TLDR

- Long-term Bitcoin holders sold 295,000 BTC over the past 30 days, averaging 9,800 BTC daily

- The selling is moderate compared to peaks in May and December 2024 when over 800,000 BTC were sold

- Institutional demand and ETF inflows continue to absorb the selling pressure, keeping the market stable

- Bitcoin is trading near $121,975 with key support at $120,000 holding firm

- CryptoQuant data shows the Net Realized Profit/Loss at 4.4 million BTC, below January 2025’s peak of 5.1 million BTC

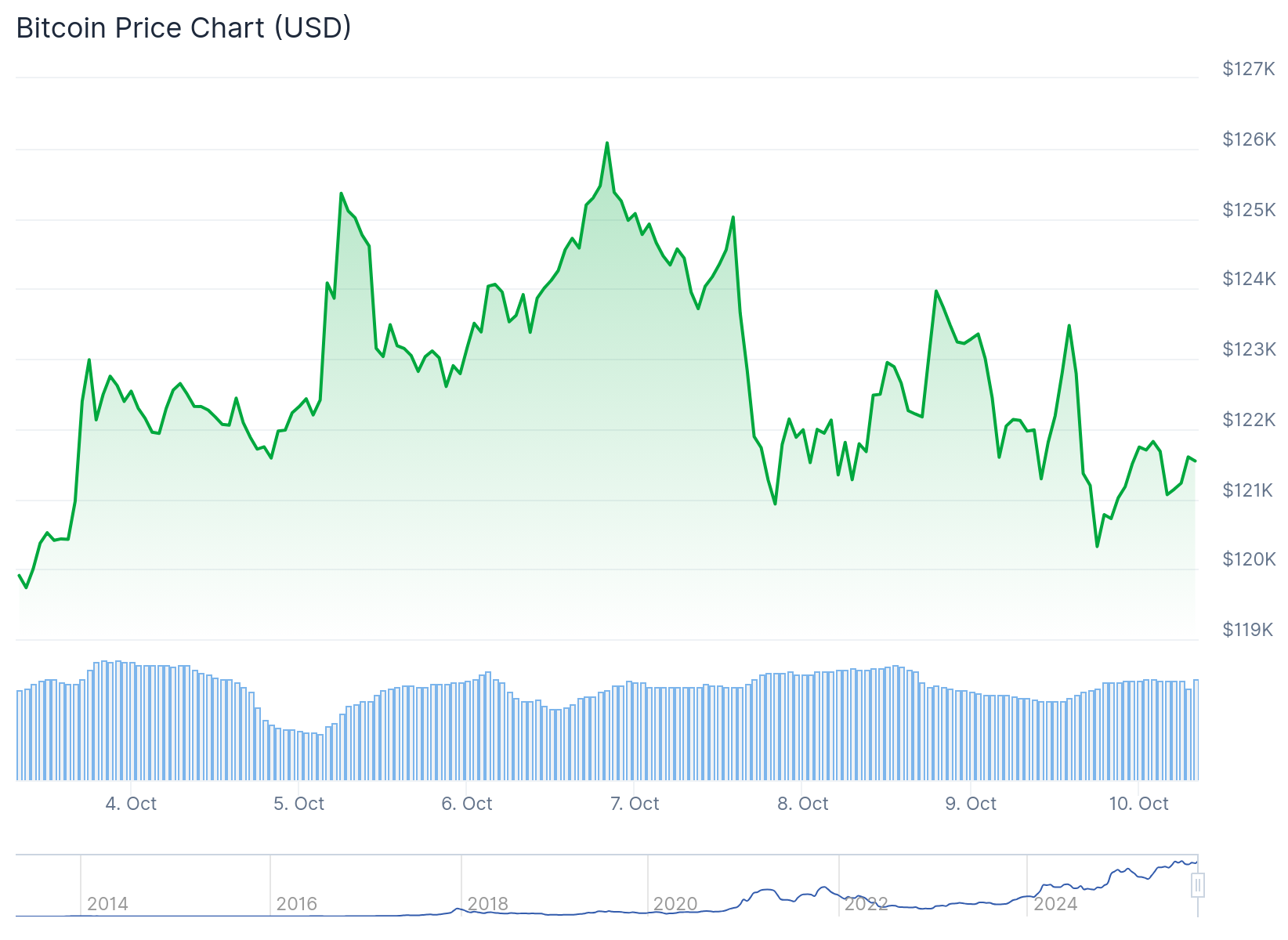

Bitcoin is trading near $121,975 after a volatile week that saw the cryptocurrency test its all-time high near $126,000. The market now sits in a consolidation phase as bulls and bears fight over the next direction.

