TLDR

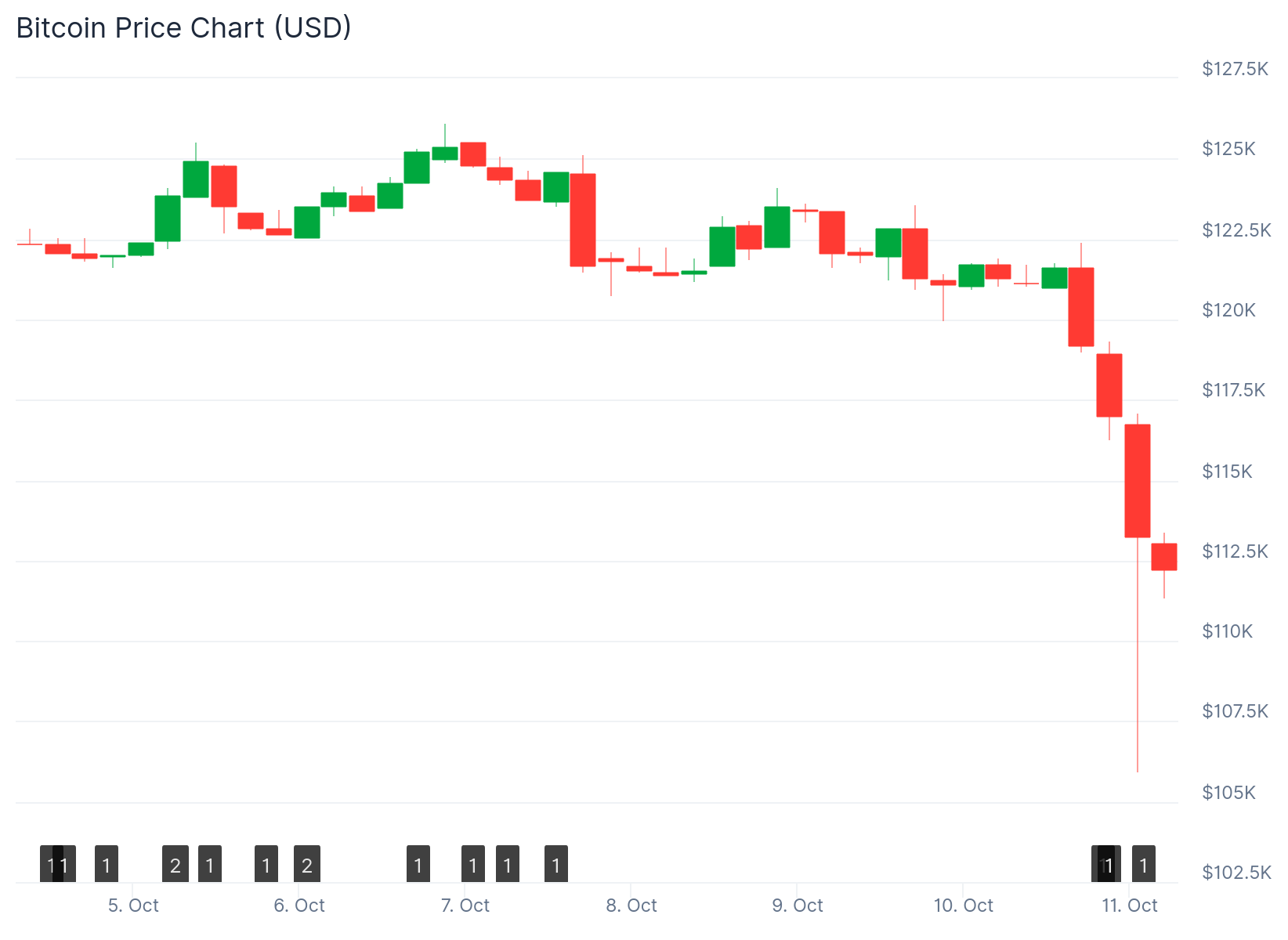

- President Trump announced a 100% tariff on China in response to export controls on rare earth minerals, sending Bitcoin below $110,000

