TLDR

- Bitcoin has triggered its fourth-ever Golden Cross technical signal, historically leading to massive rallies of 264% to over 2,200%

- Previous Golden Cross events in 2016, 2017, and 2020 all resulted in new all-time highs for Bitcoin

- Spot Bitcoin ETFs recorded $642 million in daily inflows on Friday, marking five consecutive days of gains

- Ether ETFs also saw strong performance with $405 million in inflows, showing institutional confidence

- Bull market support bands continue holding firm, providing technical foundation for potential upward movement

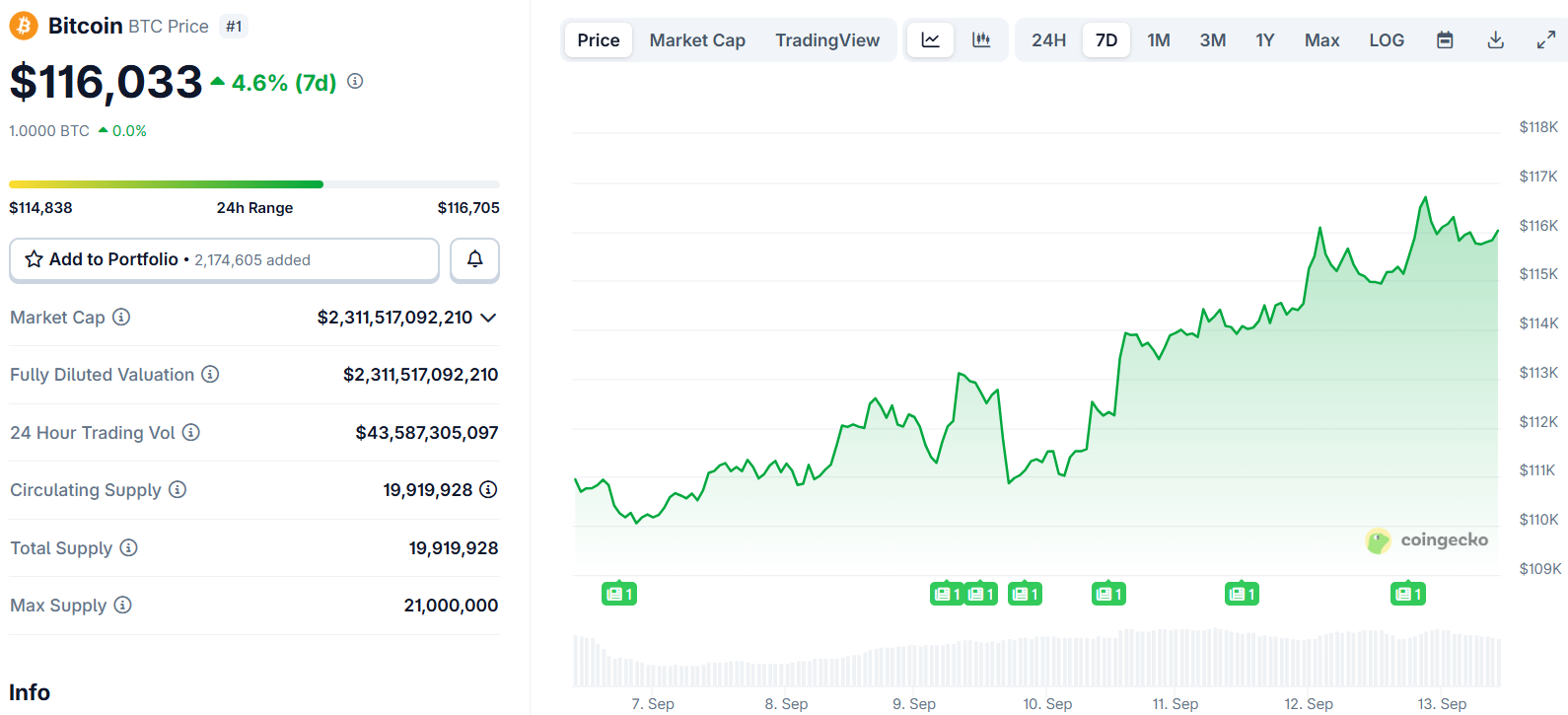

Bitcoin has just flashed one of its rarest technical signals, the Golden Cross, for only the fourth time in its history. This development comes as institutional money pours into spot Bitcoin ETFs at unprecedented levels.

