Read our Advertising Guidelines Here

Binance recently hosted a live sit-down with one of the fastest-growing lending ecosystems aimed at solving the liquidity bottlenecks of the DeFi sector.

Many agree that the decentralized finance sector is evolving fast, yet inefficiencies like illiquid markets, unreliable borrowing, and poor lender protection still limit its full potential. Traditional banks remain slow and overregulated, while most DeFi systems lack a unified model for real-world application.

Enter PayDax Protocol (PDP), a next-generation DeFi banking system that merges lending, borrowing, and staking with built-in insurance and governance. Rather than being another lending app, PDP is creating a complete peer-to-peer financial structure that mirrors the stability of banks while keeping DeFi’s openness.

How PayDax Protocol’s (PDP) DeFi Lending Works

PayDax’s standout feature is how it opens up the DeFi sector, allowing crypto users to access liquidity and capital more easily without the drawbacks of traditional finance. Using Ethereum smart contracts, PDP lets users lock both crypto and physical assets ranging from Bitcoin to art or gold as collateral for competitive loans.

Borrowers can unlock up to 97% of their collateral value, maximizing capital efficiency without liquidation risk. Picture for example, a long-term ETH holder using PayDax to borrow stablecoins without selling their ETH. This allows them access liquidity instantly by leveraging their crypto holdings.

What makes PayDax stand out is that its lending ecosystem has all the features of a robust DeFi bank. Additionally, its value generation mechanisms are utility-based, meaning that PayDax holders earn rewards from solving real problems in the DeFi sector, instead of relying on hype and short-term speculation for a value boost.

PayDax’s Incentives and Ecosystem Rewards

PayDax Protocol (PDP) motivates users with yields far exceeding traditional banks. Lenders earn up to 15.2% APY for providing peer-to-peer (P2P) stablecoin loans. These lenders enjoy smooth on-time payments even when borrowers default, thanks to PayDax’s Redemption Pool.

In cases where there are no defaults, Redemption Pool contributors earn up to 20% APY for the risk they bear when underwriting loans. This Redemption pool safeguards PayDax Protocol’s (PDP) lending and borrowing ecosystem, positioning it for long-term growth and stability. Another way users can earn extra rewards from the PayDax ecosystem is via protocol staking.

Here, users who lock their tokens will earn up to 6% APY. They will also enjoy governance rights that allow them to contribute to decision-making in the PayDax Protocol (PDP) ecosystem. Furthermore, users who have a higher risk appetite can participate in PayDax Protocol’s advanced yield farming strategies, earning returns as high as 41.2% APY.

Building Trust Through Security and Partnerships

A good DeFi lending and borrowing ecosystem requires robust infrastructure and user safety measures. PayDax Protocol (PDP) goes to great lengths to provide the infrastructure that will guarantee optimal user service. Every asset-backed loan on PDP is protected by real-world validation.

Gold holdings are stored with Brinks, while tokenized fine art and collectibles are verified through Sotheby’s and Christie’s. This not only brings secure custody but also allows PayDax Protocol (PDP) to get real-time valuations and access to auctioning markets. For live pricing, Chainlink oracles provide accurate data. Although not an official partnership, PayDax Protocol leverages the network’s technology, ensuring that users always get real-time market feeds.

Security is another crucial factor needed for a robust DeFi lending and borrowing ecosystem, and PayDax goes to great lengths to increase its user trust. The network’s smart contracts have been verified by Hacken and Quill and reinforce system reliability. They have also been audited by DeFi Assure, showing that the network meets the highest standards of user safety.

PayDax’s Binance Live AMA Boosts Investor Confidence

Another way PayDax Protocol (PDP) keeps users safe is by partnering with Onfido for robust KYC policies, which means that users have to submit some form of personal identification. This protects PayDax users, as any fraudulent activity can be traced to a person and dealt with decisively.

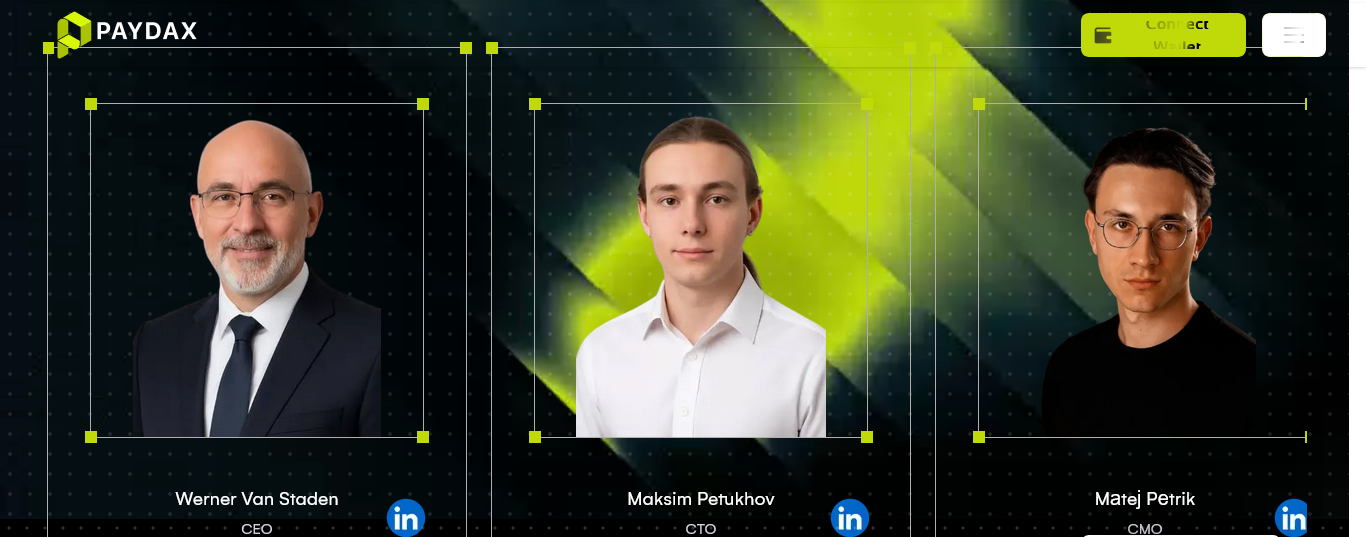

This network transparency doesn’t stop at users. PayDax also operates with a fully doxxed team, allowing users to see the individuals who run the day-to-day activities of their DeFi banking ecosystem.

PayDax’s team also hosts regular AMAs and open communication in its bid to boost market trust in its ecosystem. Most recently, PayDax Protocol’s CMO hosted a live AMA with Binance, where ongoing network updates were unveiled. This has sent PayDax’s user trust skyrocketing, with many applauding the network for its rapid technological development.

Why Investors Say PayDax Could Become the Next Top Altcoin

PayDax has earned the market’s trust, leading to over $960,000 in token sales from its ongoing presale. Although still in its early stages, PDP has become one of the fastest-growing crypto ecosystems. One token currently costs $0.015. Yet, that will change soon as stage 2 is fast approaching.

Following PayDax’s most recent Binance Live AMA, more investors have joined its ecosystem, saying PDP is poised to become a top altcoin candidate for 2025. Don’t delay any longer. Secure a stake in PayDax’s ecosystem today.

Join the Paydax Protocol (PDP) presale and community:

Website: https://pdprotocol.com/

Telegram: https://t.me/PaydaxCommunity

X (Twitter): https://x.com/Paydaxofficial

Whitepaper: https://paydax.gitbook.io/paydax-whitepaper

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above. Read our Advertising Guidelines Here.