TLDR

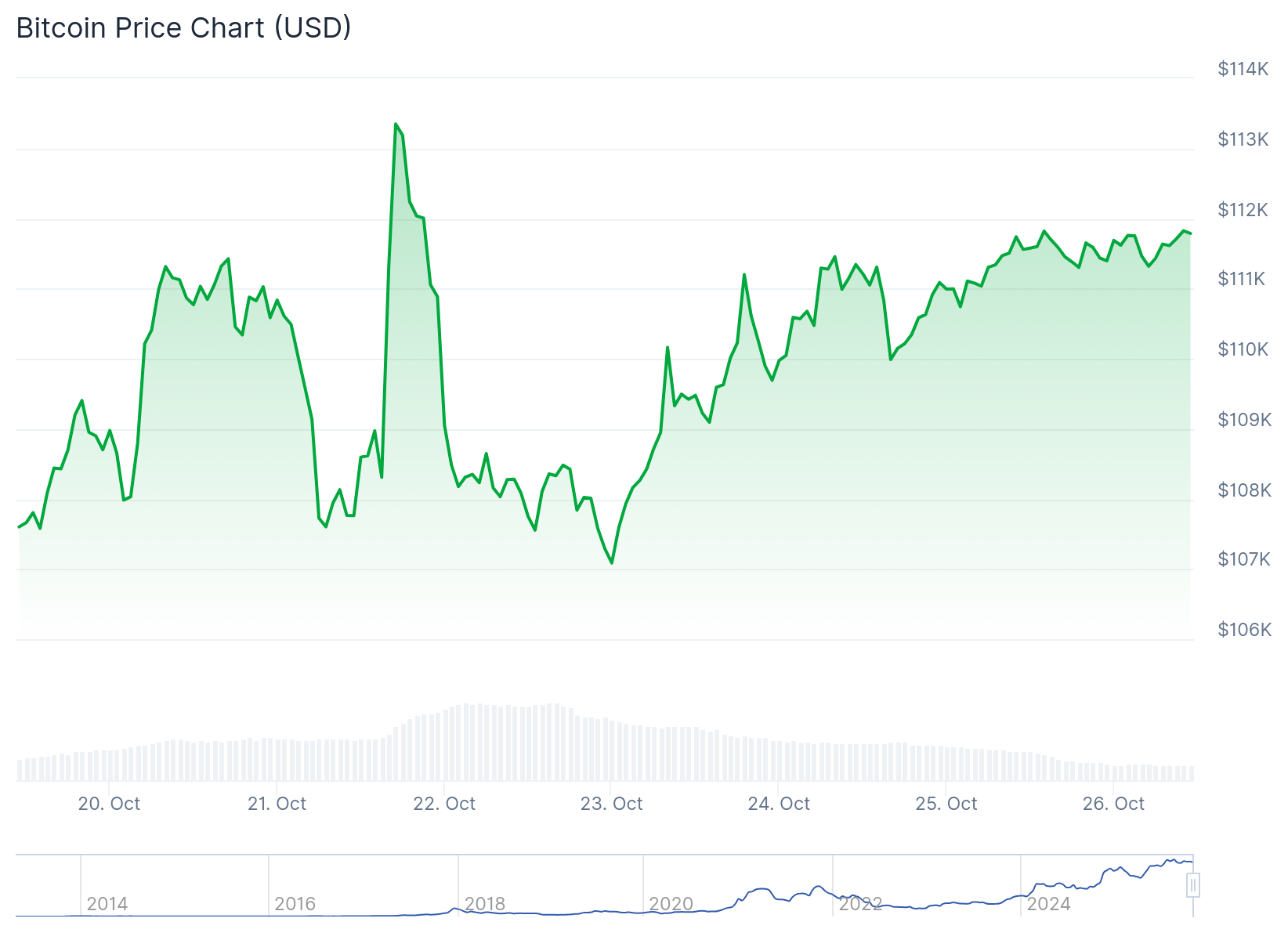

- Bitcoin price trades around $111,742 with a 0.5% gain in 24 hours and eyes the $120,000 level as market consolidation continues

