TLDR

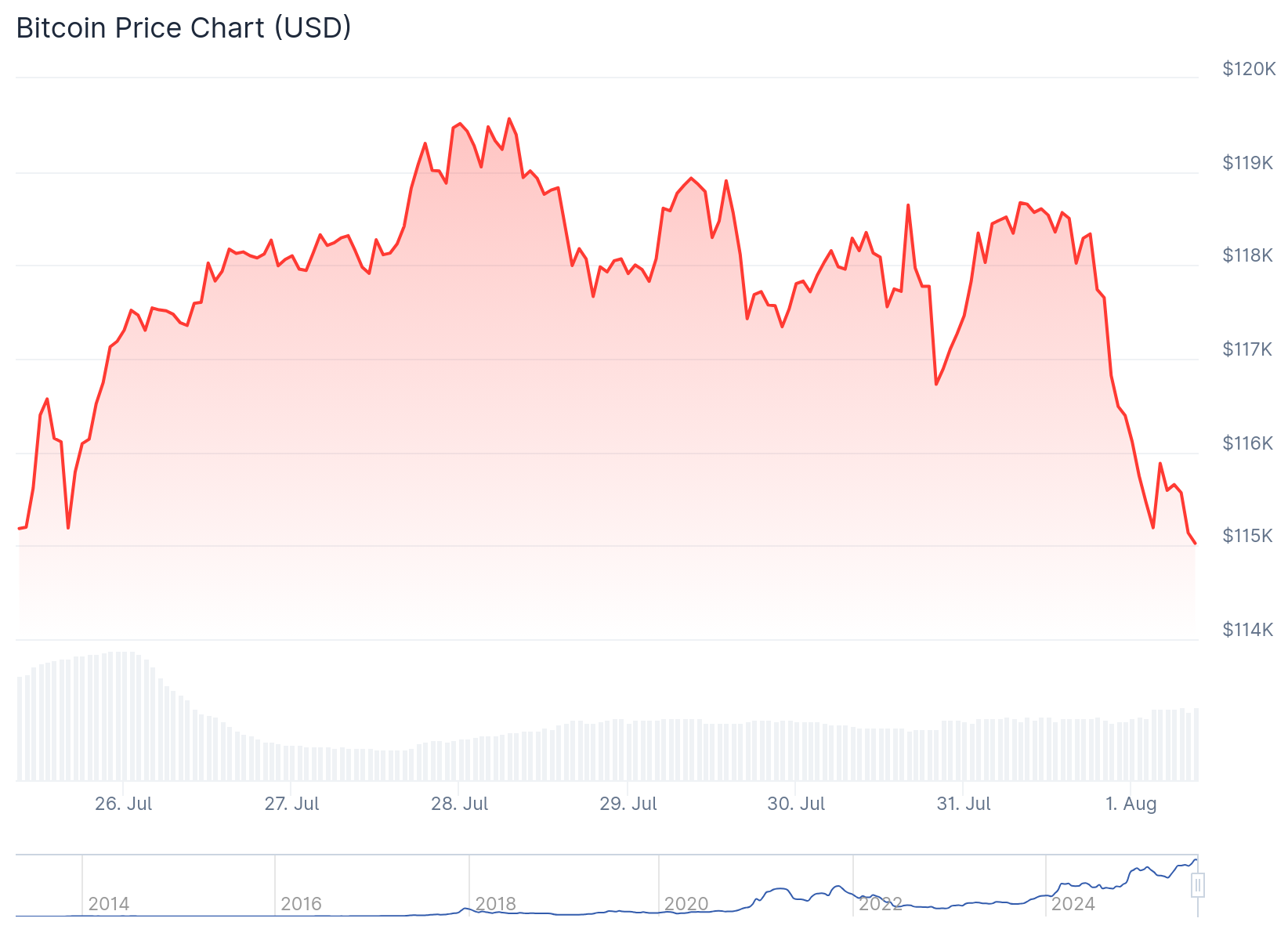

- Bitcoin dropped to $114,250, its lowest level in three weeks, following Trump’s tariff executive order

- The cryptocurrency fell 2.6% and is now about 6.5% below its all-time high of $122,800 from July 14

