TLDR

-

Bitcoin price is near $119,000, stuck in a tight range with little movement over 24 hours.

-

Stablecoin Supply Ratio (SSR) is high, suggesting limited new capital to fuel further gains.

-

$120K–$122K is a key resistance zone, with liquidation risk on both sides.

-

Miners aren’t selling, and exchange reserves are low, pointing to reduced sell pressure.

-

A breakout above $120,700 could lead to a move toward $124K–$127K.

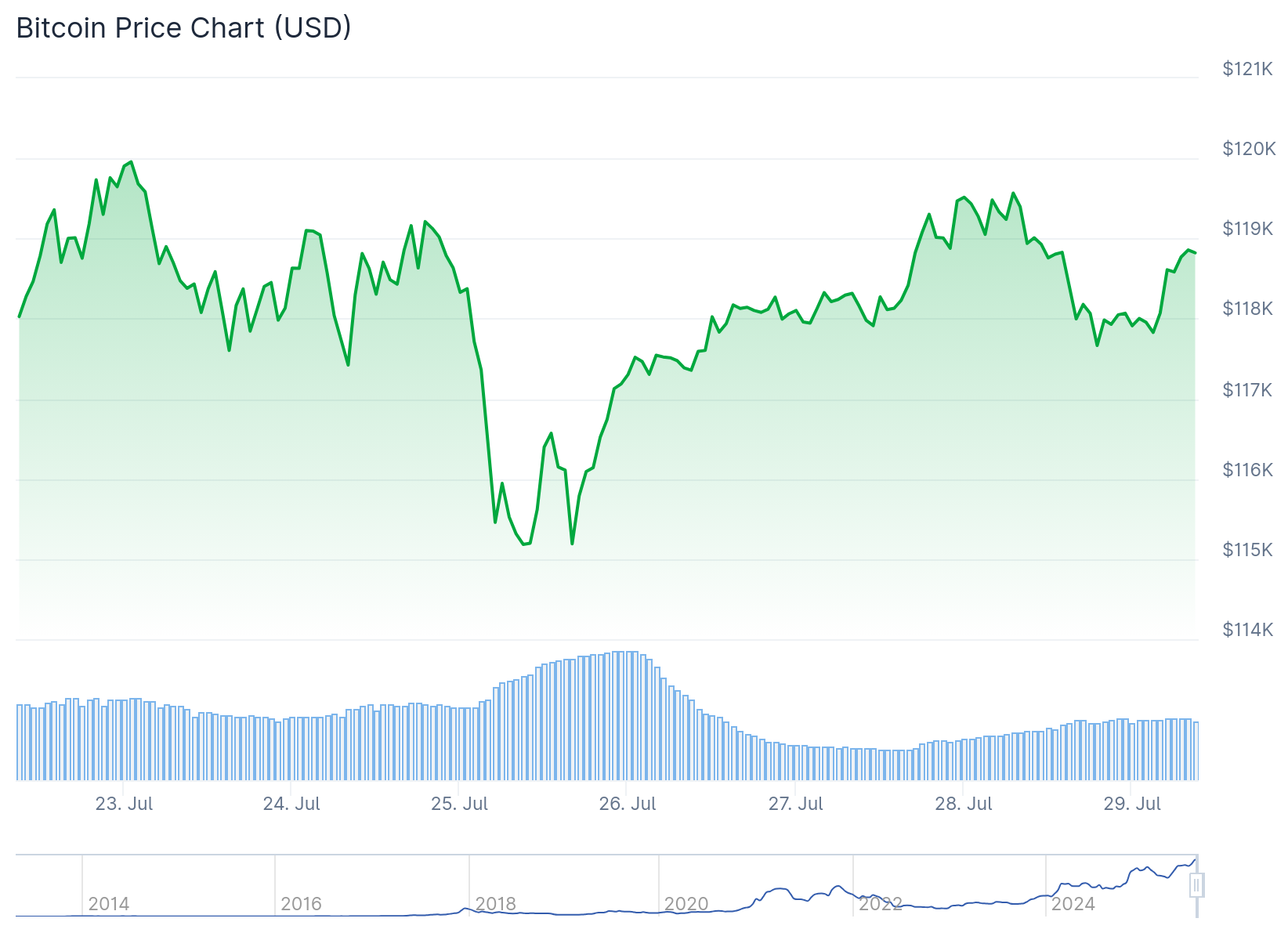

Bitcoin (BTC) is currently trading around $119,000, moving less than 1% over the past 24 hours. The price has held within a tight range between $118,000 and $119,000 for several days now.

Resistance sits at $120,666 and has proven difficult to break. This level lines up with a key Fibonacci retracement and short liquidation cluster.

At the same time, the Stablecoin Supply Ratio (SSR) has climbed to multi-month highs. This suggests less fresh capital is available to push the price higher.

SSR measures the buying power of stablecoins relative to Bitcoin. When it rises, it often signals weakening liquidity on exchanges.

Liquidity Support and Miner Behavior

Bitcoin’s ascending trendline still holds, offering support near $116,800. A breakdown below $114,800 could signal a reversal and trigger a move lower.

Exchange reserves have dropped to 2.384 million BTC, the lowest in a month. Lower reserves typically mean fewer coins are available for sale, which can reduce downside pressure.

Miners also appear to be holding. The Miners’ Position Index (MPI) dropped 32% in the past day to -1.06, which suggests miners are not rushing to take profits.

This reduces immediate selling overhead, though sentiment can shift if the rally stalls. For now, their inaction is a small relief for bulls.

Sentiment Signals and Volatility Zones

The Spent Output Profit Ratio (SOPR) stands at 1.0105, meaning most selling is happening just above breakeven. This reflects a lack of urgency to take profits, which could help support the price if demand returns.

Funding rates are slightly positive at +0.0104%, showing a small bullish lean. Open interest is stable, not rising fast but not falling either—indicating cautious involvement by traders.

Liquidation data shows key clusters around $120K–$122K. If the price pushes through this range, it could trigger short liquidations and fuel a rally toward $124,000 or more.

On the flip side, a drop below $116,000 could liquidate long positions. That might drag the price down toward $114,000 in a fast move.

The MVRV Z-score, which tracks unrealized profits, has risen to 2.83. This level has historically signaled increased risk of profit-taking, though it’s still below extremes.

While bulls are still in control of the structure, the rally now faces friction. Without new inflows, the price could remain stuck or fade.

Many indicators suggest a move is coming, but the direction remains unclear. With fewer coins on exchanges, a breakout could come quickly if demand picks up.