TLDR

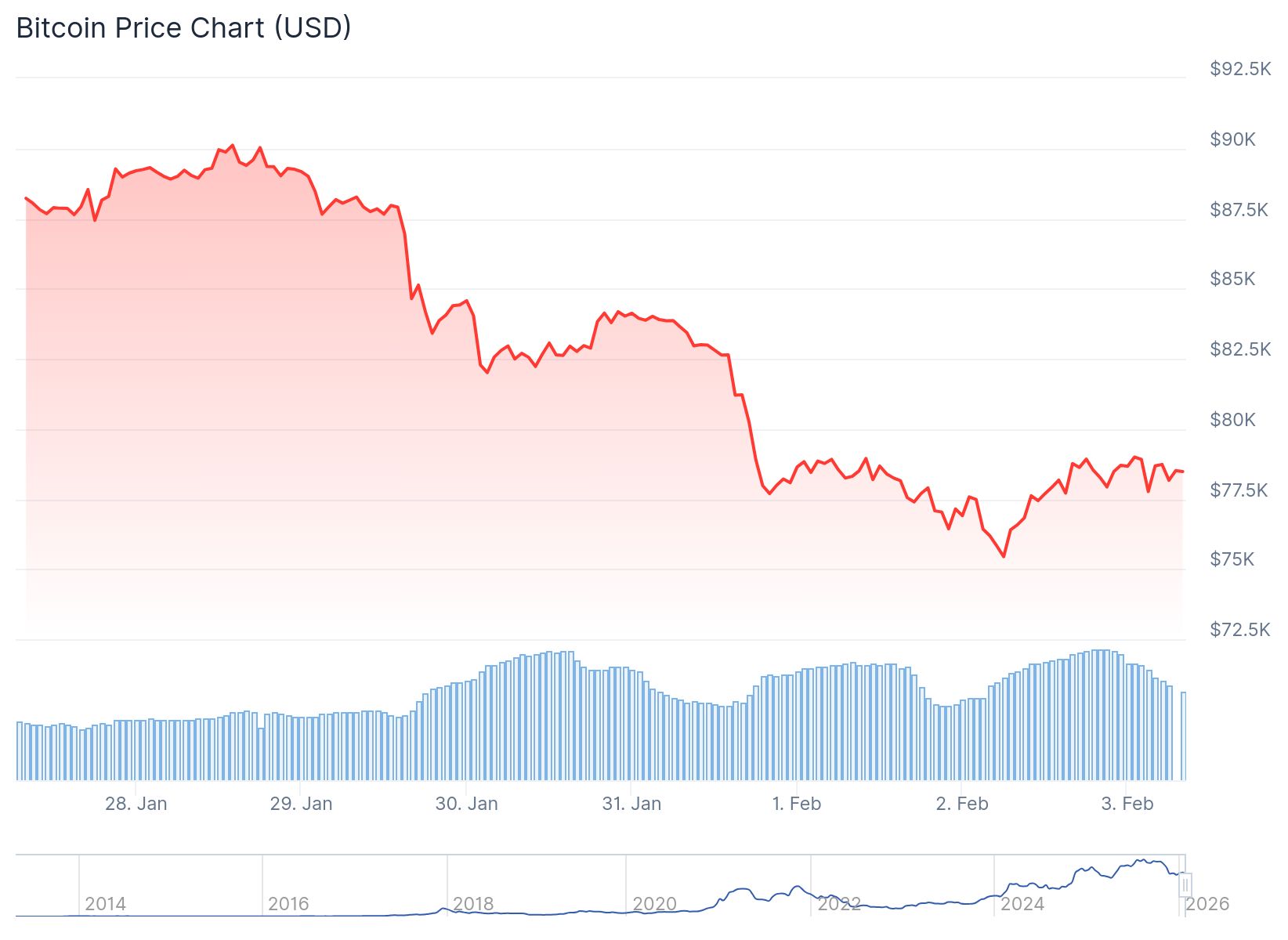

- Bitcoin dropped to around $74,000 over the weekend, roughly 40% below its all-time highs, before recovering to $78,244

- Bernstein analysts predict Bitcoin could fall to $60,000 in the first half of 2026 before establishing a stronger base

- Spot Bitcoin ETFs ended a four-day outflow streak with $561.9 million in net inflows on Monday, the largest since January 14

- Trump’s nomination of Kevin Warsh as Federal Reserve chair is weighing on crypto markets due to his hawkish monetary policy stance

- About $1.6 billion in leveraged crypto positions were liquidated as prices fell, with $111 billion wiped from total market cap

Bitcoin experienced intense volatility over the weekend as prices plunged to approximately $74,000. The world’s largest cryptocurrency has since recovered to trade around $78,244.

