TLDR

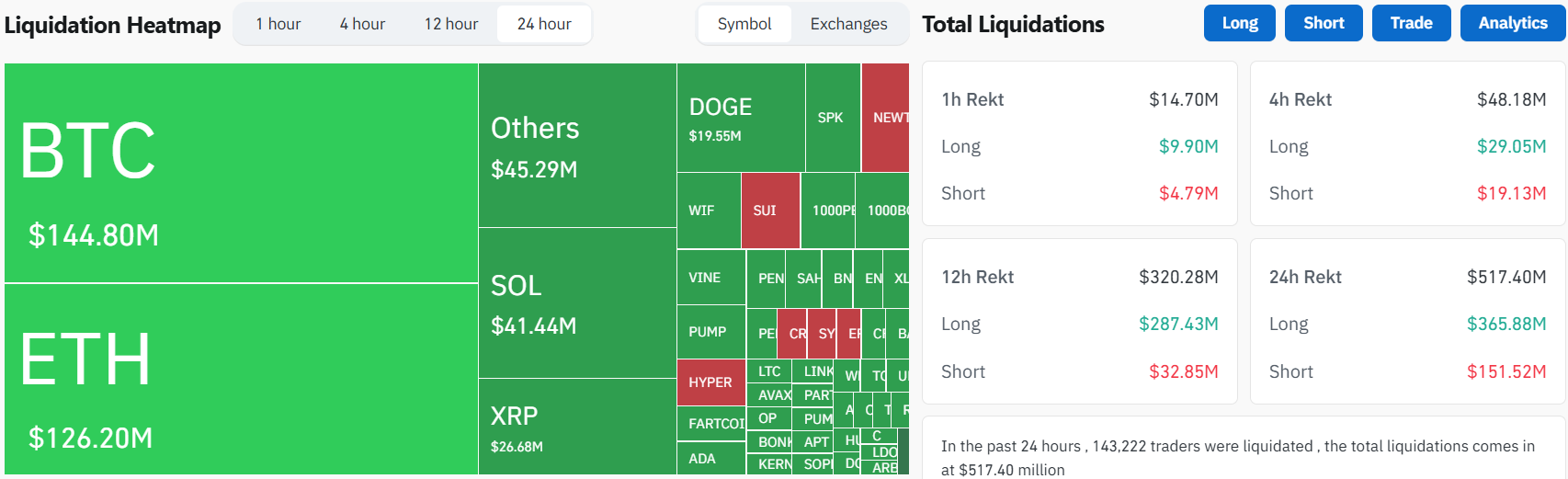

- Bitcoin dropped below $116,000 in a market downturn that liquidated $585.86 million in long positions over 24 hours

- Over 213,729 traders were liquidated for a total of nearly $600 million across the crypto market

- Dogecoin led losses among top 10 cryptocurrencies, falling 7% to $0.22 and wiping out $26 million in long positions

- Despite the pullback, Bitcoin is currently trading around $119,300 and analysts remain optimistic about future price targets

- Experts like Tom Lee predict Bitcoin could reach $200,000-$250,000, citing upcoming halving events and institutional adoption

Bitcoin experienced a sharp decline below $116,000 on Friday, causing widespread liquidations across the cryptocurrency market. The sudden downturn caught many traders off guard after weeks of bullish sentiment following Bitcoin’s all-time high of $123,100 reached on July 14.

According to CoinGlass data, $585.86 million in long positions were liquidated during the market correction. Bitcoin accounted for $140.06 million of these liquidations as the price dropped 2.63% to $115,356. The total number of liquidated traders reached 213,729 over a 24-hour period.

Ethereum followed Bitcoin’s decline with $104.76 million in long liquidations. The second-largest cryptocurrency fell 1.33% to $3,598 during the same timeframe. Across all cryptocurrencies, total liquidations reached $731.93 million in both short and long positions.

Crypto trader Ash Crypto described the market movement as a “pure leverage flush” in a social media post. He explained that many traders had opened long positions on alternative cryptocurrencies after seeing Ethereum’s recent price gains. Market makers then dumped positions to liquidate these late entries.

This dump is a pure leverage flush

Many people longed Alts after they saw

ETH pumping hard, so market makers

dumped and liquidated the late longs.Alts will pump back up and even higher

— Ash Crypto (@Ashcryptoreal) July 24, 2025

Dogecoin suffered the heaviest losses among the top 10 cryptocurrencies by market capitalization. The meme coin dropped 7% over 24 hours to $0.22, resulting in $26 million worth of liquidated long positions according to Nansen data.

Current Market Position and Technical Analysis

As of July 25, Bitcoin is trading around $119,300, showing recovery from the Friday selloff. The cryptocurrency has maintained its position above key technical levels despite the recent volatility. Bitcoin continues to hold above the ascending trend line support at $118,200.

The current price structure suggests Bitcoin remains within a bullish flag formation. This pattern typically precedes upward price movements when confirmed by increased trading volume. Key resistance levels exist at $119,300 and $120,250 for the near term.

Technical indicators show mixed signals in the short term. The MACD is building strength in the bullish zone while the RSI sits at 48.88. This suggests room for growth without immediate overbought conditions. Support levels are located at $118,500 and $117,200.

Despite the recent correction, market sentiment remains positive. The Crypto Fear & Greed Index posted a “Greed” score of 70 in its Friday update. This indicates that investor confidence has not been severely damaged by the liquidation event.

Long-Term Outlook and Expert Predictions

Several prominent analysts maintain bullish forecasts for Bitcoin’s future price performance. Tom Lee from Fundstrat Capital stated on CNBC that Bitcoin could reach $200,000 to $250,000. He estimates this would represent approximately 25% of gold’s total market capitalization.

Lee cited the recently passed GENIUS Act as a potential regulatory catalyst. This legislation could ease the path for broader cryptocurrency adoption in the United States. The regulatory clarity may attract more institutional investors to the Bitcoin market.

MicroStrategy Chairman Michael Saylor continues his ultra-bullish stance on Bitcoin. Saylor projects that Bitcoin could reach $1 million in the longer term as institutional adoption increases. He believes bear markets will become less frequent as the asset matures.

Political support has also emerged for Bitcoin recently. President Trump endorsed Bitcoin as “digital gold” while Crypto Czar David Sacks called U.S. Bitcoin reserves a “digital Fort Knox.” This political legitimacy could drive further adoption.

The upcoming Bitcoin halving event in April 2025 adds another bullish catalyst. Historically, halving events have led to reduced supply and accelerated price rallies over 6-12 month periods. Traders are watching for accumulation patterns ahead of this event.

On-chain analytics show increased whale activity in Bitcoin wallets. Large holders have demonstrated accumulation patterns according to blockchain data platforms. This suggests high-net-worth individuals and institutions are positioning for future price increases.

If Bitcoin can sustain above $118,000, analysts believe the path to $200,000 becomes more realistic. However, some experts suggest a small correction would be healthy for building a stronger foundation before the next rally phase.