TLDR

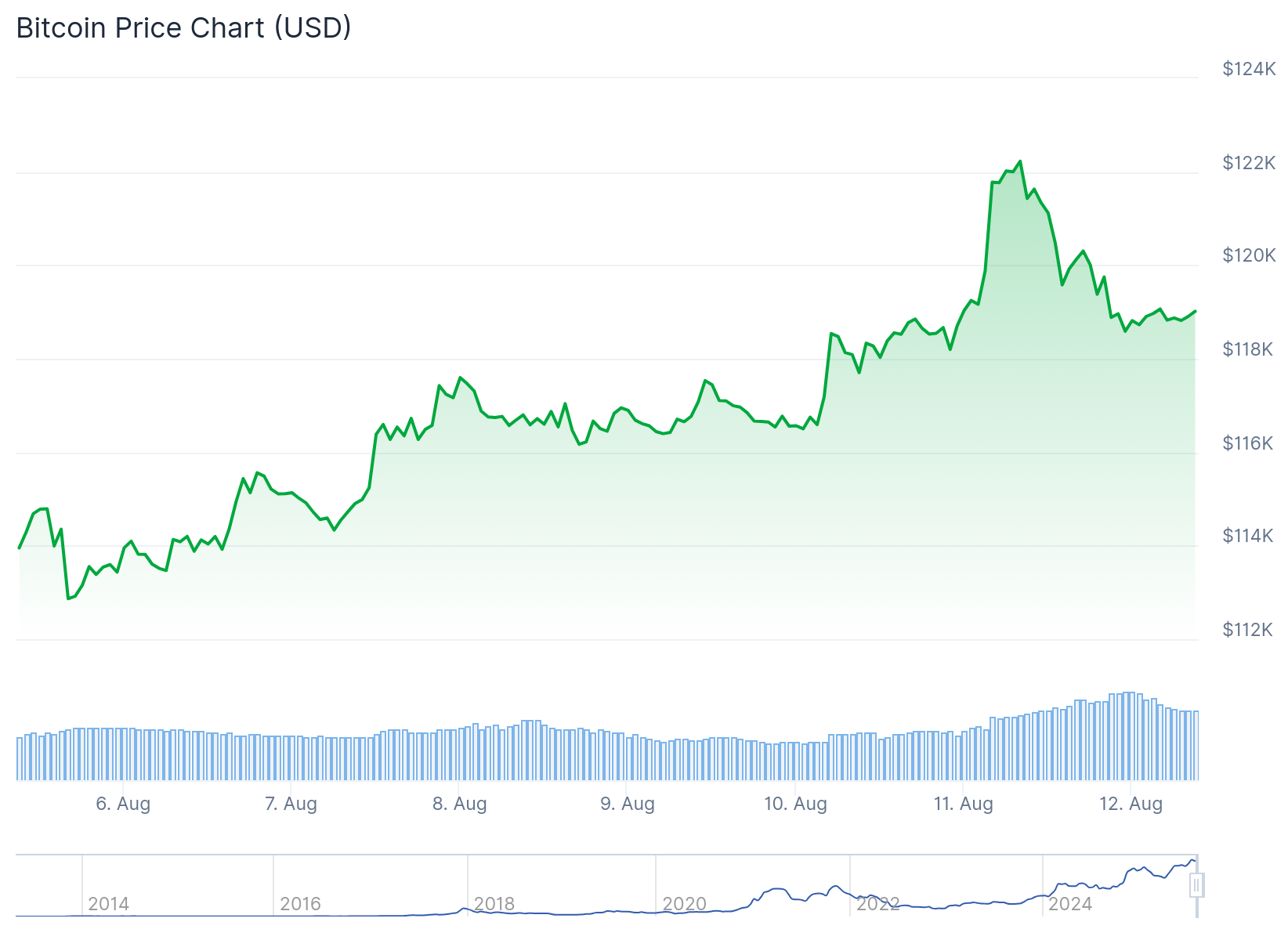

- Bitcoin dropped 2.8% to $118k after reaching highs above $122,000, facing resistance at $120,000

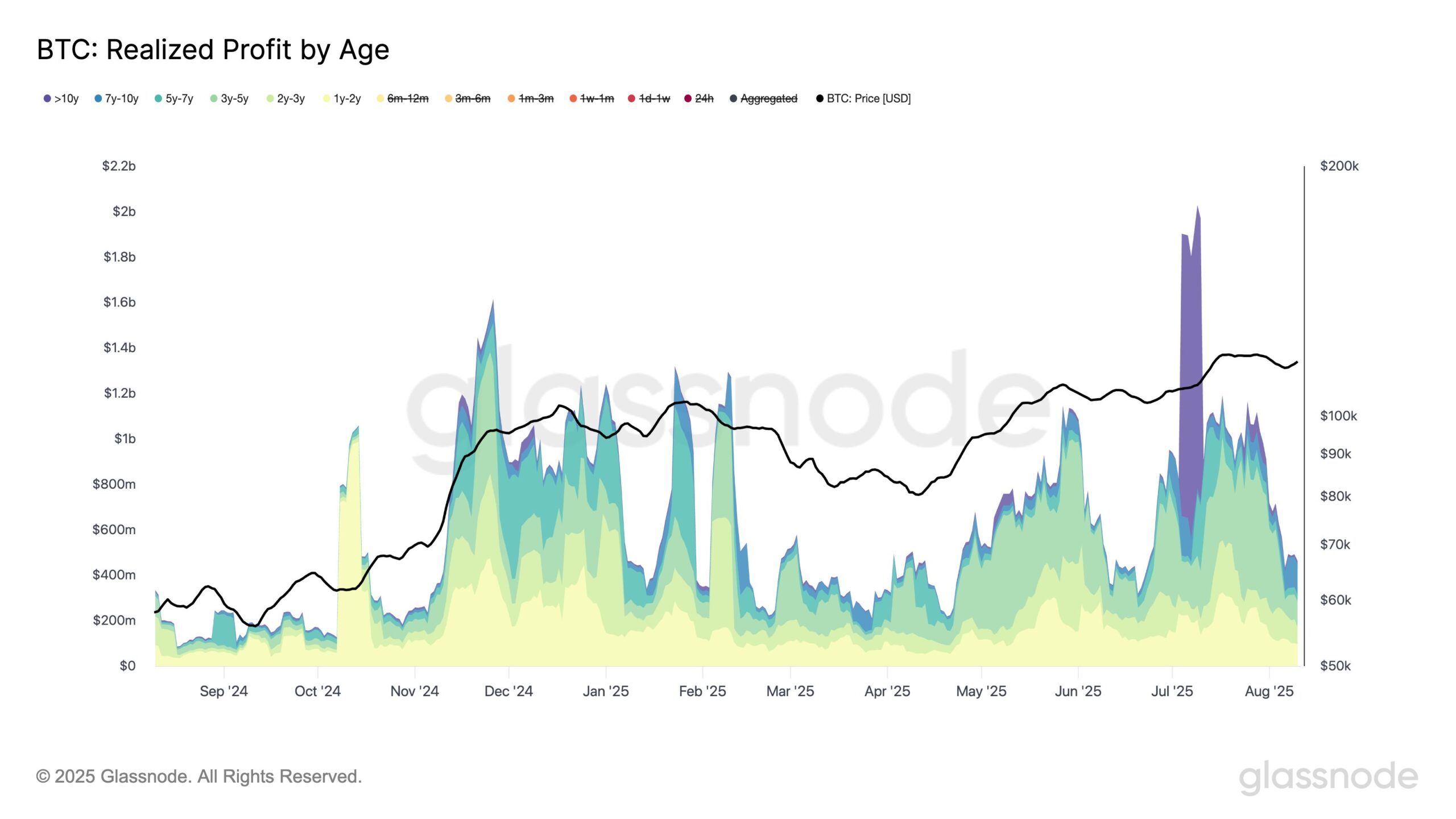

- Long-term Bitcoin holders reduced selling activity after July’s massive profit-taking period above $1 billion daily

- New Bitcoin addresses increased 15% over ten days, with active addresses hitting 367,349 – a 9-month high

- US CPI report expected Tuesday could determine if Bitcoin breaks past $120,000 resistance or remains consolidated

- Bitcoin’s correlation with US equities at 0.76 means inflation data will heavily influence price direction

Bitcoin price experienced sharp price swings this week as traders positioned ahead of Tuesday’s US Consumer Price Index report. The cryptocurrency fell 2.8% to $118k after surging above $122,000 during weekend trading.

The recent volatility reflects broader market caution as investors await inflation data that could influence Federal Reserve policy decisions. Bitcoin retreated from its monthly high as risk appetite declined across financial markets.

Long-term Bitcoin holders have reduced their selling pressure after July’s intense profit-taking period. The seven-day moving average of realized profits by long-term holders dropped after reaching over $1 billion daily in July.

This decrease in selling activity from experienced investors suggests growing confidence in Bitcoin’s price stability. The reduced supply pressure has contributed to the cryptocurrency’s ability to maintain levels above $118,000.

