TLDR

- Long-term Bitcoin holders sold 52,000 BTC as the price reached $118,000, marking the first major distribution since accumulation began

- The Coinbase Premium Index turned negative for the first time in 62 days, ending the longest institutional demand streak on record

- Analyst Ali Martinez projects Bitcoin could reach $149,679 based on the CVDD model’s “Accessing Tops” zone

- Bitcoin ETF inflows dropped 80% to $496 million, while 96.9% of Bitcoin supply remains profitable

- Technical indicators show compressed volatility with Bollinger Bands tightening, suggesting a major price move is coming

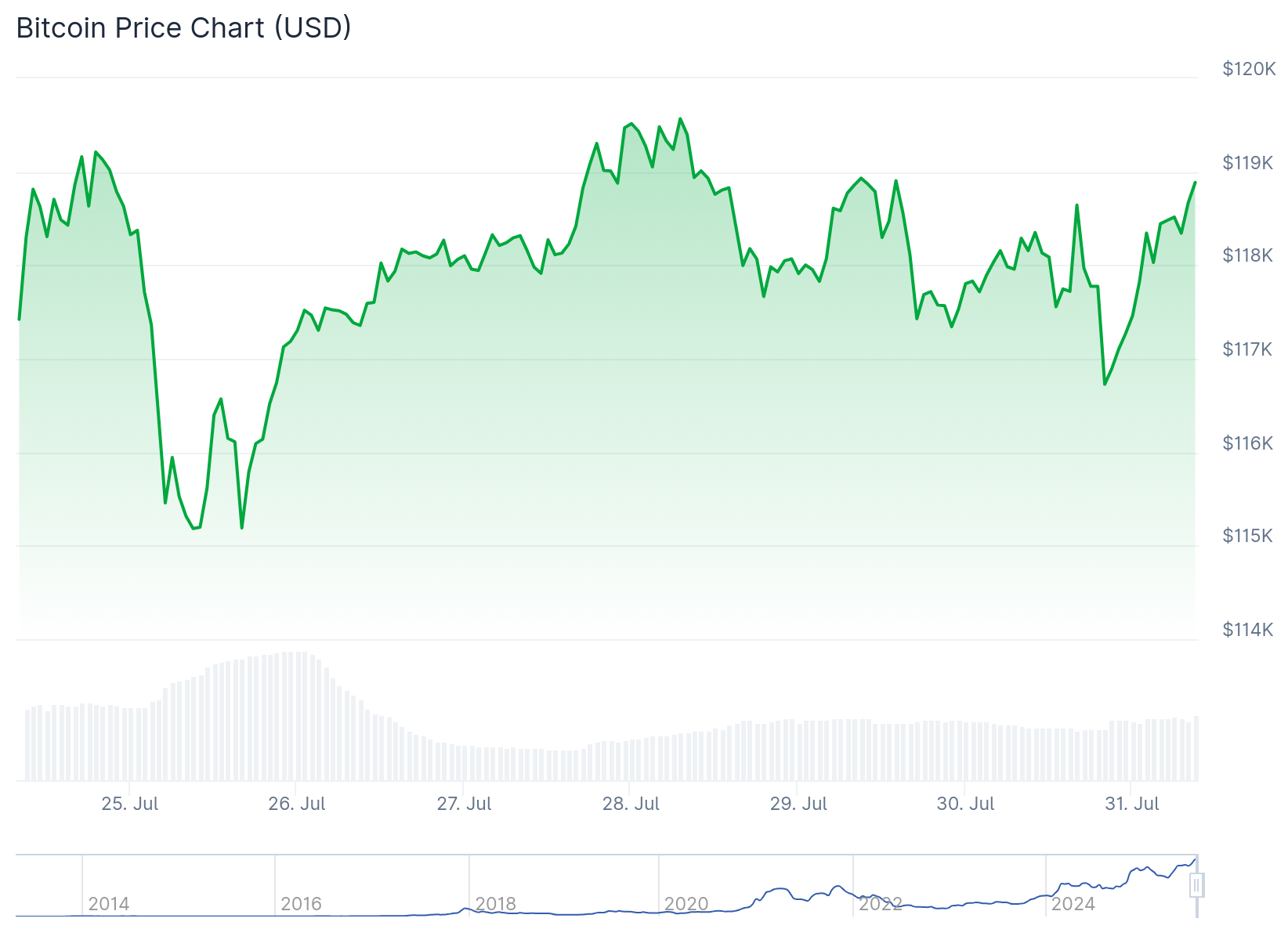

Bitcoin faces a critical moment as long-term holders begin taking profits while technical indicators point to an upcoming major price movement.

Long-term Bitcoin holders have started reducing their positions after the cryptocurrency reached $118,000. On-chain data reveals these experienced investors sold 52,000 BTC at this price level.

This selling represents the first major distribution after months of steady accumulation. The shift mirrors patterns seen between late 2024 and early 2025 when Bitcoin rose from $65,000 to over $100,000.

The long-term holder supply dropped from above 15.5 million BTC to 15.3 million BTC. This type of distribution often signals that experienced holders believe prices are nearing a temporary peak.

Analyst Axel Adler Jr reported the data using CryptoQuant metrics. The selling pattern follows historical trends where distribution periods occur after major accumulation phases.

At the $118K level LTH supply began to decline, having decreased by 52K BTC at the moment. Essentially, LTH started distributing accumulated supply, and as the price rises, this will intensify as it did in previous macro cycles.

