TLDR

- Bitcoin price trades near $115,986 as ETF inflows surge to $642 million in a single day, pushing weekly totals above $2.3 billion

- Technical analysis shows Bitcoin following historical Q4 rally patterns with falling wedge and megaphone formations pointing to potential breakouts

- Analysts project Bitcoin could reach $150,000 by early 2026, with some targeting this level based on Fibonacci extensions and technical patterns

- 105 of 107 economists expect three Federal Reserve rate cuts before 2025 ends, which could create favorable conditions for Bitcoin

- Traders emphasize the importance of Bitcoin maintaining weekly closes above $114,000 to preserve bullish momentum

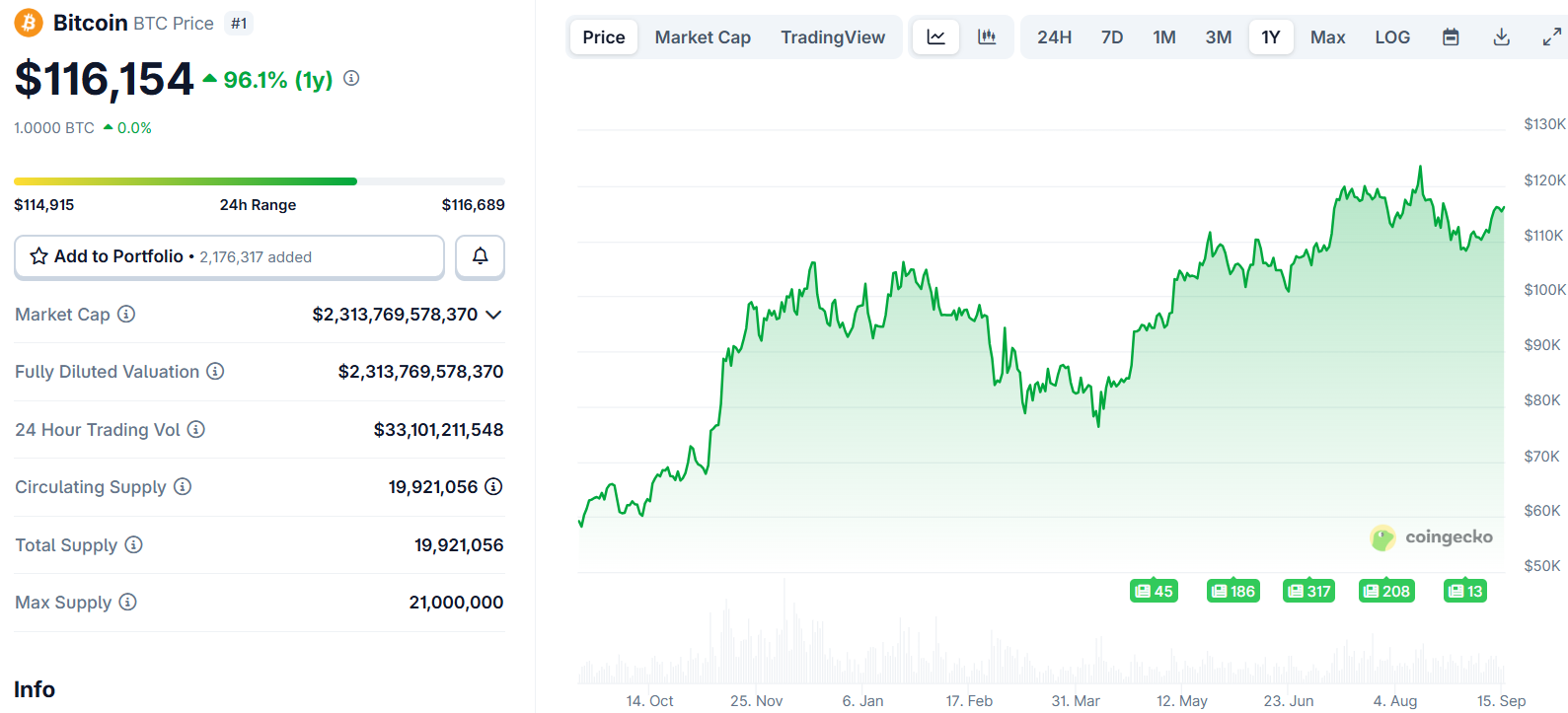

Bitcoin price continues to attract institutional attention as exchange-traded fund inflows reach new highs. The cryptocurrency trades near $115,986 while investors monitor Federal Reserve policy decisions.

ETF inflows jumped $642 million in a single trading day this week. Weekly totals have climbed above $2.3 billion, showing strong institutional demand.

Fidelity and BlackRock led the charge in Bitcoin ETF contributions. These firms continue to play central roles in driving institutional adoption of the cryptocurrency.

Technical Patterns Point to Historical Q4 Strength

Bitcoin’s current price structure mirrors past Q4 patterns according to technical analysis. Falling wedge and megaphone formations have appeared in previous years before major rallies.

The 2024 falling wedge breakout initiated last year’s surge. The current 2025 megaphone formation appears to follow a similar path.

A confirmed breakout above $120,000 could strengthen investor confidence. This level may invite broader participation and increased liquidity inflows.

Technical analysts project Bitcoin could reach $150,000 by early 2026. This target aligns with seasonal strength patterns and growing institutional demand.

CoinGape has also issued a $150,000 projection using Fibonacci extensions. Symmetrical triangle patterns serve as additional technical indicators supporting this view.

$BTC history replays. Q4 surge is coming!

I see the exact same setup that started the last few Q4 big surges.

