Bitcoin’s consolidation around $112,000 on October 15 coincides with Japan planning to ban insider trading in crypto by 2026, granting its Securities and Exchange Surveillance Commission power to investigate and penalize violations just like in traditional markets.

With Japan reporting 7.88 million active crypto accounts as of August, a fourfold increase over five years, and the Retirement Investment Choice Act backed by four Republican cosponsors, the regulatory landscape is shifting in crypto’s favor.

It never hurts to make safe crypto investments at a time like this. For those seeking remarkable rewards, security, and explosive growth potential at once, DeepSnitch AI is probably the best choice right now.

With early-stage pricing at $0.01877 in Stage 2 and institutional-grade security through dual audits from Coinsult and SolidProof, this top long-term coin offers asymmetric upside, and early investors are already seeing returns of over 24%.

Crypto market remains resilient

The crypto market’s recovery from Friday’s record $19 billion in liquidations shows remarkable resilience, with spot Bitcoin ETFs reversing course to capture $103 million in inflows on Tuesday, while Ethereum ETFs surged with $236 million across all nine funds.

Global adoption continues accelerating as Japan’s crypto user base hits 12.41 million, with projections reaching 19.43 million by year-end, while stateside developments like the potential inclusion of crypto in retirement accounts could route billions from traditional finance into digital assets.

Even amid volatility, institutional confidence remains strong, with 48 treasury updates from corporations adding Bitcoin to their balance sheets in just one week from August 18-24, signaling that smart money sees the current consolidation as accumulation, not distribution, territory. This environment separates the best crypto to invest in from the rest.

While the most established cryptos are consolidating and finding their footing after the jolt, DeepSnitch AI combines downside protection through audited security with rare upside potential.

Best 3 cryptos to invest in as Bitcoin consolidates

Best 3 cryptos to invest in as Bitcoin consolidates

Best crypto to invest in: DeepSnitch AI

DeepSnitch AI has all the fix-ins to be the best crypto to invest in among presale opportunities. Post-launch, its AI agents will solve a fundamental problem, information asymmetry, which currently plagues retail traders. While established coins can appear to be the safest crypto investments in some ways, they simply cannot deliver the 100x potential that early-stage projects with genuine utility provide.

The platform’s SnitchFeed will monitor alpha groups, Telegram channels, and social sentiment 24/7, flagging whale activity and crowd emotion swings before they hit mainstream awareness. Traders won’t miss opportunities because they were offline or scrolling through the chaos. The AI will filter the signal from chaos and deliver actionable alerts in real time.

Meanwhile, SnitchCast will curate and push the latest crypto news and alpha from top channels directly to users. Instead of manually tracking dozens of sources, traders will receive filtered, relevant updates instantly through Telegram integration. This addresses time poverty, the real constraint preventing most people from staying ahead of markets. The AI does the work, while traders make the decisions.

DeepSnitch AI has clear potential to 100x. Thanks to its early stage, the same dollar amount that moves Ethereum 1% can move DeepSnitch 1,000%. The staking program went live during presale, creating immediate utility and holder retention. The presale is swiftly advancing toward $706,000, when its price is set to increase, and early-stage buyers have already pocketed 24% gains through tier progression, with a token now priced at only $0.01877.

All this puts DeepSnitch AI firmly among the top long-term coins for portfolios seeking both security through audits and explosive growth through early entry.