The shift in balance from accumulation to… pic.twitter.com/ernjYgvvlE— Axel 💎🙌 Adler Jr (@AxelAdlerJr) July 29, 2025

Market Sentiment Shifts as Institutional Demand Cools

The Bitcoin Coinbase Premium Index turned negative for the first time since May 29. This ended a 62-day positive streak that marked Bitcoin’s strongest institutional demand period on record.

The metric tracks price differences between Coinbase’s BTC/USD and Binance’s BTC/USDT pairs. It serves as a proxy for US spot demand from institutional investors.

The shift comes after an even longer 94-day run of sustained positive premium. This change may indicate fading appetite from US buyers.

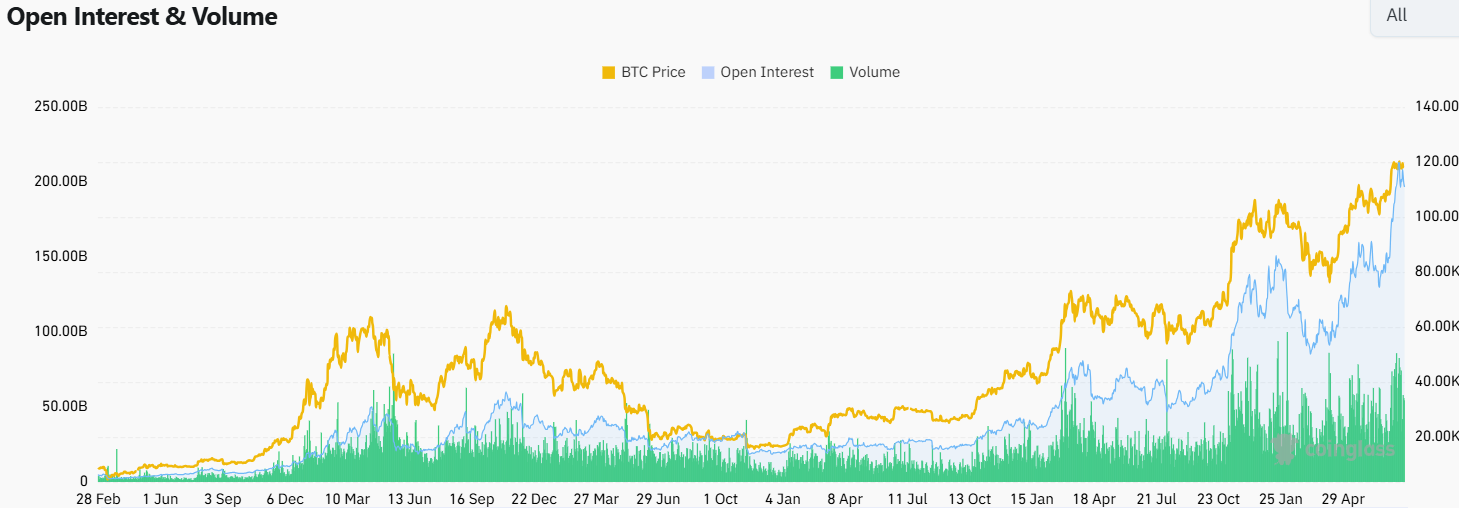

Bitcoin ETF inflows dropped sharply by 80% to $496 million last week. Trade volume in the ETF market also fell to $18.7 billion.

Despite these changes, most Bitcoin holders remain profitable. Glassnode data shows 96.9% of the total Bitcoin supply stays above its cost basis.

Technical Analysis Points to Major Move

Crypto analyst Ali Martinez believes Bitcoin could still reach $149,679 based on the CVDD model. This model tracks long-term activity and possible cycle peaks.

The next Bitcoin $BTC top could be at $149,679! pic.twitter.com/knZXTdjKve

— Ali (@ali_charts) July 29, 2025

The estimate places Bitcoin in the “Accessing Tops” zone where prices have peaked during past cycles. Previous levels in this zone included $119,344 and $101,284.

Technical indicators suggest volatility is building. Bollinger Bands are compressing on the daily chart, which often signals a major breakout or breakdown is coming.

The RSI dropped from 74.4 to 51.7, showing some cooling in momentum. Active addresses and transfer volume also declined recently.

Bitcoin’s taker buy/sell ratio fell to 0.9, indicating increased selling from market makers. Despite this selling pressure, Bitcoin continues holding above $115,000.

Futures funding rates remain neutral at 0.01, showing neither bullish nor bearish dominance. This balanced leverage suggests a larger move could be ahead.

The futures cumulative volume delta continues showing persistent sell pressure without major price breakdowns. This divergence between volume and price action suggests underlying strength.

Open interest in futures markets stayed high at $45.6 billion. Funding rates also rose, showing leveraged traders remain active.

Options data revealed rising volatility expectations. The skew turned slightly positive, meaning traders focused less on hedging downside risk.

Realized Cap Change rose 6.6%, indicating buyers remain active despite fewer coins moving on-chain. The Net Realized Profit/Loss metric shows no evidence of large-scale exits.

The Adjusted SOPR remains well below the 1.10 threshold typically associated with market tops. These indicators suggest investors remain confident and are not rushing to secure profits.

Macro conditions support the current market structure. The US JOLTS report came in slightly weaker than expected, creating a favorable backdrop for risk assets.

Consumer confidence rebounded after a six-month decline, reflecting broader recovery in investor sentiment. Bitcoin remains in a neutral position as markets await the next Federal Open Market Committee meeting.