1.Pattern: Bullish structure (megaphone, falling wedge) forming.

2.Sentiment: Everyone is yelling "the top has come" to shake you up.

3.Breakout: The real move… pic.twitter.com/WO1syMh3AG— 𝐊𝐚𝐦𝐫𝐚𝐧 𝐀𝐬𝐠𝐡𝐚𝐫 (@Karman_1s) September 13, 2025

Popular trader Rekt Capital outlined short-term goals for Bitcoin price movement. The focus remains on reclaiming $114,000 as support rather than immediate breaks above $117,000.

The goal isn't for Bitcoin to break $117k in the short-term

The goal is for Bitcoin to reclaim $114k into support first

Because that's what would enable the premium-buying necessary to get price above $117k later on$BTC #Crypto #Bitcoin

— Rekt Capital (@rektcapital) September 14, 2025

Federal Reserve Policy Shifts Create Favorable Environment

Market participants expect Federal Reserve rate cuts in the coming months. A Reuters survey shows 105 of 107 economists anticipate three rate cuts before 2025 ends.

Lower interest rates typically create easier liquidity conditions. Institutions are positioning early, expecting Bitcoin to benefit alongside other risk assets.

Gold ETFs still lead overall inflows compared to Bitcoin ETFs. However, Bitcoin ETFs are rapidly closing this gap as investors seek macro hedges.

Trader Skew noted “decent bid depth and liquidity just below $115,000” on exchange order books. This suggests strong support levels exist near current prices.

Bitcoin avoided major volatility after reaching $116,800 during the week’s last Wall Street session. This marked the highest level since August 23.

The cryptocurrency drifted toward $115,000 heading into the weekly close. Market participants remain focused on maintaining levels above $114,000.

Trading firm Mosaic Asset Company expressed optimism about Q4 prospects for risk assets. The firm cited improving leading indicators and ongoing loose financial conditions.

Strong market breadth includes participation from cyclical industries. This supports continued economic expansion expectations.

The combination of technical patterns and macro conditions creates a supportive environment. ETF demand continues to serve as a decisive factor in long-term projections.

Bitcoin maintains stability above $115,000 as accumulation phases support further growth potential.