TLDR

- BNB Smart Chain hit record transaction volume with over 405 million transactions in 30 days, up 243%

- Non-sybil users reached all-time high of 1.7 million, showing genuine network growth beyond bots

- BNB price dropped to $650, down 6.70% from yearly highs despite strong network metrics

- DEX volume on BSC surpassed Ethereum and Solana with $147 billion in monthly trading

- Futures markets show 73% long positions, indicating bullish sentiment among large traders

Binance Coin has experienced mixed performance as its underlying blockchain network achieves record growth metrics. The token dropped to $650 on June 15, falling 6.70% from its yearly peak despite strong fundamentals.

BNB Smart Chain processed over 405 million transactions in the past 30 days. This represents a 243% increase from the previous month. The surge places BSC among the most active blockchains, trailing only Solana in transaction volume.

Network adoption has reached new milestones with genuine user growth. Non-sybil users hit an all-time high of 1.7 million according to Artemis data. These verified real users exclude airdrop hunters and bots, making the growth more meaningful for long-term network health.

Active addresses on the network jumped to 2 million monthly users. This represents a 17% increase and exceeds activity levels on Ethereum and Tron networks. New wallet creation also spiked to 595,700 addresses in the past month.

Trading Volume Leadership

BNB Smart Chain has overtaken major competitors in decentralized exchange volume. The network processed $147 billion in DEX trading over 30 days. This exceeds Solana’s $79 billion and Ethereum’s $65 billion in the same period.

PancakeSwap leads this surge as the network’s primary DEX platform. The protocol handled $3.3 billion in 24-hour volume, surpassing Uniswap’s $1.7 billion. Other major platforms like Raydium and Aerodrome recorded $545 million and $343 million respectively.

The increased transaction activity generated $14.8 million in network fees. This represents a 3% increase in fee revenue, which directly impacts BNB’s burn mechanism.

Market Sentiment and Price Action

Despite network growth, BNB price has faced downward pressure. The token retreated from a local high of $673 following Middle East political tensions. It successfully defended the $640 support level and bounced back over the past day.

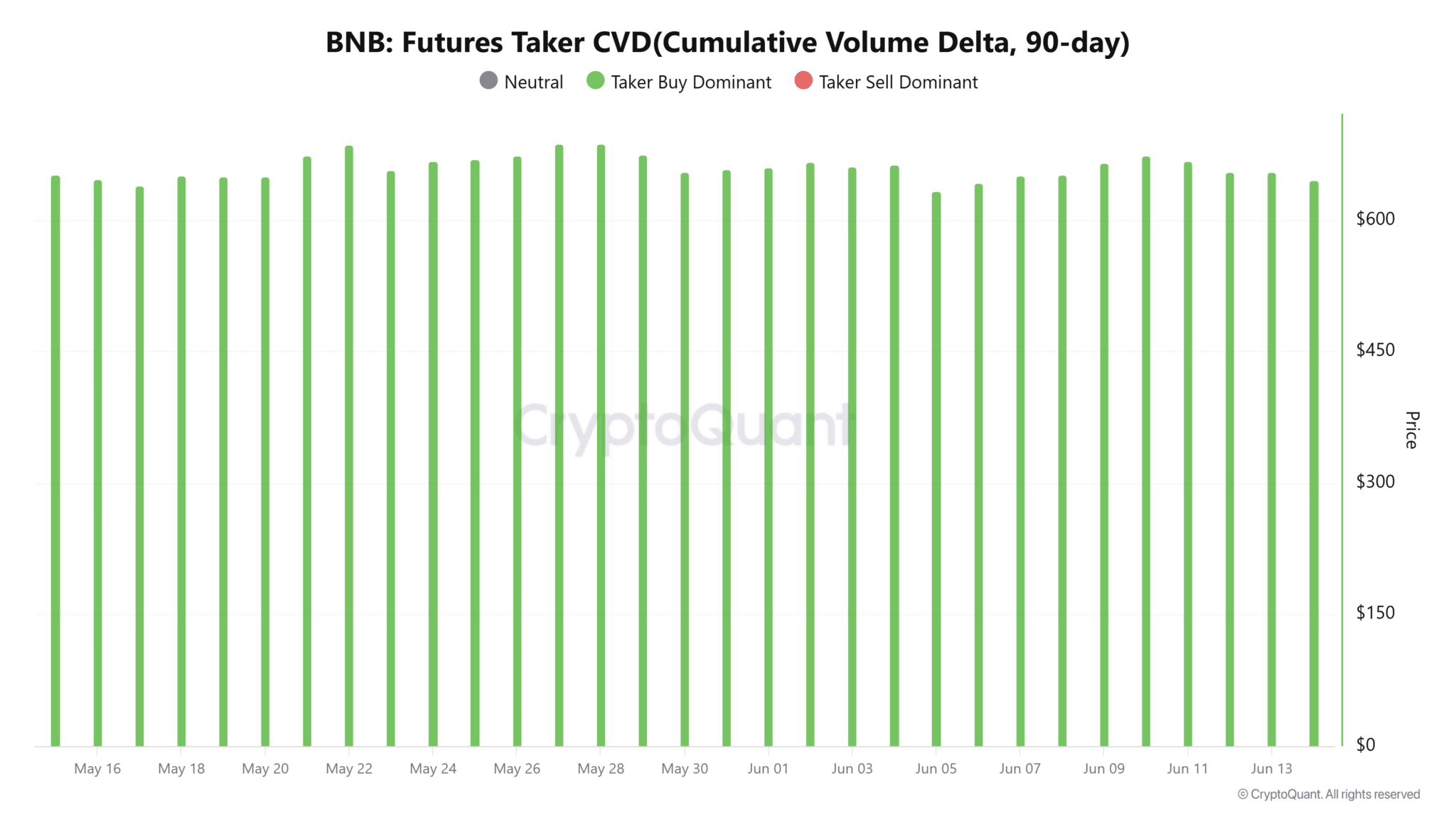

Futures market data reveals bullish positioning among institutional traders. Long positions account for 73% of total futures contracts. The futures taker cumulative volume delta shows buyer dominance over the past 90 days.

Large whale trades have returned to the market according to futures average order size data. Green indicators dominate recent charts, confirming institutional participation. These large entities are entering long positions, expecting price appreciation.

Technical analysis shows BNB consolidating near the 100-period moving average. The token trades slightly above $644, matching the March 25 swing high. A bullish pennant pattern has formed with potential upside targets around $674-$697.

BNB Smart Chain processed over 405 million transactions in 30 days while the token price dropped to $650 despite record network adoption metrics.