TLDR

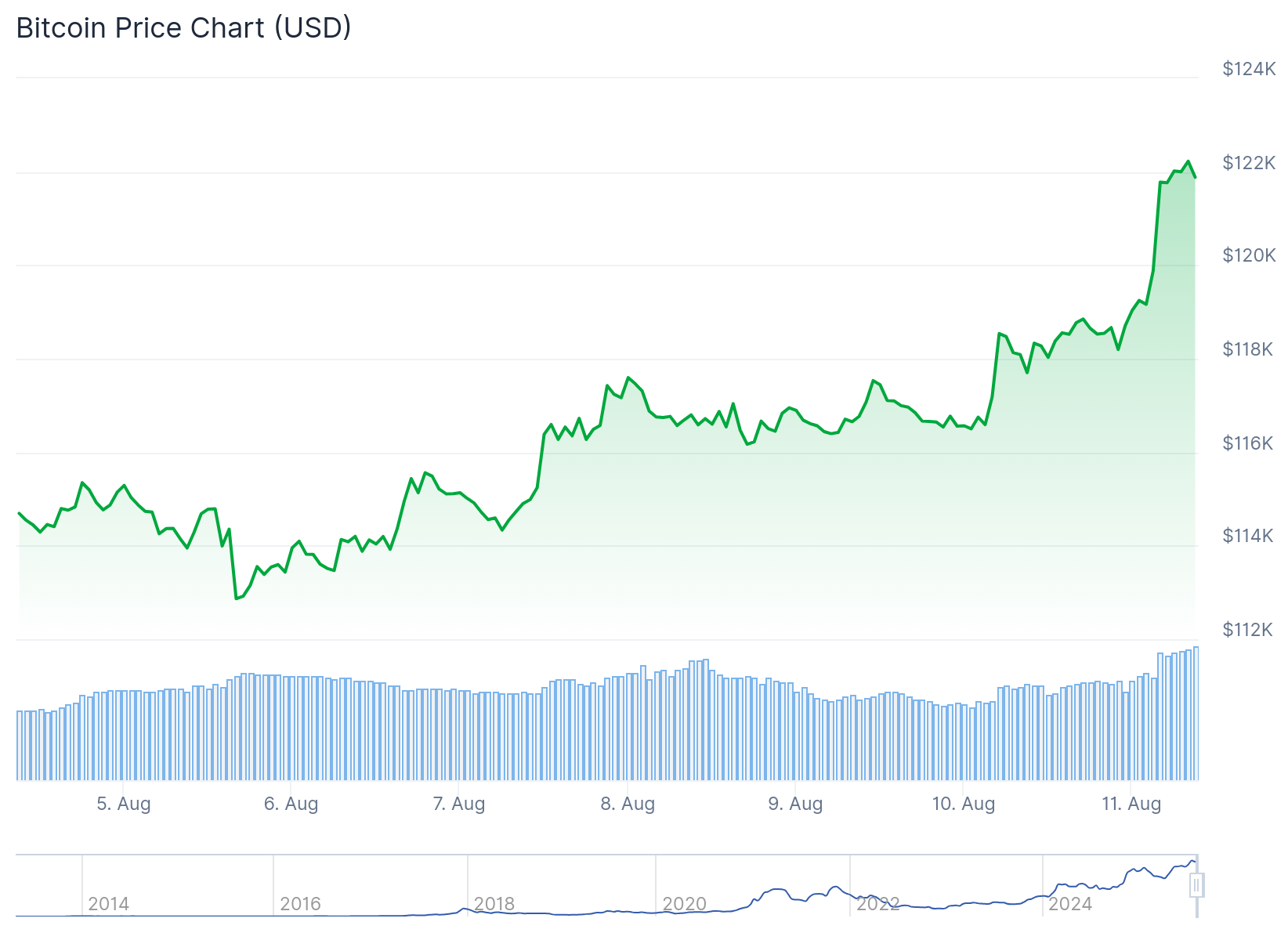

- Bitcoin price surged 3.6% in 24 hours, reaching over $122,000 and approaching its July all-time high of $122,838

- New Bitcoin addresses hit a one-year high of 364,126 daily, showing strong network adoption

- Open interest jumped 7,834 BTC as leveraged long positions increased over the weekend

- US Consumer Price Index data due Tuesday could influence Federal Reserve rate cut expectations

- Analysts predict potential rally to $130,000-$150,000 based on post-halving historical patterns

Bitcoin price has climbed over $122,000 as the cryptocurrency approaches its previous all-time high ahead of crucial US inflation data this week. The world’s largest cryptocurrency by market cap gained 3.6% in the past 24 hours.

The current price action puts Bitcoin within striking distance of its July 14 record of $122,838. Weekend trading helped the cryptocurrency recover from losses witnessed last week, with a 4.5% gain since Saturday’s open.

Derivatives data shows increased speculative activity driving the current momentum. Open interest rose by 7,834 BTC alongside higher spot and perpetual trading volumes. This surge indicates traders are taking leveraged long positions on the cryptocurrency.

Network Activity Shows Strong Growth

On-chain metrics support the bullish price movement. New Bitcoin addresses reached 364,126 on a daily basis, marking the highest level in one year according to crypto analyst Ali Martinez. This metric suggests growing network adoption and user interest.

364,126 new Bitcoin $BTC addresses created daily, the highest in a year! pic.twitter.com/GJTzrT3Yo9

— Ali (@ali_charts) August 11, 2025

The Golden cross pattern has reappeared on Bitcoin’s chart, which technical analysts view as a positive signal. Popular crypto analyst Benjamin Cowen notes that Bitcoin historically performs well in July and August during post-halving years.

Cowen’s analysis suggests Bitcoin could see some pullback in September before reaching new market cycle peaks in Q4. This pattern aligns with previous post-halving cycles the cryptocurrency has experienced.

Admittedly, there is a lot going on with this chart.

But if you look carefully at it, you'll see that #Bitcoin prints the same pattern each post-halving year.

Up in July-Aug

Down in Sep

Up into the market cycle top in Q4

Bear Market pic.twitter.com/k2VmXW0vJx— Benjamin Cowen (@intocryptoverse) August 11, 2025

Inflation Data Could Drive Next Move

Markets are focusing on Tuesday’s July Consumer Price Index report from the US Bureau of Labor Statistics. Economists expect the annual inflation rate to increase by 10 basis points to 2.8%.

The inflation data will influence Federal Reserve policy expectations. Current market pricing suggests investors anticipate rate cuts as early as September’s Federal Open Market Committee meeting.

Polymarket data shows 40% odds for two rate cuts totaling 50 basis points. Expectations for three rate cuts totaling 75 basis points have increased from 8% to over 23% in the past week.

Rising Trump tariffs are beginning to impact consumer prices in household furnishings and recreational goods categories. This could contribute to higher inflation readings in the coming months.

Sean Dawson from derivatives platform Dervie expects Bitcoin to reach $150,000 before year-end based on volatility data. He cited the confluence of macro and political factors supporting higher prices.

The cryptocurrency’s correlation with technology stocks and the NASDAQ has increased recently. Bitcoin tends to trade as a risk-on asset despite being considered digital gold by many investors.

A softer-than-expected inflation print could boost rate cut expectations and support further Bitcoin gains. However, some traders are positioning defensively through put options purchases.

An upside surprise in inflation data could trigger a “mini panic” and lead to sharp downturns according to market observers. Bitcoin closed the weekend trading session just below its all-time high level.