Long-term holders have been selling their Bitcoin positions over the past month. Data from analyst Axel Adler shows these veteran investors sold 295,000 BTC in the last 30 days. This works out to an average of 9,800 BTC sold each day.

Over the last 30 days, Long-Term Holders have sold 295K BTC (9.8K BTC/day). This is an elevated but not extreme level compared to peaks in May and December 2024 (800K).

Such flow is compatible with a bullish trend, as long as demand for coins absorbs the distribution, which is… pic.twitter.com/G9h7Rp7d29

— Axel 💎🙌 Adler Jr (@AxelAdlerJr) October 9, 2025

The selling represents elevated activity from experienced holders. However, Adler notes this level is not extreme when compared to previous distribution peaks. In May and December 2024, long-term holders sold over 800,000 BTC during each period.

These selling phases have historically happened during major bullish runs. They typically signal profit-taking events rather than the end of a cycle. The coins often rotate from experienced holders to new market participants.

Adler explains the current flow remains compatible with a bullish market structure. The key factor is whether demand continues to absorb the coins being sold. Current data shows institutional investors and ETF-related buying are offsetting much of the selling pressure.

This balance suggests the market remains structurally healthy. Strong demand is sustaining prices above key support zones even as long-term holders realize gains.

CryptoQuant Shows Rally Still Intact

CryptoQuant has analyzed the Bitcoin Net Realized Profit/Loss indicator to assess market conditions. This metric tracks whether investors are selling their coins at a net profit or loss.

Bitcoin’s rally still looks intact.

Profit-taking remains moderate as net realized profits keep trending higher.

No signs yet of a price peak. pic.twitter.com/5XrzrwAKFE

— CryptoQuant.com (@cryptoquant_com) October 8, 2025

The 1-year sum of Net Realized Profit/Loss currently sits at 4.4 million BTC. This value shows investors are taking profits during the recent rally. However, the number is lower than January 2025’s peak of 5.1 million BTC.

The January peak itself was below the 7.7 million BTC high from October 2021 during the previous cycle. CryptoQuant states that Bitcoin’s rally still looks intact based on this trend. The firm sees no signs yet of a price peak.

The indicator witnessed an uptrend throughout 2024 and reached its January 2025 high. After that peak, the metric reversed and started declining due to bearish price action in early 2025. When bullish conditions returned, the Net Realized Profit/Loss began moving up again alongside Bitcoin’s latest rally.

Key Support Levels Hold

Bitcoin is currently consolidating after its rejection near the $126,000 all-time high. The broader structure continues to favor bulls as long as price holds above $120,000.

The 4-hour chart shows BTC in a short-term corrective phase. The 50-period moving average is acting as immediate support and providing a potential rebound zone if buying pressure returns.

Below that, the $117,500 level remains a key support to watch. A breakdown below this point could open the door to deeper retraces toward $114,000 where the 200-period moving average sits.

On the upside, Bitcoin needs to reclaim $123,000 to $124,000 with strong volume. This would confirm renewed bullish momentum. A breakout above $125,000 would likely invalidate the correction and signal the start of a new leg toward price discovery.

The coming days could prove decisive for Bitcoin’s direction. Many analysts are watching whether BTC can reclaim the $125,000 resistance level. If buying momentum holds and the distribution remains well absorbed, Bitcoin could gear up for its next move.

Failure to maintain current levels could trigger a temporary cooling phase. Inflows from institutional investors and ETF-related buying continue to provide support to the market.

Bitcoin is consolidating within a healthy range after a strong rally. As long as buyers continue defending the current support area, the market structure remains bullish.