe that the RWA market could explode to a $34 trillion valuation by 2034, and Ondo’s leadership in this space could help it attract a sizable portion of this value, potentially sending the ONDO price soaring.

At press time, Ondo trades at $0.77 with a $2.4 billion market capitalization. While this is by far the largest valuation on our list, it could still be seen as inexpensive when considering the long-term prospects of the RWA industry.

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.