Best Crypto Presale To Buy Now searches are filled with names like BlockDAG and Digitap, but many serious buyers are starting to ask a different question. Does another “under the radar” project with real payment utility have a better chance of holding value when the next cycle cools down?

BlockDAG leans on technology branding, Digitap leans on its app and cards, while a quieter PayFi name, Remittix, focuses on moving money between crypto and bank accounts. That mix of hype, utility, and adoption now sits at the centre of every Best Crypto Presale To Buy Now list.

Are BlockDAG and Digitap Still the Best Crypto Presales to Buy Now?

BlockDAG positions itself as a high-performance network that blends Bitcoin-style security with Directed Acyclic Graph speed. The marketing pitch frames it as a contender for best crypto presale 2025 lists and a long-term settlement layer.

The team states that more than $437.48 million has been raised, reinforcing the scale of attention around its Ground-Breaking Crypto Presale 2025 initiative.

Supporters point to its emphasis on scalability and energy efficiency, arguing that it could become a foundation for future DeFi project activity if delivery matches the claims.

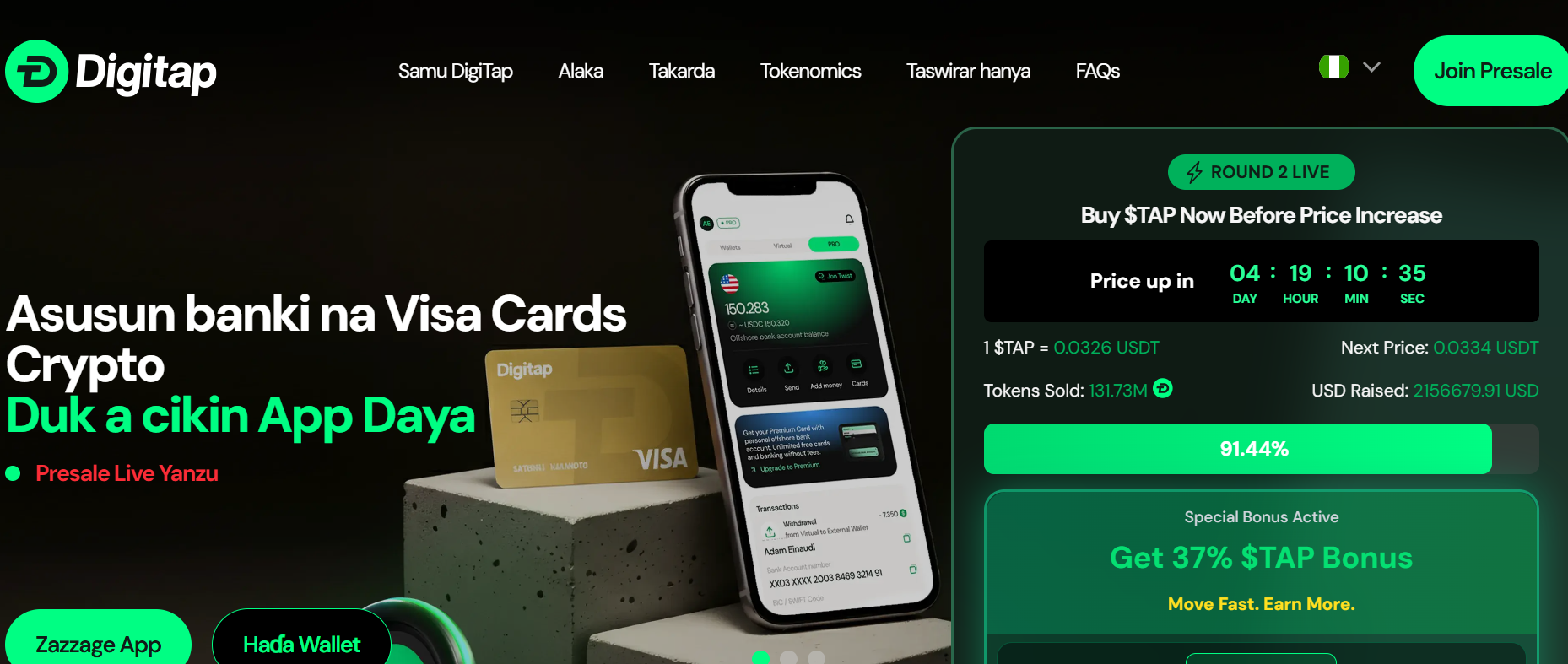

Digitap takes a different route. It promotes an “omni-bank” experience that combines crypto and fiat inside one app, with Visa cards, external fiat accounts, and in-app bonuses tied to its TAP37 and DIGITAP20 codes.