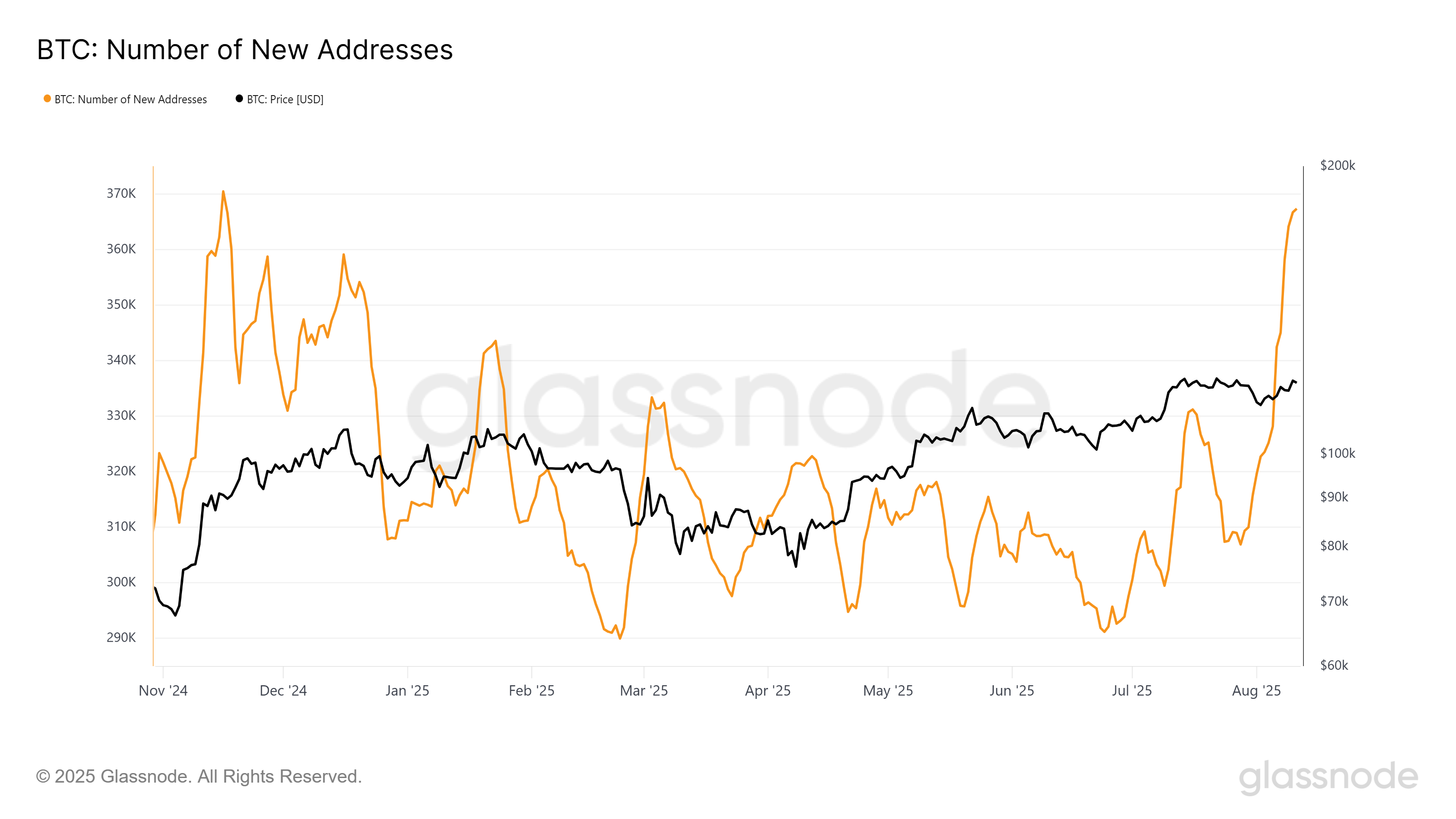

Growing Network Activity

Bitcoin network activity shows positive trends despite price volatility. New addresses increased 15% over the past ten days, indicating fresh investor interest.

Active addresses reached 367,349, marking a nine-month high for network participation. This growth suggests Bitcoin continues attracting new users even during periods of price uncertainty.

The combination of reduced selling pressure from long-term holders and increased new user adoption creates a supportive foundation for potential price recovery.

CPI Report Impact

Bitcoin currently faces resistance just below $120,000, a level that has prevented further upward movement. The upcoming CPI report could determine whether this resistance level breaks.

Market forecasts expect inflation to rise slightly to 2.8% year-over-year from July’s 2.7% reading. Higher-than-expected inflation could keep Bitcoin consolidated under current resistance levels.

Bitcoin’s correlation with US equities stands at 0.76, meaning the cryptocurrency often moves in tandem with stock markets. This relationship makes inflation data particularly important for Bitcoin’s direction.

Bitcoin Price Prediction

If the CPI report shows inflation below forecasts, Bitcoin may push past the $120,000 resistance level. A break above this threshold could open the path toward the previous high of $122,000.

Lower inflation readings typically support risk assets like Bitcoin by increasing the likelihood of Federal Reserve interest rate cuts. Rate cuts boost crypto markets by increasing available liquidity for speculative investments.

Crypto analyst Michael Van De Poppe noted that historical trading patterns may not apply in the current market environment. Traditional seasonal trends have proven unreliable as markets broke higher during typically weaker periods.

The recent tariff policies have added complexity to inflation dynamics, making predictions more challenging. Standard economic relationships between inflation and asset prices may not follow historical patterns.

Metaplanet’s continued Bitcoin purchases as the sixth-largest corporate holder provided some support but failed to offset broader selling pressure. Corporate demand remains a positive factor for long-term price prospects.

Bitcoin’s ability to hold above $118,000 despite broader market weakness demonstrates underlying strength. The cryptocurrency has maintained most of its recent gains even as risk sentiment deteriorated.

Market participants remain focused on the CPI data release, with Bitcoin’s near-term direction largely dependent on the inflation reading and its implications for Federal Reserve policy.