TLDR

- Bitcoin expected to experience 20%+ corrections similar to Nvidia’s pattern before reaching new all-time highs

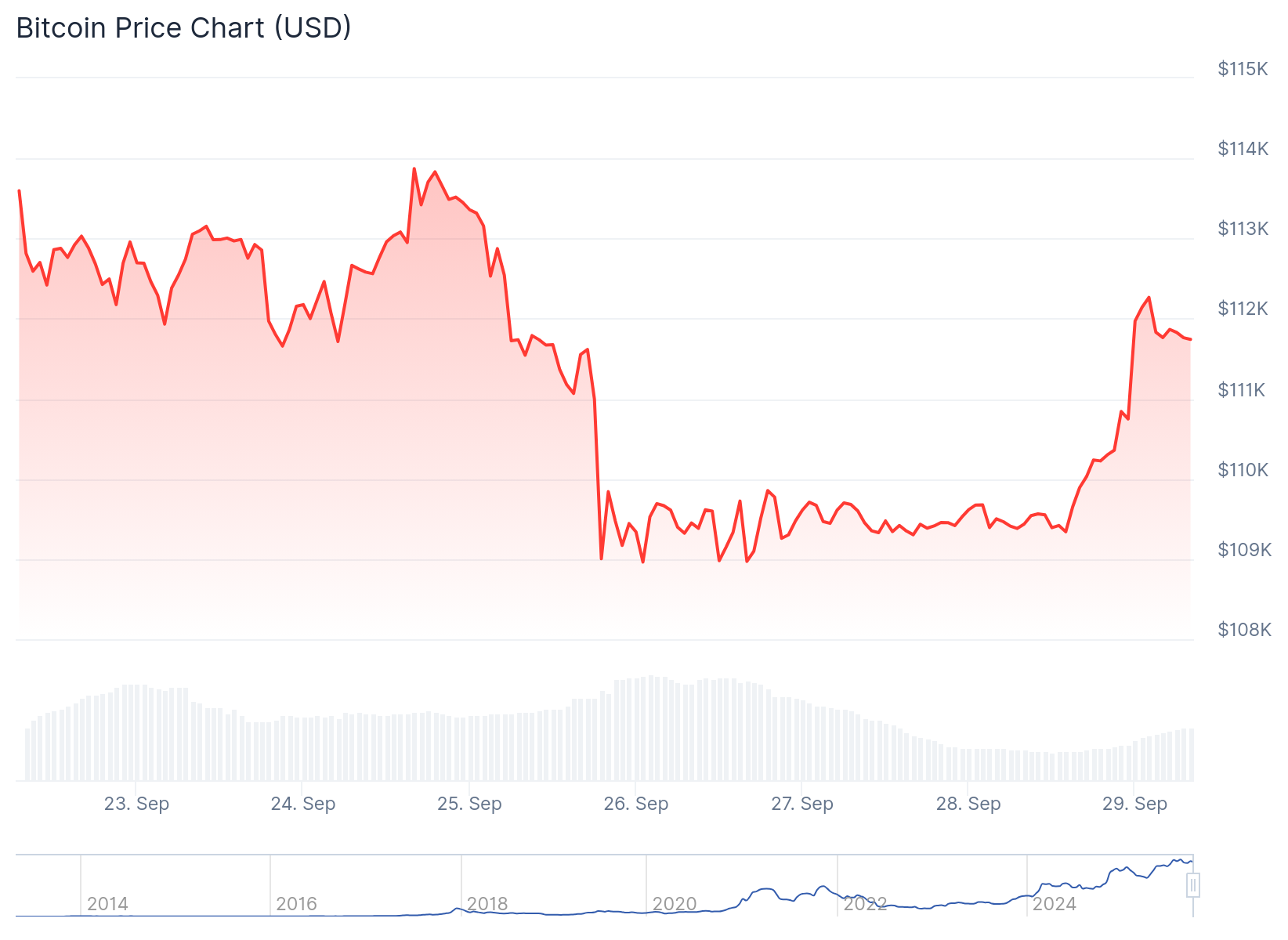

- BTC currently trading around $111,900, down 11% from its $123,000 peak

- CME gap formation creates short-term uncertainty for traders this week

- Historical October data shows 10-30% gains, fueling “Uptober” rally expectations

- Analysts compare current market setup to September 2020 before strong rally

Bitcoin continues to face volatility as analysts prepare for what many expect to be a strong October rally. The cryptocurrency is currently trading at $111,900, representing a 2.25% daily increase.

Market analyst Jordi Visser draws comparisons between Bitcoin and Nvidia’s performance trajectory. He points out that Nvidia has gained over 1,000% since ChatGPT’s launch while experiencing five corrections of 20% or more during the same period.

Visser believes Bitcoin will follow a similar pattern on its path to new all-time highs. The analyst suggests these corrections are normal parts of the growth cycle, even during typically strong quarters for crypto assets.

Bitcoin currently sits about 11% below its all-time high of over $123,000. This has created debate among investors about whether new highs are achievable in Q4 or if a prolonged bear market could emerge.

CME Gap Creates Trading Uncertainty

Bitcoin futures opened with a CME gap for the first time in several weeks. These gaps historically tend to close quickly, creating concerns about potential near-term pullbacks.

Analyst Daan Crypto Trades notes that downside risk becomes more relevant if Bitcoin falls below $111,000. However, the gap could remain open for months, which has happened rarely in the past.

$BTC Has opened up with a CME gap and has continued higher since the futures open.

It has been quite a while since we did open with a gap. like this. These used to close quite quickly. If that were to happen here then the entire structure would look pretty bad in the short term.… pic.twitter.com/z4yoSOFUaO

— Daan Crypto Trades (@DaanCrypto) September 29, 2025

Trading activity has increased substantially. Daily trading volume jumped 50% to $37.5 billion, while futures open interest rose 2% to over $78.5 billion.

The market experienced significant leverage liquidations last week. Two separate occasions saw over $1 billion in daily liquidations as traders were forced out of positions.

October Rally Expectations Build

Benjamin Cowen highlights that Bitcoin secured a weekly close above its bull market support band. He compares the current setup to September 2020, when Bitcoin posted gains and pullbacks before rallying strongly in October.

Nice weekly close by #BTC to close above the bull market support band.

Kind of similar to 2020, where in September, we had 2 weeks up and then 2 weeks down. pic.twitter.com/1MzIS9VaCk

— Benjamin Cowen (@intocryptoverse) September 29, 2025

Historical data supports optimism for October performance. CoinGlass data shows Bitcoin has delivered 10-30% gains in October over the past decade, earning the nickname “Uptober” rally.

Bitcoin faces immediate resistance at $112,000 levels. Crossing above this level would be crucial for establishing a bullish tone moving forward.

A rejection at current levels could open the door for a drop to $105,000. Bulls need to defend the $111,000 level to avoid further downside risk.

Despite September’s selling pressure, Bitcoin remains 3% positive for the month. The cryptocurrency market appears to be shaking off last week’s volatility as investors position for potential October gains.

Some analysts previously forecasted that US government purchases for a national Bitcoin reserve would drive prices higher in 2025. However, regulatory hurdles and lack of progress on this front have tempered some expectations.

Market veterans like Mike Novogratz maintain bullish long-term outlooks, with some predicting Bitcoin could reach $200,000 in the current bull cycle.