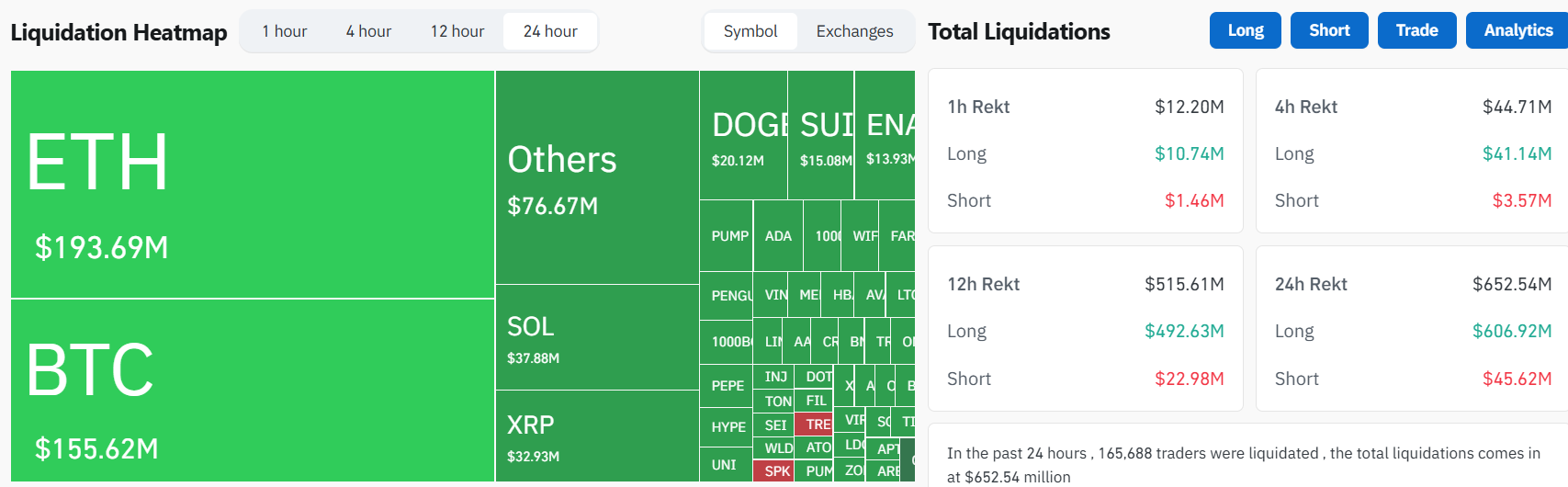

- Over $110 billion exited spot crypto markets in 12 hours, with 158,000 traders liquidated for $630 million

- Trump imposed tariffs ranging from 19% to 39% on countries including South Africa, Switzerland, Taiwan and Thailand

- Despite the dip, Bitcoin posted its highest-ever monthly candle close in July at $115,784

Bitcoin dropped to a three-week low near $114,000 as President Donald Trump’s tariff executive order sent shockwaves through both stock and crypto markets. The world’s largest cryptocurrency fell to $114,250 on Coinbase during early Asian trading Friday.

This marks Bitcoin’s lowest point since June 11. The digital asset has now broken below its three-week range-bound channel, with the next support zone sitting around $111,000 if no rebound occurs.

The 2.6% decline positions Bitcoin approximately 6.5% below its all-time high of $122,800, which was reached on July 14. Trading data shows the cryptocurrency was changing hands at $115,540.9 as of early Friday morning.

Market data reveals the scale of the sell-off. Over $110 billion exited spot crypto markets in just 12 hours leading up to and following the tariff announcement.

A total of 158,000 traders faced liquidation worth $630 million over the past 24 hours. Most of these were long positions, indicating many investors were betting on price increases.

Trump’s Tariff Implementation

President Trump formalized his promised trade tariffs late Thursday through an executive order. The directive hiked tariffs on Canada from 25% to 35%.

🚨 US Futures Drop as Trump’s Trade Deadline Hits…

🔹 White House rolls out new tariffs after Trump’s trade deadline expires, hiking tariffs on Canada from 25% to 35%

🔹 S&P 500 $ES down over 2% from Thursday's highs

🔹 70+ countries hit with tariffs ranging from 15%-40%.

🔹… pic.twitter.com/wGxq3P5Ms8— Trader Edge (@Pro_Trader_Edge) August 1, 2025

Countries that failed to reach agreements with the administration now face varying tariff rates. South Africa, Switzerland, Taiwan and Thailand will see tariffs between 19% and 39%.

The executive order also made official agreements with major trading partners. The European Union, Japan, South Korea and the United Kingdom all secured trade deals with the new administration.

Stock markets across Asia traded lower Friday morning alongside crypto markets. The tariff implementation came just before Trump’s self-imposed August 1 deadline for trade deals.

While trade tariffs don’t directly impact cryptocurrency markets, their effect on overall market sentiment influences speculative assets like Bitcoin. Higher interest rates also present direct pressure on Bitcoin by reducing the appeal of high-risk investments.

Broader Market Impact

The Federal Reserve’s recent signals added to market pressure this week. The central bank indicated it will keep interest rates unchanged until the inflationary effects of tariffs become clear.

Apollo Capital’s chief investment officer Henrik Andersson noted the natural profit-taking after strong runs in both equity and crypto markets. He suggested a potential deal with China could remove current market uncertainty.

LVRG Research director Nick Ruck described the week’s market dip as reflecting tariff deadline fear and broader macroeconomic uncertainty. He viewed the sell-off as a temporary correction rather than a structural shift.

Altcoins experienced steeper losses than Bitcoin. Ethereum fell 4.4% to $3,688, while XRP dropped 4.8% to $2.99. Solana and Cardano each declined about 6%.

Memecoins saw even larger drops. Dogecoin slid 6.6%, while the Trump-themed token fell 5.8% and was down 12.4% for the week.

Despite Friday’s decline, Bitcoin remains near historically high levels. The cryptocurrency posted its highest-ever monthly candle close in July at $115,784.

However, this wasn’t the largest monthly gain in Bitcoin’s history. That record belongs to November, when the asset surged $26,000 in one month following Trump’s election victory.

Focus now turns to upcoming nonfarm payrolls data for additional cues about the U.S. economy. Strong labor market data could give the Federal Reserve less reason to cut interest rates soon.