TLDR

- Bitcoin reached a new all-time high above $126,000 on Monday and analysts say technical indicators show it’s not overbought yet

- CryptoQuant analysts note Bitcoin is roughly halfway through its four-year price cycle with stable upward momentum

- Bitwise predicts Bitcoin ETF inflows will hit a record in Q4 2025, potentially exceeding the $36 billion attracted in 2024

- Bitcoin is currently consolidating between $108,000 and $125,000 as the U.S. government shutdown delays crypto regulation

- Morgan Stanley guides its 16,000 advisers to consider crypto allocations of up to 4% for risk-tolerant investors

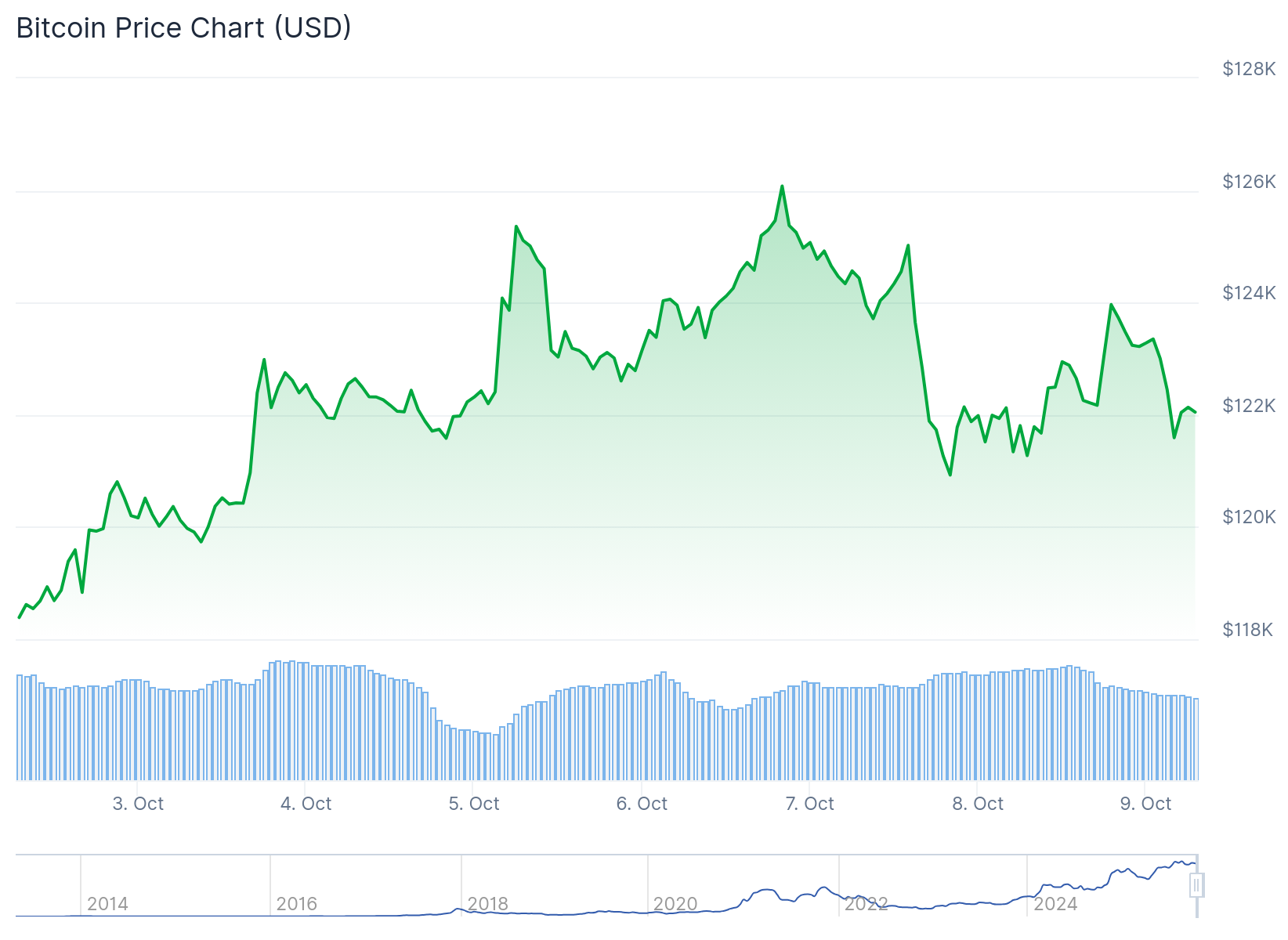

Bitcoin reached a new all-time high above $126,000 on Monday. The price surge has analysts examining technical indicators to determine if the rally can continue.

CryptoQuant contributor Arab Chain said Bitcoin is roughly halfway through its four-year price cycle. Despite the strong performance, technical indicators suggest the price is moving within a stable range. The analysis found Bitcoin is far from the overbought conditions that typically appear before historical peaks.

Bitcoin’s 30-day moving average sits just under $116,000. This suggests a steady upward trend without sharp deviations. The 30-day standard deviation stands at $4,540, reflecting relatively low volatility.

Arab Chain noted that compressed volatility typically precedes strong price movements. These movements trend upward if supported by renewed liquidity inflows. The analysts said Bitcoin’s growth ratio has been on an upward trajectory since May 2024.

Bitcoin tends to reach its cycle peak up to 600 days after its halving event. Mining rewards were slashed 50% during the most recent halving. If this pattern continues, Bitcoin is now within the critical window that has previously led to major bull market tops.

Record ETF Inflows Expected

