TLDR

- Bitcoin options traders are positioning for upside despite recent price weakness, with 25 Delta Skew flipping positive across multiple timeframes

- MicroStrategy purchased another 10,100 BTC for $1.05 billion, bringing their total holdings to 592,100 Bitcoin

- Analyst MrParaBULLic predicts Bitcoin could reach above $200,000 before crashing to $30,000 in final bear market phase

- Short-term options expiring in one week saw skew jump from -2.6% to +10.1%, indicating aggressive bullish positioning

- Current Bitcoin price sits around $106,600 after slight recovery in past 24 hours

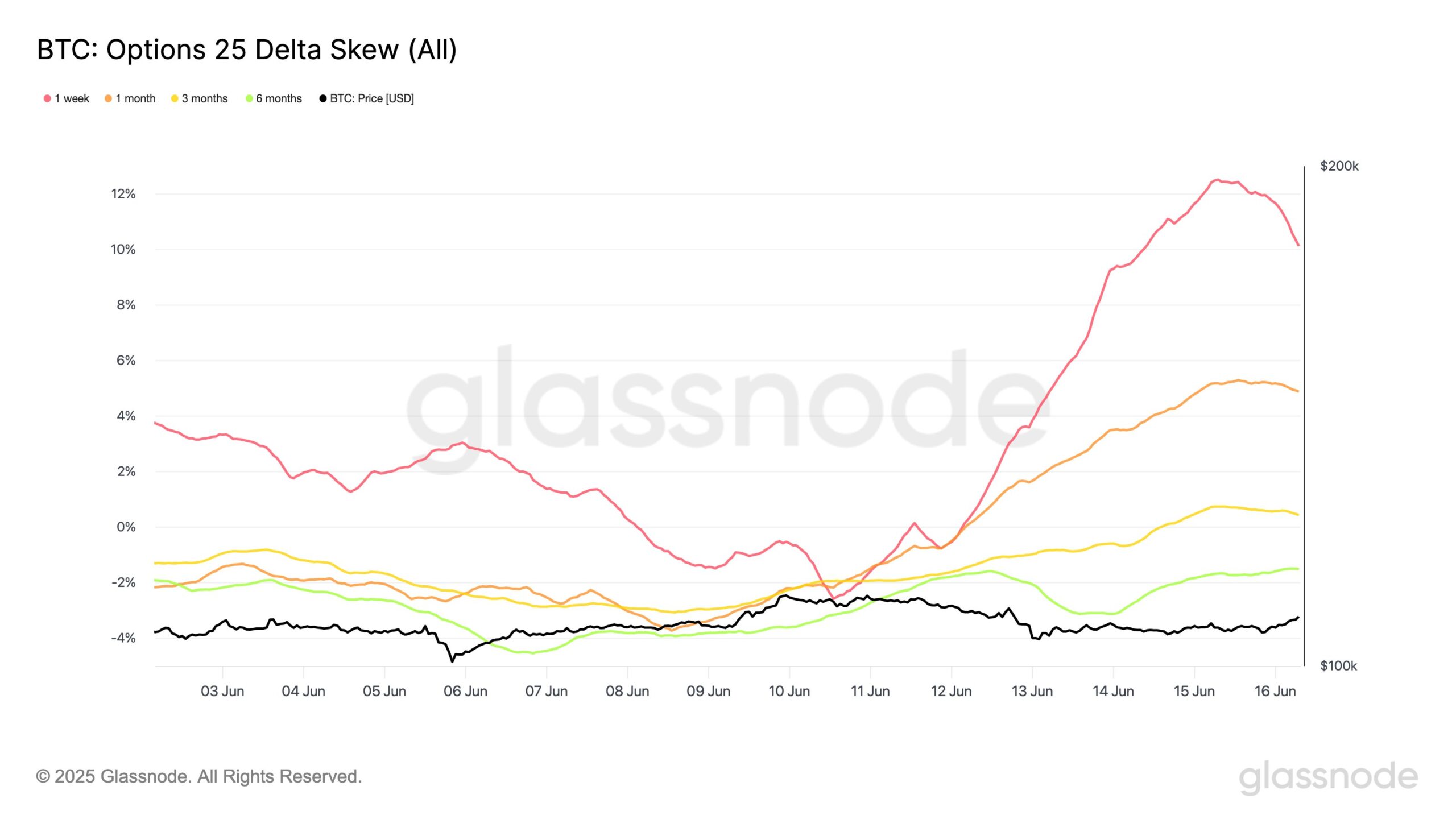

Bitcoin options data reveals a stark contrast between trader sentiment and bearish price predictions. Recent analysis shows options markets have flipped bullish despite ongoing price volatility.

The Bitcoin Options 25 Delta Skew has reversed to positive territory across multiple expiration timeframes. This indicator compares implied volatility between bearish puts and bullish calls with a delta of 25.

Short-dated contracts show the strongest bullish positioning. Options expiring in one week jumped from -2.6% to +10.1% skew. Monthly expiration contracts moved from -2.2% to +4.9%.

Analytics firm Glassnode notes traders are “aggressively positioning for near-term upside or volatility.” This bullish shift occurred while Bitcoin faced downward price pressure.

Institutional Activity Continues

MicroStrategy completed another major Bitcoin purchase this week. The company acquired 10,100 BTC for approximately $1.05 billion.

Chairman Michael Saylor announced the purchase on social media. MicroStrategy now holds 592,100 Bitcoin with a total cost basis of $41.84 billion.

Strategy has acquired 10,100 BTC for ~$1.05 billion at ~$104,080 per bitcoin and has achieved BTC Yield of 19.1% YTD 2025. As of 6/15/2025, we hodl 592,100 $BTC acquired for ~$41.84 billion at ~$70,666 per bitcoin. $MSTR $STRK $STRF $STRD https://t.co/n7q77DmqCY

— Michael Saylor (@saylor) June 16, 2025

The purchase demonstrates continued institutional accumulation despite market uncertainty. Corporate Bitcoin adoption remains steady throughout recent price fluctuations.

Bitcoin currently trades around $106,600 after recovering slightly in the past day. The price remains well above previous cycle highs despite recent volatility.

Analyst Warns of Major Correction

Crypto analyst MrParaBULLic presents a contrasting view of Bitcoin’s future trajectory. The analyst predicts the current bull market represents the final phase of Bitcoin’s first institutional cycle.

This our last bull in cryptos first macro cycle.

No surprise it’s got the greatest euphoria trap ever. The perpetual institutional bid.

It’s a strong anchoring narrative creating a collective conviction – in the end no one will believe $btc can hit sub $30k. It will. Enjoy. https://t.co/lID0mOCbUj pic.twitter.com/Mkff6D8ZoI

— MrParaBULLic (@iLiquidatebots) June 15, 2025

Using Elliott Wave theory, the analyst suggests Bitcoin is completing its fifth wave in a classic impulse pattern. This typically marks the end of major upward moves.

The analyst expects Bitcoin to reach above $200,000 before reversing course. However, the subsequent bear market could drive prices as low as $30,000.

This would represent a 70-90% decline from peak levels. Such drops mirror previous Bitcoin cycles including 2013, 2017, and 2021.

The analyst identifies $88,115 as a critical support level. Breaking below this zone could trigger cascading liquidations toward the $34,932 target.

MrParaBULLic expects the current rally to continue for five to eight months. The analyst believes institutional adoption has not eliminated Bitcoin’s cyclical nature.

The prediction counters popular narratives about Bitcoin’s institutional maturity. Previous cycles saw similar drawdowns regardless of adoption levels.

Options traders currently bet against this bearish scenario. The positive skew indicates expectations for continued upward movement or increased volatility.

Bitcoin recovered to $106,600 during the past day after recent declines.