TLDR

- July US CPI data held at 2.7% year-over-year, boosting Federal Reserve rate cut odds to 94% for September

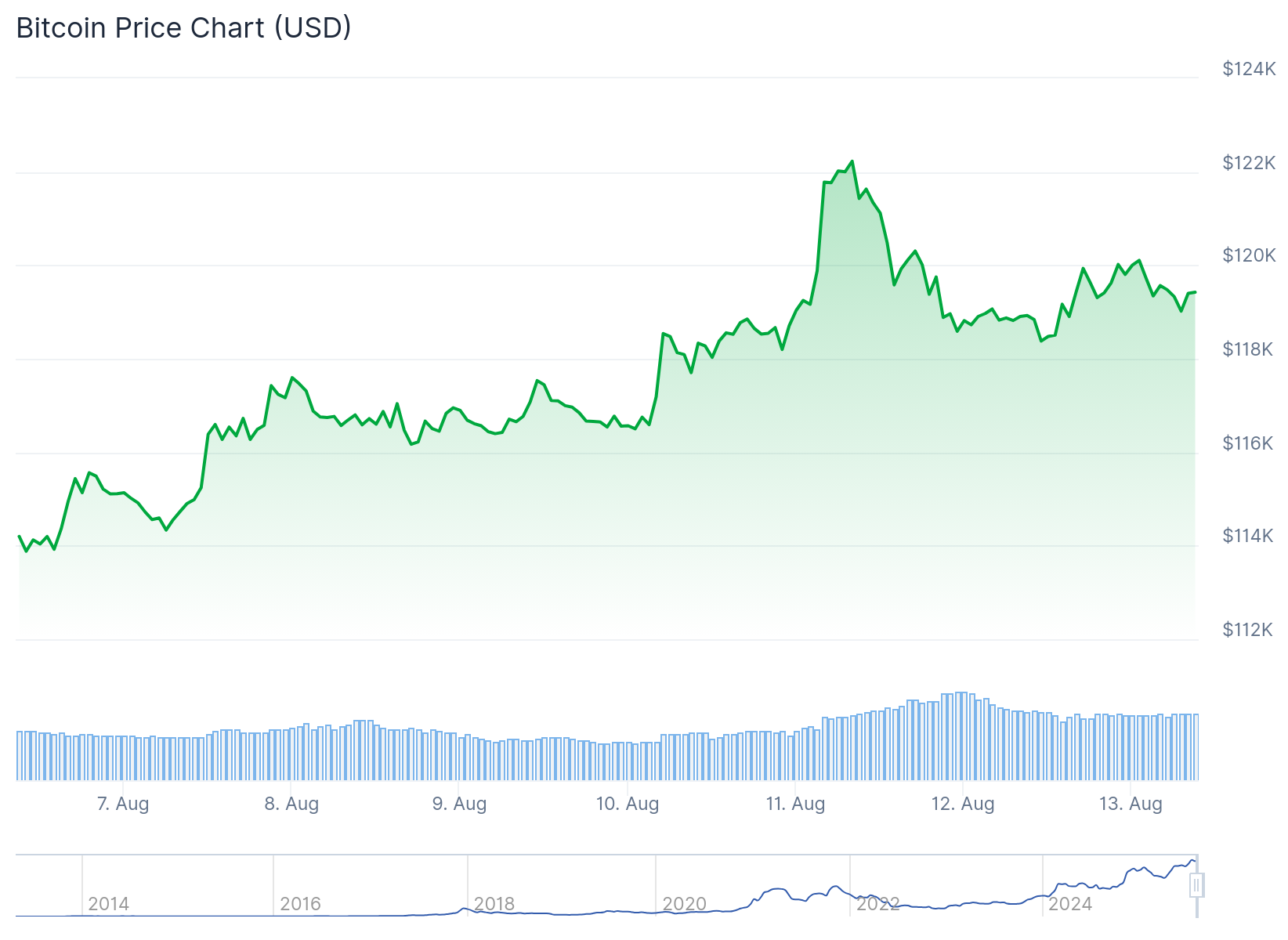

- Bitcoin price surged to $122,190 on Monday before pulling back to around $119,500 after CPI release

- Technical analysts target $130,000-$137,000 based on bullish flag pattern and trendline breakouts

- Record-high accumulation from whales and long-term holders, with 94% of Bitcoin supply currently in profit

- Key support levels identified between $117,650-$115,650, with deeper correction potentially testing $95,000

Bitcoin price action gained momentum following the release of July Consumer Price Index data that showed inflation holding steady at 2.7% year-over-year. The reading matched June levels and came in below the 2.8% forecast.

💥BREAKING:

🇺🇸 CPI DATA CAME IN AT 2.7%

EXPECTATIONS: 2.8%

RATE CUTS ARE COMING! 🚀 pic.twitter.com/mTiKrbMRj4

— Crypto Rover (@rovercrc) August 12, 2025

Core CPI excluding food and energy rose 3.1% annually, meeting expectations. Monthly CPI increased 0.2%, down from 0.3% in June, while core CPI rose 0.3% compared to the previous 0.2% gain.

The inflation data strengthened expectations for Federal Reserve monetary easing. CME FedWatch shows market odds for a September rate cut jumped to 93.9% following the release.

Lower interest rates typically reduce the opportunity cost of holding Bitcoin. This environment often draws fresh capital into cryptocurrency markets as investors seek higher-yielding assets.

Bitcoin reached Monday highs of $122,190 before quickly declining 3% to $118,500. The price failed to secure a daily close above the $120,000 level.

Following the CPI release, Bitcoin rebounded to $119,500. A decisive close above $119,982 remains crucial for confirming immediate upward momentum.

Technical Analysis Points to Higher Targets

A bullish flag pattern on the daily chart recently broke to the upside. The current pullback could represent a retest before continuation toward the primary target of $130,000.

Technical analyst Titan of Crypto projects a bullish scenario targeting $137,000. This forecast is based on a descending trendline breakout observed on Sunday.

A daily close above $120,000 would mark a historic first for Bitcoin. This milestone could potentially trigger the next phase of the current rally.

However, failure to reclaim $120,000 could invite short-term downside pressure. Immediate support lies in the $117,650 to $115,650 zone.

This support area coincides with a CME gap formed over the weekend. The gap makes this zone particularly important for traders to monitor.

Bitcoin Price Prediction

Bitcoin accumulation has reached an all-time high, driven by buying from whales and long-term holders. This occurs despite 94% of Bitcoin’s supply currently sitting in profit.

Nakamoto CEO David Bailey announced plans to purchase $1 billion worth of Bitcoin. MicroStrategy added another $18 million to its holdings, bringing total reserves to 628,946 BTC.

Network activity shows increasing demand with Active Addresses climbing 8% to 793,000 last week. Transaction fees rose 10% over the same period.

The high profit levels place the market in a zone where sentiment can shift quickly. Short-term traders may rush to lock in gains if momentum weakens.

At current levels, Bitcoin trades at $118,724, holding above both 9-day and 21-day simple moving averages. The RSI hovers near 58, indicating neutral momentum territory.

MACD lines are converging, suggesting a possible bullish crossover if buying pressure continues. The recent spike briefly pushed Bitcoin price above $120,000 before sellers stepped in.

Next week’s Producer Price Index data could provide additional clarity. Estimates call for PPI at 2.3% and Core PPI at 2.5%. Softer-than-expected readings could reinforce the bullish macro setup.

Bitcoin currently trades at $119,500 as accumulation from major players continues despite elevated profit levels across the network.