Digitap takes a different route. It promotes an “omni-bank” experience that combines crypto and fiat inside one app, with Visa cards, external fiat accounts, and in-app bonuses tied to its TAP37 and DIGITAP20 codes.

Digitap’s current figures show Round 2 live, with 1 TAP priced at 0.0326 USDT ahead of the next increase to 0.0334 USDT. The project reports 131.73 million tokens sold and $2 million raised, underscoring the early traction behind its TAP rollout.

Users are encouraged to link everyday payments, transfers, and savings to its token, which has helped Digitap appear in many Best Crypto Presale To Buy Now discussions as a card-focused product play.

Both projects are built around growth narratives, but they still sit largely at the promotion stage. For buyers who want crypto with real utility from day one, attention is now turning to a payment project already running wallet tests, integrating compliance, and preparing for centralized exchanges. This is where the “secret project” angle points directly toward Remittix.

Why Remittix is Different From Hype-Driven Presales

Remittix targets the gap between crypto balances and real-world bank rails. Instead of just branding itself as the next big altcoin in 2025, the team is building a PayFi stack designed to send digital assets directly to bank accounts with low friction.

The RTX token is priced at $0.1166 per token, with more than $28.2 million raised from private funding and over 686.6 million tokens already acquired by early backers.

Delivery is already visible. The Remittix Beta Wallet is live, and testing is now opening to more holders, with the top 10 purchasers each week (on iOS) invited into the next wave of users.

Security has been a core focus: the team is fully verified, and Remittix is ranked #1 for pre-launch tokens on CertiK Skynet, giving RTX a strong position among payment-focused candidates for Best Crypto Presale To Buy Now spotlights.

Liquidity planning is clear as well. Remittix has confirmed future listings on BitMart and LBank once the funding milestones are met, providing holders with a defined path from private funding to major centralized exchanges.

Alongside that, there is a 15% USDT referral program paid through the dashboard and claimable every 24 hours, plus a headline $250,000 Remittix Giveaway for community growth.

What’s Anchoring Remittix’s Growth Story:

What’s Anchoring Remittix’s Growth Story:

- PayFi focus: crypto-to-fiat flows and bank payouts

- Wallet beta testing expanded to more iOS holders

- Ranked #1 for pre-launch tokens on CertiK Skynet

- 15% USDT referral rewards for new buyer invites

- $250,000 Remittix Giveaway

Beyond The Next Hype Cycle

In the next bull run, BlockDAG and Digitap may still attract attention as high-growth narratives. Yet buyers who want exposure to payments, bank connectivity, and structured CEX access are increasingly treating Remittix as more than just another Best Crypto Presale To Buy Now candidate.

For those trying to choose between marketing-heavy launches and infrastructure built for actual money movement, Remittix stands out as the “secret project” that could quietly eclipse both BlockDAG and Digitap when the next cycle arrives.

Frequently Asked Questions

1. What makes the “secret project” stand out in the Best Crypto Presale to Buy Now category?

The project introduces a payments-driven design that supports crypto-to-fiat transfers and direct user payout options. Its focus on bank connectivity, wallet testing, and exchange preparation gives it a more practical role compared to many early-stage tokens.

2. How does Remittix differ from BlockDAG and Digitap?

BlockDAG positions itself as a high-speed, scalable network, while Digitap focuses on a card and app system that blends crypto with traditional banking. Remittix aims to stand out by targeting direct crypto-to-fiat payments, structured around wallet testing, bank payout rails, and centralized exchange access.

3. Why are BlockDAG and Digitap being compared with another project in the Best Crypto Presale to Buy Now discussion?

BlockDAG and Digitap are two highly visible names in the current cycle, but many investors are now reviewing alternatives because market interest is shifting toward projects with stronger real-world use.

4. Why do some investors think this “secret project” could become the Best Crypto Presale to Buy Now, ahead of BlockDAG and Digitap?

Many traders point to its payments-focused model, which enables smooth crypto-to-fiat transfers and supports real user payouts. It is also progressing quickly through wallet testing and future exchange preparation, giving it a stronger real-world angle than most early-stage projects.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway