TLDR

- Bitcoin climbed above $115,000 and is now trading above $114,400 after fresh recovery momentum

- A US-China trade framework agreement reached in Malaysia on October 26 helped boost crypto markets

- The global crypto market cap rose about 1.9% to roughly $3.92 trillion on the trade deal news

- Bitcoin faces immediate resistance at $115,500 with potential to test $116,200 if bulls break through

- Treasury Secretary Scott Bessent said the deal could prevent threatened 100% US tariffs and pause China’s rare-earth export limits

Bitcoin price moved higher over the weekend after US and Chinese negotiators announced a new trade framework following two days of talks in Malaysia. The cryptocurrency tested resistance levels above $115,000 as markets responded to easing trade tensions between the two countries.

WELL, IT LOOKS LIKE WE MAY HAVE A DEAL FOLKS.

The Chinese Embassy posted that after successful trade talks during the weekend, the US & China have agreed to:

– make full use of the China/US economic and trade consultation mechanism

– maintain close communication on… pic.twitter.com/K9tVG8Aoyc

— amit (@amitisinvesting) October 26, 2025

The price recovery came after Bitcoin previously declined to the $106,720 zone. Bulls then pushed the price through the $112,000 resistance level and eventually spiked above $115,000.

US Treasury Secretary Scott Bessent announced that negotiators reached a “very substantial framework” during the Malaysia talks. The agreement could prevent threatened 100% US tariffs and secure a pause on China’s rare-earth export restrictions.

Chinese Vice Premier He Lifeng described the relationship as focused on “mutual benefit and win-win results.” He urged both sides to properly address each other’s concerns and protect progress from this year’s talks.

Market Response to Trade News

The crypto market responded positively to the trade framework announcement. Global crypto market capitalization increased about 1.9% to reach roughly $3.92 trillion.

Major cryptocurrencies extended their weekly gains as traders reduced concerns about near-term tariff effects on risk assets. Large-cap altcoins also moved higher alongside Bitcoin and Ethereum.

The joint statement from both countries said they reached “basic consensuses” on six trade areas. These included Section 301 measures on China’s maritime and shipbuilding sectors, extension of reciprocal tariff suspension, and fentanyl-related cooperation.

Technical Levels and Price Action

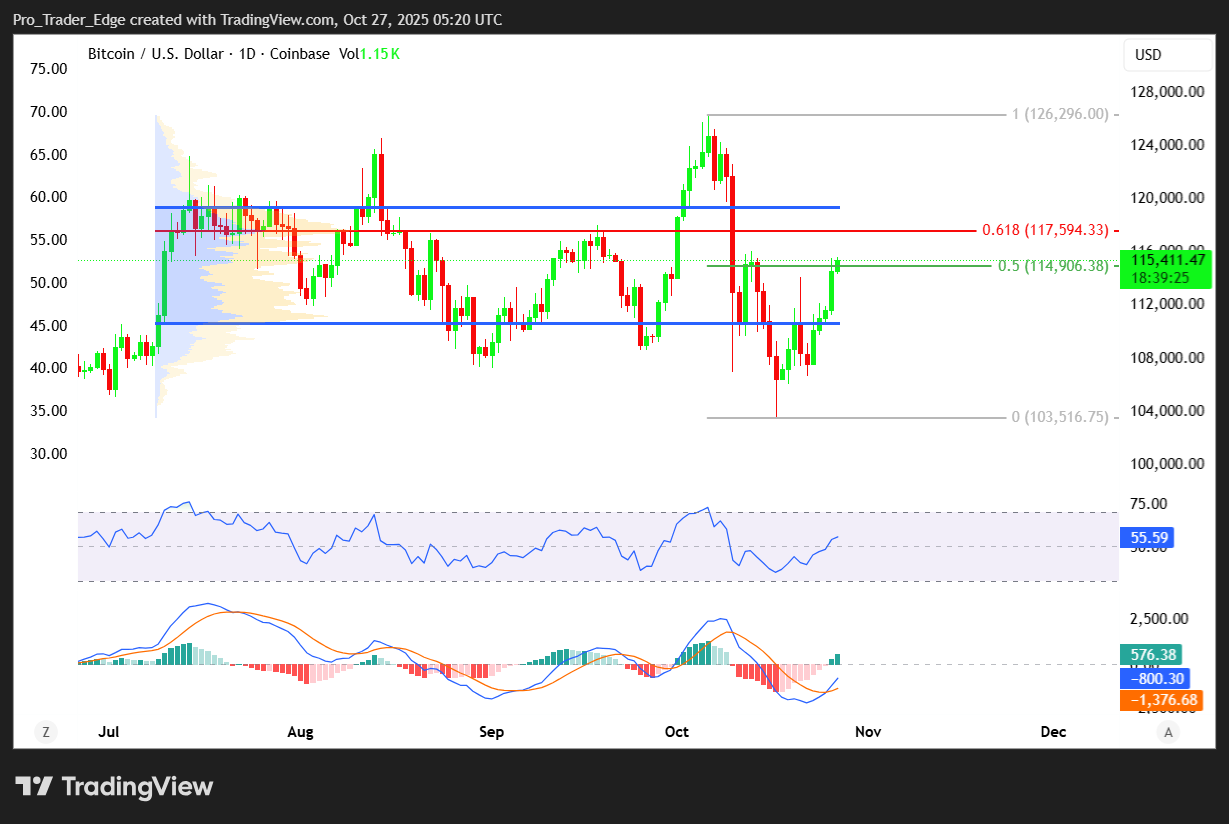

Bitcoin now faces immediate resistance near $115,500. If bulls can push through $115,500, the next resistance target would be $116,200. A close above that level could send Bitcoin toward $117,000.

The recent price move represented a recovery from a swing low of $106,718 to a high of $115,400. Bitcoin is consolidating above the 23.6% Fibonacci retracement level of this recent wave.

Support levels for Bitcoin sit at $114,000 as immediate support and $113,500 as the first major support level. The trend line also provides support at $113,350.

The deal marks a change from recent trade rhetoric. Earlier in October, Bessent said a Senate supermajority was ready to grant President Donald Trump authority to impose tariffs up to 500% on China related to Russian oil purchases.

Both countries agreed to work out specific details of the framework and follow their domestic approval processes. Close communication will continue under the existing consultation mechanism to maintain stable ties.