- The Federal Reserve has a 98-99% probability of cutting interest rates at its next meeting on October 29, based on CME FedWatch tool data

- US Consumer Price Index rose 3.0% year-over-year in September, coming in below the 3.1% forecast and boosting rate cut expectations

- Bitcoin needs to break above $112,000-$114,000 resistance to confirm further upside, with key support holding at $110,000

- Bitcoin ETFs saw net outflows of $90.60 million over three consecutive days, while spot ETFs recorded net inflows of $149.96 billion

Bitcoin price currently sits at $111,742 after gaining 0.5% in the past 24 hours. The leading cryptocurrency has climbed 5% over the past week while the broader market added 0.48%.

The US Labor Department released September’s Consumer Price Index report during the ongoing government shutdown. The data showed inflation cooled more than economists expected.

Headline CPI rose 3.0% year-over-year, below the forecasted 3.1%. Core CPI, which excludes food and energy prices, also came in at 3.0%, under the 3.1% expectation.

Both monthly headline and core CPI readings came in weaker than projected. The softer inflation numbers increased expectations for Federal Reserve action.

According to CME’s FedWatch tool, there is now a 98-99% probability the Fed will cut interest rates at its next meeting on October 29. The latest inflation data, combined with signs of a slowing labor market, has strengthened market confidence.

‼️ Money market funds just hit an all-time high of $7.4 TRILLION

99% chance the Fed cuts rates in 6 days.

Rate cuts will push treasury holders to seek more risk, driving liquidity into Bitcoin and other assets

Liquidity tsunami incoming 🌊 🌊 🌊 pic.twitter.com/LEozSuzd1g

— Bitcoin Archive (@BTC_Archive) October 23, 2025

The S&P 500 gained nearly 1% following the CPI release, reaching record highs near 6,800. The positive sentiment in traditional markets has carried over to crypto assets.

Bitcoin Holds Key Support Levels

Bitcoin has rebounded from its $110,000 support zone multiple times in recent days. The cryptocurrency’s ability to hold above this level suggests potential for further gains.

Crypto analyst Ted Pillows stated that Bitcoin needs to reclaim the $113,000-$114,000 range to confirm additional upside. He warned that if the current rally proves to be another false breakout, the market could face a sharp correction.

$BTC bounced back from its $110,000 support zone again.

The next crucial level to reclaim is $112,000 which will start the next uptrend.

If Bitcoin gets rejected again, expect a sharp correction towards the $108,000-$110,000 level. pic.twitter.com/EfJepr27EY

— Ted (@TedPillows) October 25, 2025

The Relative Strength Index currently stands at 60, placing Bitcoin in neutral territory. The Moving Average Convergence Divergence indicator shows bullish positioning with the MACD line above the signal line.

If Bitcoin continues trading around $111,000, it will likely face resistance near $120,000. A successful break above $112,000 could open the path toward $113,000 and beyond.

On the downside, Bitcoin maintains strong support at the $105,000 level. The primary support zone to watch for potential corrections sits between $108,000 and $110,000.

Altcoins Join the Rally

The broader cryptocurrency market participated in the upward movement following the CPI data. Ethereum, XRP, Binance Coin, Solana, Cardano, and Dogecoin all posted gains above 3%.

Bitcoin ETFs experienced net outflows of $90.60 million, marking three consecutive days of withdrawals. In contrast, spot Bitcoin ETFs recorded net inflows of $149.96 billion.

On-chain data reveals that a trader known as the Trump insider whale opened $150 million in long positions ahead of former President Trump’s speech. The trader claims a perfect track record predicting major price movements in Bitcoin and Ethereum.

Bitcoin price was last recorded at $111,842 as the market awaits the Fed’s rate decision next week.