Ethereum: Layer-2 scaling drives long-term value

Ethereum: Layer-2 scaling drives long-term value

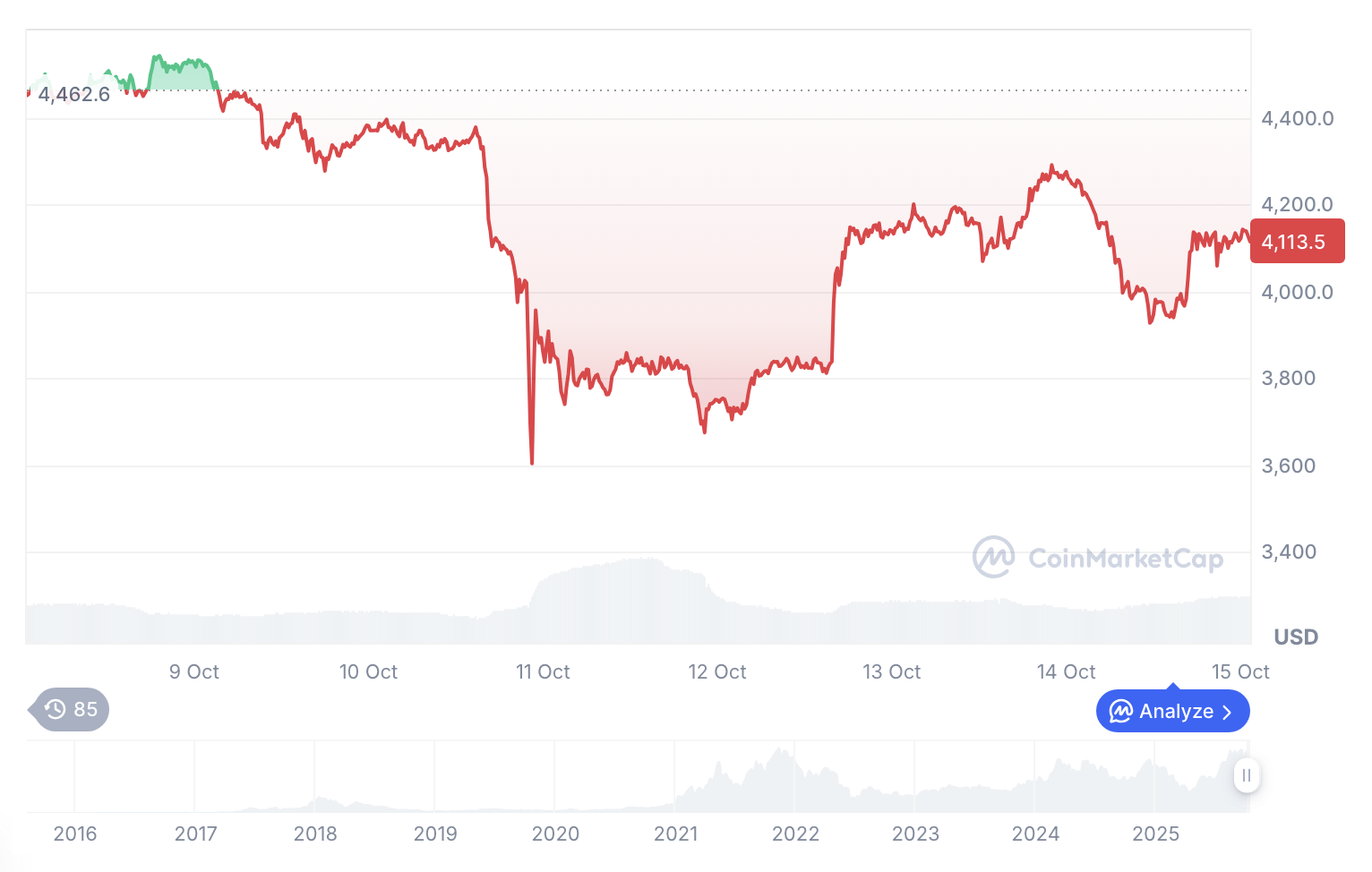

Ethereum traded around $4,100 on October 14, consolidating after an 8% pullback earlier in the week triggered liquidations exceeding $115 million in long positions. Despite short-term weakness, technical patterns suggest ETH remains positioned for a breakout toward new highs.

A bull flag pattern on the weekly chart points to potential targets around $10,000, though bulls must first hold support near $3,800. Meanwhile, layer-2 scaling solutions continue expanding Ethereum’s capabilities while reducing mainnet congestion, addressing the primary criticism that limited adoption during previous cycles.

ETF flows remain mixed, but show institutional interest persists. Some forecast targets near $5,000 by year-end under base scenarios, with aggressive projections extending higher if layer-2 adoption picks up speed and ETF approvals for staking features materialize.

There are many ifs and buts here, though, and at $500 billion market cap, Ethereum offers stability but limited percentage upside potential compared to the best crypto presale opportunities, DeepSnitch AI among them.

Solana: ETF approvals could trigger institutional surge

Solana held around $195 on October 14 and is therefore among the established tokens showing resilience. Recent on-chain activity also shows strength, with Solana processing $1.21 trillion in DEX volume during 2025, surpassing Ethereum’s $400 billion and BNB’s $761 billion combined.

Multiple Solana ETF applications face SEC deadlines in mid-October from VanEck, Fidelity, Bitwise, Grayscale, and 21Shares, with approval odds placed near 95% by analysts for 2025, which would validate SOL as a commodity and open up institutional access.

Based on a combination of technicals and fundamentals, analysts project targets between $300 and $500 by year-end, with some seeing potential for $400 as the network’s ecosystem continues expanding.

But at a roughly $111 billion valuation, this is already a strong project, with limited percentage returns compared to DeepSnitch AI’s presale valuations.

The verdict

Despite the market’s temporary weakness and outflows at the start of October, institutional accumulation continues, and seasonal patterns suggest this consolidation precedes rather than prevents the move higher.

At a time like this, strategic portfolios balance established projects with early-stage opportunities. DeepSnitch AI pricing at $0.01877 combines security through dual audits with explosive growth potential through early entry and genuine utility.

Over $415,000 raised proves this platform’s already-steady momentum. Early backers are already sitting on 24% gains, up from only $0.01510.

Presale-stage projects with working products, security validation, and market timing offer 100x potential that billion-dollar caps cannot deliver, and DeepSnitch AI is among the best of those available.

Visit the official website before the next price jump.

FAQs

FAQs

What makes a crypto the best to invest in during October 2025?

The best crypto to invest in combines strong fundamentals with perfect timing. DeepSnitch AI at $0.01877 offers early-stage pricing with security through dual audits, positioning it as one of the safest crypto investments with 100x potential as Q4 strength builds.

Why are safest crypto investments important for long-term portfolios?

Safest crypto investments balance risk and reward through security validation. DeepSnitch AI’s Coinsult and SolidProof audits provide institutional-grade protection, while early presale pricing offers asymmetric upside that established coins cannot match due to market cap constraints.

Which top long-term coins offer the best growth potential?

Among top long-term coins, DeepSnitch AI combines utility through five AI agents with holder incentives via staking rewards. While Ethereum and Solana offer stability, the best crypto returns come from crypto presales, where small capital movements create exponential percentage gains.

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.