Bitwise chief investment officer Matt Hougan predicted on Tuesday that inflows into Bitcoin exchange-traded funds will surge in the fourth quarter. He said inflows will set a record in Q4 and will pull in more money in 2025 than they did in their first year.

The ETFs attracted $36 billion in their record-setting first year. They have attracted $22.5 billion in inflows in the first nine months of 2025. This would put them on pace to end 2025 with approximately $30 billion in flows.

On October 8, Bitcoin spot ETFs recorded a total net inflow of $441 million, marking eight consecutive days of net inflows. Ethereum spot ETFs saw a total net inflow of $69.05 million, also extending their eight-day streak of inflows.

https://t.co/Hj2Gs49bWa pic.twitter.com/BZCdctwUtn— Wu Blockchain (@WuBlockchain) October 9, 2025

Hougan said he’s bullish on Bitcoin returns for Q4. He noted that higher prices often spur greater demand for Bitcoin ETFs. The media, companies, and everyday investors pivot their attention to Bitcoin when prices rise.

In every quarter where Bitcoin saw double-digit growth, inflows to Bitcoin ETFs also saw double-digit billions in inflows. Hougan said his prediction is based on a wider range of investors being able to access the ETFs.

Wealth Managers Opening Platforms

Wall Street wealth managers are finally changing to open up their platforms to Bitcoin ETFs. Morgan Stanley released a report earlier this month that guides 16,000 advisers. The report said they could flexibly allocate to cryptocurrency as part of their multiasset portfolio.

The suggested allocation is up to 4% for risk-tolerant investors. Hougan said advisers want their year-end printouts to show they hold the most successful investments. Gold and Bitcoin have both performed well so far this year.

The fourth quarter is off to a great start with the ETFs taking in $3.5 billion in net flows in the first four trading days. There are 64 more trading days remaining in the quarter. Hougan believes the ETFs will take in another $10 billion and then some.

