TLDR

- Gold’s eight-week winning streak ended this week as traders took profits before the Federal Reserve’s October policy decision, with spot gold falling over 6% from its all-time high above $4,380/oz to around $4,120

- The pullback was driven by profit-taking, heavy ETF outflows, and improved US-China trade relations after officials reached a “preliminary consensus” on trade issues

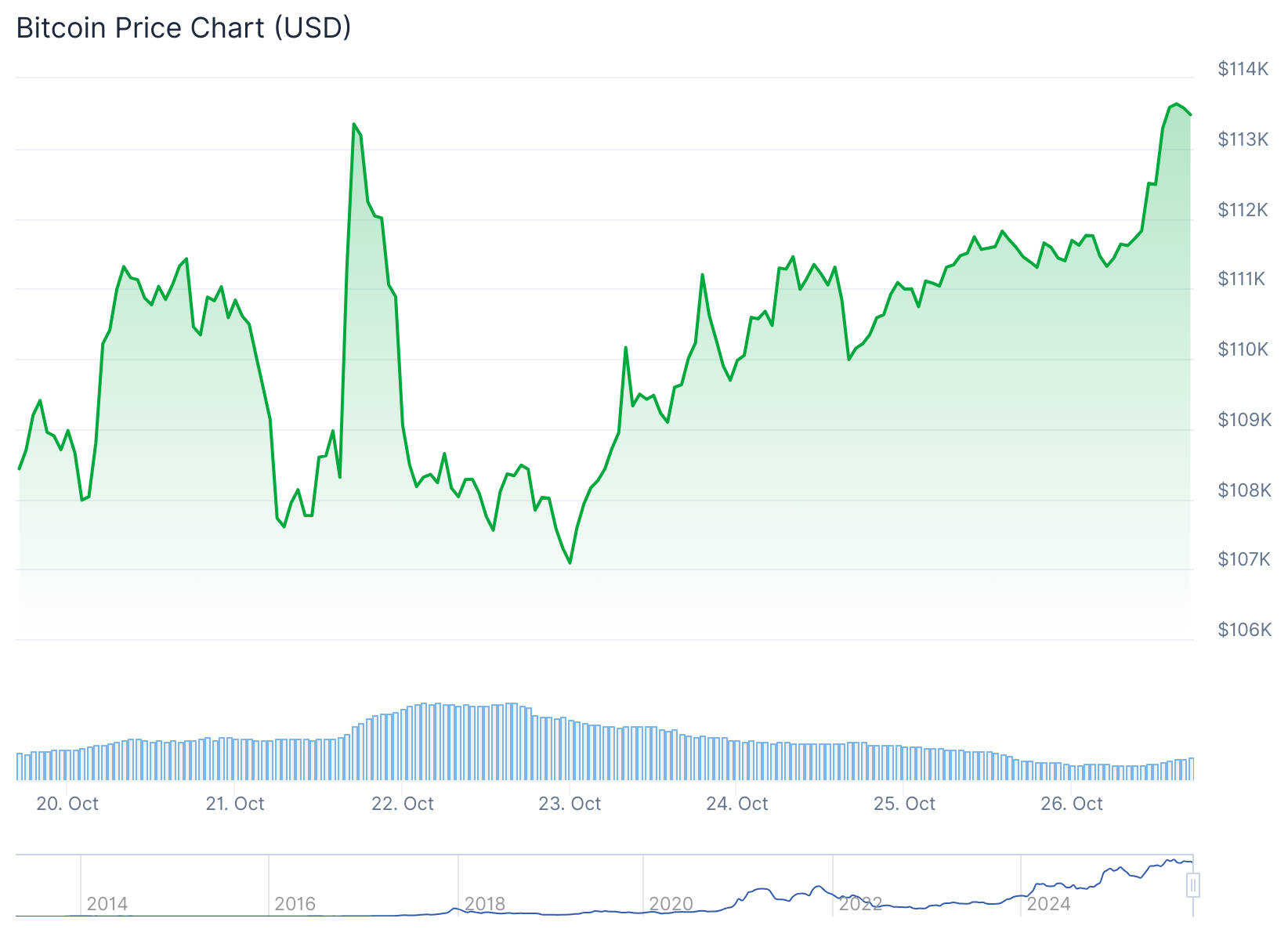

- Bitcoin gained over 5% last week, breaking above $113,500 and escaping a month-long trading range as risk appetite returned to markets

- The BTC/gold ratio hit its most oversold level in nearly three years last week, with its 14-day RSI dropping to 22.20, historically signaling local bottoms for Bitcoin

- Federal Reserve is expected to cut rates by 25 basis points this week, with odds of a cut reaching 98% ahead of the October 29 policy meeting

Gold ended its eight-week rally this week. Traders took profits ahead of the Federal Reserve’s October policy decision.

The pullback has reduced safe-haven demand. For the first time in weeks, attention shifted back toward risk assets like Bitcoin.

Spot gold fell more than 6% from its record high. The metal touched $4,380 per ounce on Monday before settling near $4,120 by the weekend.

The decline came from several factors. Profit-taking, heavy ETF outflows, and changing trade relations all played a role.

Officials from the US and China said they reached a “preliminary consensus” on trade issues. This eased fears of new tariffs that had pushed gold higher.

Trade Tensions Ease Between US and China

US Treasury Secretary Scott Bessent spoke Sunday after two days of talks in Malaysia. He said the threat of 100% tariffs on Chinese goods is “effectively off the table.”

The discussions set the stage for a broader deal between President Trump and President Xi Jinping. The softer trade backdrop reduced demand for safe-haven assets.

The Federal Reserve is expected to cut rates by 25 basis points this week. This expectation took pressure off gold’s recent rally.

Silver and platinum also dropped sharply. The moves signal a reset before Wednesday’s Fed decision.

Bitcoin Breaks Free from Trading Range

The timing appears good for Bitcoin. After trailing gold most of the quarter, Bitcoin gained over 5% in the past week.

The cryptocurrency reclaimed the $113,500 level. It broke free from a narrow trading range that lasted a month.

Bitcoin briefly topped $114,000 before settling near $113,700. Traders positioned for a potentially bullish weekly close.

The BTC/gold ratio measures Bitcoin’s value against gold. This ratio flashed its most oversold reading in nearly three years last week.

The ratio’s 14-day Relative Strength Index dropped to 22.20 last week. This fell below its February low and marked the weakest level since November 2022.

Such extreme readings have historically marked local bottoms for Bitcoin. These periods often led to outperformance as traders moved back into higher-risk assets.

Fed rate-cut odds have now exceeded 98%. The October 29 policy meeting could define the next market trend.

Traders are watching key levels closely. Some analysts see potential for Bitcoin to reach $118,000 to $123,000 if it holds support above $113,000.