- Bitcoin’s futures pair on Binance fell to $102,000, the lowest price since late June

- Total crypto market liquidations reached $7 billion in 24 hours, with $7.15 billion in leveraged long positions wiped out

- Ether fell to $3,500 and Solana dropped below $140, with altcoins declining 15%-40% across the market

- The global crypto market capitalization decreased 11.80% to $3.64 trillion in 24 hours

President Donald Trump announced a 100% tariff on China on Friday, causing Bitcoin to fall below $110,000. The announcement came through a Truth Social post where Trump stated the tariffs were in response to China’s attempted export restrictions on rare earth minerals.

Trump wrote that China had taken an “extraordinarily aggressive position on Trade” by sending a “hostile letter” announcing export controls on virtually every product they make. The controls were set to take effect on November 1, 2025.

*TRUMP: US WILL IMPOSE 100% TARIFF ON CHINA STARTING NOV 1

Welcome back to the trade war. pic.twitter.com/clooxnR8zc

— Geiger Capital (@Geiger_Capital) October 10, 2025

Bitcoin’s futures pair on Binance fell to $102,000 shortly after the announcement. This marked the lowest price for Bitcoin since late June when the cryptocurrency dropped below $100,000.

The spot price at Coinbase reached an intraday low of $107,000. The decline represented a 12% drop over a 24-hour period.

Data from CoinGlass showed total crypto market liquidations of $7 billion in the past 24 hours. Leveraged long positions accounted for $7.15 billion of these liquidations.

Broader Market Impact

The wider cryptocurrency market experienced similar declines. Ether fell to $3,500 at Coinbase, representing a 16% decrease.

Solana dropped below $140 in its Binance futures pair. Other major cryptocurrencies including XRP and Dogecoin fell between 20% and 30%.

Some altcoins experienced even steeper losses. The tokens of Cardano, Chainlink, and Aave declined as much as 40%.

Analysts at Hyblock Capital stated that “global 2x leverage on most altcoins was totally wiped out.” The liquidations affected traders who had bet on higher prices.

Rare Earth Elements and Technology

Rare earth elements are essential for semiconductor production. China’s threat to restrict access to these materials affects the global hardware supply chain.

These materials are crucial for AI development, high-performance computing, and crypto mining infrastructure. The US has been implementing measures targeting Chinese tech exports as part of efforts to reduce dependency on foreign manufacturing.

Trump’s initial tariff announcements in April had previously sent shockwaves through crypto markets. Those announcements sparked concerns about a potential recession.

Friday’s Trade Escalation

The market situation worsened throughout Friday. Bitcoin was trading around $117,000 following Trump’s morning comments about threatening China with tariffs.

The cryptocurrency fell $3,000 immediately when Trump’s Truth Social post went live. Traditional markets had already closed for the week when the additional 100% tariff announcement was made.

Trump also stated that export controls on “any and all critical software” would begin on November 1. This added to market concerns about trade tensions.

Oh, hadn’t even checked alt’s.

Covid level nukes.

— Bob Loukas 🗽 (@BobLoukas) October 10, 2025

Traders compared the price action to the March 2020 market crash during COVID-19 pandemic lockdowns. Prominent trader Bob Loukas called it “Covid level nukes” and described the action as “nasty.”

I know there are a lot of emotions right now and this flush is in the top 3 all time

There are a lot of people in incredible pain right now, myself included in that

Not really a lot to say, but just check in on your friends if you have moment, make sure they are okay. You…

— 🐧 Pentoshi (@Pentosh1) October 10, 2025

Ram Ahluwalia, founder of Lumida Wealth, said the Trump news combined with overbought market conditions led to the sharp decline. Trader Pentoshi noted the flush was “in the top 3 all time” for market crashes.

Zaheer Ebtikar, CIO of Split Capital, stated that altcoins reached levels not seen in more than a year. He described it as a “full leverage reset and market dislocation.”

The global crypto market capitalization stood at $3.64 trillion at the time of writing, representing an 11.80% decrease over 24 hours.