The drop represents nearly a 40% decline from Bitcoin’s all-time highs. The sell-off triggered widespread liquidations across the digital asset market.

Investment firm Bernstein released analysis suggesting Bitcoin remains in a “short-term crypto bear cycle.” The analysts led by Gautam Chhugani predict the downturn could last several more months.

🔥BERNSTEIN: $60K BTC COULD MARK THE BOTTOM

Bernstein says crypto is in a short-term bear phase but expects a reversal in 2026, with Bitcoin bottoming in the $60K range.

The firm points to institutional flows, U.S. policy alignment, and sovereign-asset demand as catalysts for… pic.twitter.com/J803KFgVIp

— Coin Bureau (@coinbureau) February 2, 2026

Bernstein expects Bitcoin may find support near $60,000 in the first half of 2026. This price level aligns with Bitcoin’s previous cycle highs.

Roughly $111 billion was erased from the total cryptocurrency market capitalization in 24 hours. Data from Coinglass shows approximately $1.6 billion in leveraged positions were liquidated as prices fell.

Does this look familiar?

Imagine if Bitcoin $BTC is mirroring Alphabet $GOOG. pic.twitter.com/shOife4kTH

— Ali Charts (@alicharts) February 2, 2026

Thinning liquidity during weekend trading sessions made the sell-off worse. Stop-loss orders and margin calls accelerated the decline as prices dropped through key levels.

Fed Nomination Impacts Market Sentiment

President Donald Trump’s nomination of Kevin Warsh as Federal Reserve chair has created uncertainty in crypto markets. Warsh previously served as a Federal Reserve governor and is known for hawkish views on monetary policy.

His stance on inflation control and balance-sheet discipline suggests tighter financial conditions ahead. Cryptocurrencies typically perform better during periods of abundant liquidity and lower interest rates.

David Scutt, market analyst at StoneX Group, noted that Warsh’s past criticism of quantitative easing triggered immediate selling. Trades that benefited from currency debasement concerns unwound quickly.

Despite the bearish near-term outlook, Bernstein sees structural changes supporting Bitcoin long-term. The analysts pointed to spot Bitcoin ETFs, which now manage approximately $165 billion in assets.

Corporate Bitcoin treasuries have also grown substantially. Strategy has accumulated about $3.8 billion worth of Bitcoin year-to-date.

ETF Inflows Signal Renewed Interest

U.S. spot Bitcoin ETFs recorded $561.9 million in net inflows on Monday, February 3. The inflows ended a four-day streak of outflows.

According to SoSoValue, on Feb. 2 (ET), U.S. spot Bitcoin ETFs recorded total net inflows of $562 million. Fidelity’s FBTC saw the largest single-day net inflow among Bitcoin spot ETFs at $153 million. Spot Ethereum ETFs posted total net outflows of $2.86 million, while Solana… pic.twitter.com/iy8sMMQHft

— Wu Blockchain (@WuBlockchain) February 3, 2026

Fidelity’s FBTC led with $153.4 million in inflows. BlackRock’s IBIT followed with $142 million.

Bitwise’s BITB saw $96.5 million in net inflows. Funds from Grayscale, Ark & 21Shares, VanEck, Invesco, and WisdomTree also posted gains.

Vincent Liu, CIO at Kronos Research, described the inflows as a sign of conviction among large investors. He said allocators are using regulated ETFs to scale exposure as part of portfolio rebalancing.

The previous two weeks saw substantial ETF outflows totaling nearly $3 billion combined. Tim Sun, senior researcher at HashKey Group, attributed earlier withdrawals to narrowing arbitrage opportunities.

Sun said Bitcoin testing support levels twice in a short period allowed the market to price in pessimistic expectations. Some medium and long-term investors now view current prices as attractive entry points.

Bitcoin’s market cap has fallen to just 4% of gold’s market cap, a two-year low. Central banks from China and India have pushed gold’s share of global reserves to around 29% by late 2025.