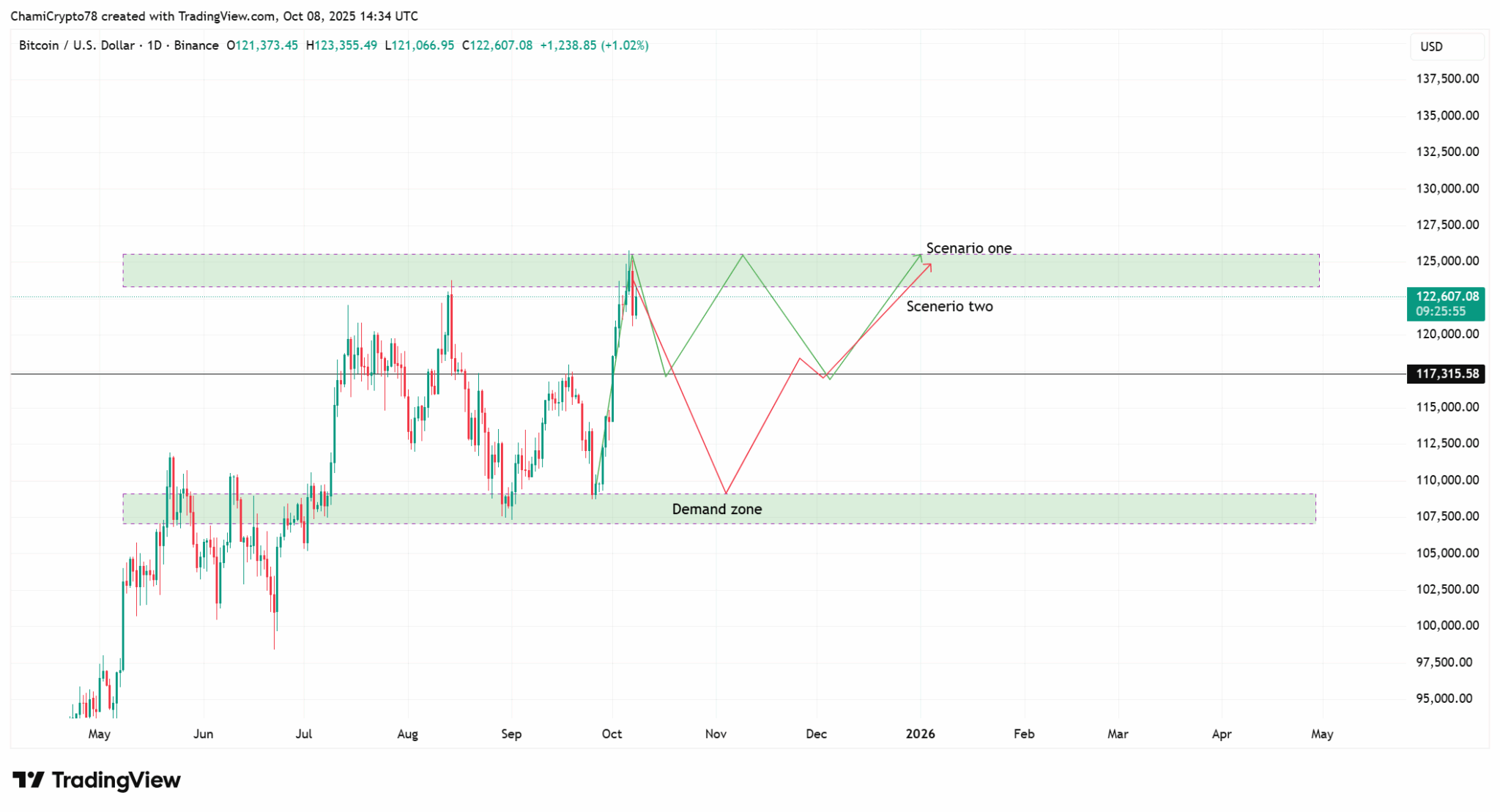

Bitcoin is currently consolidating between $108,000 and $125,000. The U.S. government shutdown has delayed progress on the Crypto Market Structure Bill. The bill is designed to establish clearer industry oversight.

Lawmakers have cautioned that legislative voting may not resume until late 2025 or early 2026. Morgan Stanley’s new guidance opens Bitcoin ETFs to 16,000 financial advisers with allocation recommendations up to 4% for appropriate investors.