Crypto analyst Merlijn The Trader identified the Golden Cross formation on Thursday. The signal has appeared just three times before since Bitcoin’s creation. Each previous occurrence led to extraordinary price movements.

BITCOIN’S RAREST SIGNAL JUST FLASHED.

The Golden Cross.

2016: +264%

2017: +2200%

2020: +1190%2025 is the 4th time in history.

This isn’t noise. This is ignition.Few will ride it. Most will miss it. pic.twitter.com/Qd3PtIjmKT

— Merlijn The Trader (@MerlijnTrader) September 11, 2025

The first Golden Cross in 2016 preceded a 264% rally. Bitcoin’s second Golden Cross in 2017 coincided with a meteoric rise of over 2,200%. The cryptocurrency reached unprecedented highs between $17,000 and $27,000.

The third Golden Cross formation occurred in 2020. Bitcoin surged more than 1,190% following this signal. The cryptocurrency climbed from lows between $4,600 and $7,000 to roughly $69,000 by late 2021.

Each Golden Cross event resulted in Bitcoin reaching new all-time highs. The pattern suggests the current signal could trigger another powerful bull run.

Technical Support Remains Strong

Bull market support bands continue to hold firm across multiple testing periods. Crypto analyst Mags notes these bands have acted as critical support zones throughout past cycles.

#Bitcoin is still looking bullish.

The bull market support bands have acted as a strong support zone in this cycle.

Each time the price has tested these bands, they’ve held as support.

Price is bouncing again from the bands and looks ready to move higher. pic.twitter.com/c13FpyhQMY

— Mags (@thescalpingpro) September 12, 2025

Bitcoin’s price has consistently bounced off the bull market support band during temporary corrections. The most recent test saw the cryptocurrency rebound cleanly from these levels.

This technical foundation suggests buyers are defending key support areas. The consistent support creates a base for potential further gains without market overextension.

Based on historical patterns, even conservative projections suggest Bitcoin could climb well beyond $200,000. A 100% rally from current levels above $115,000 could push Bitcoin above $230,000.

Some projections point to even greater potential. Chart analysis suggests Bitcoin could surge toward $400,000 if historical patterns repeat.

Institutional Money Floods In

Spot Bitcoin ETFs recorded $642.35 million in net inflows on Friday. This marked the fifth consecutive day of gains for these investment products.

On September 12, Bitcoin spot ETFs recorded a total net inflow of $642 million, marking the fifth consecutive day of inflows. Ethereum spot ETFs saw a total net inflow of $406 million, their fourth consecutive day of inflows.https://t.co/Hj2Gs49bWa pic.twitter.com/TFPDcuoxVZ

— Wu Blockchain (@WuBlockchain) September 13, 2025

Cumulative net inflows have reached $56.83 billion. Total net assets now stand at $153.18 billion, representing roughly 6.62% of Bitcoin’s total market cap.

Fidelity’s FBTC led Friday’s inflows with $315.18 million in fresh capital. BlackRock’s IBIT followed with $264.71 million in new investments.

Trading volumes across all spot Bitcoin ETFs topped $3.89 billion. The high volume signals robust institutional activity and growing positioning.

Bitcoin spot ETFs saw $2.34 billion in cumulative net inflows over the past five trading days. This represents a shift in sentiment from a quieter start to the month.

Ether ETFs also attracted strong institutional interest. Spot Ether ETFs pulled in $405.55 million in daily net inflows on Friday.

This marked the fourth consecutive day of gains for Ether-based products. Total Ether ETF inflows have reached $13.36 billion with net assets at $30.35 billion.

BlackRock’s ETHA brought in $165.56 million while Fidelity’s FETH added $168.23 million. ETHA alone saw $1.86 billion in trading value on Friday.

Vincent Liu from Kronos Research commented on the institutional activity. “Bitcoin and Ethereum spot ETFs keep seeing strong inflows, showing rising institutional confidence,” Liu said.

The analyst added that favorable macroeconomic conditions could strengthen liquidity and drive momentum for both assets. BlackRock is exploring tokenization of ETFs on blockchain networks following the success of its spot Bitcoin products.