TLDR

- Bitcoin options open interest reached a record $63 billion, with Deribit accounting for $50 billion of the total

- Bullish strike prices dominate the market, with over $2 billion each at $120,000, $130,000, and $140,000 levels

- Around $5.1 billion worth of BTC options will expire on Friday with a balanced put/call ratio of 1.03

- Gold lost $2.5 trillion in market value, more than Bitcoin’s entire market cap, while BTC remained stable

- The max pain point for expiring options sits at $114,000, where most contracts would make a loss

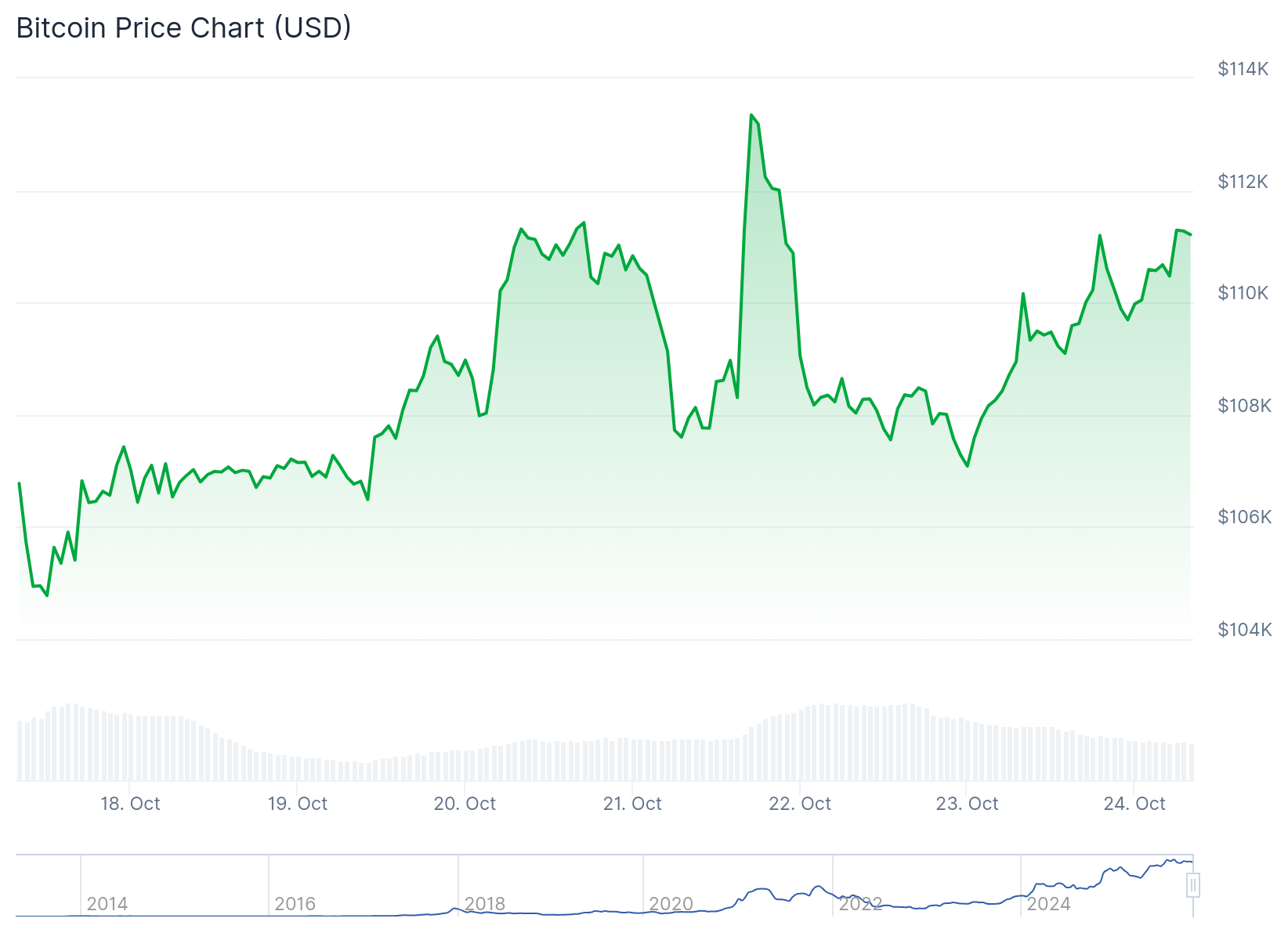

Bitcoin derivatives markets are showing strong activity with options open interest hitting a record $63 billion. The data from CoinGlass reveals traders are positioning heavily at higher strike prices.

Deribit, the world’s largest crypto options exchange, reported its own record of $50 billion in open interest. The Coinbase-owned platform controls about 80% of the total options market.

Open interest refers to the total value of all outstanding options contracts that haven’t expired or been settled yet. Record levels indicate high engagement in crypto derivatives markets.

Traders are actively positioning for major price moves. The elevated open interest suggests strong conviction about Bitcoin’s near-term direction.

Higher Strike Prices Draw Attention

Deribit noted that open interest at the $100,000 strike price reached around $2.17 billion. These contracts represent bets that Bitcoin will fall below that level.

However, bullish positions dominate at even higher levels. More than $2 billion in open interest sits at each of the $120,000, $130,000, and $140,000 strike prices.

When open interest concentrates well above current price levels, it shows traders betting on substantial upside. This pattern indicates expectations for continued price growth.

Luuk Strijers, CEO of Deribit, said call activity is building around $120,000 and above. Traders appear to be positioning for potential upside volatility or gamma exposure.

Friday Expiration Looms

Around $5.1 billion worth of Bitcoin options will expire on Friday on Deribit. The contracts have a put/call ratio of 1.03.

This ratio means long and short contract sellers are evenly matched. Neither bulls nor bears have a clear advantage heading into expiration.

The max pain point sits at $114,000. This is the strike price where most contracts would make a loss.

Deribit reported that positioning is balanced overall. Puts slightly outweigh calls, suggesting traders are hedging downside risk.

However, they’re not positioning for a major sell-off. The market structure indicates cautious optimism rather than fear.

Gold Experiences Sharp Correction

Financial analyst Tom Tucker revealed that gold lost $2.5 trillion in market value. This drawdown is larger than Bitcoin’s entire market capitalization.

Whoa. Gold crashed $2.5 TRILLION; that's more than the entire value of Bitcoin!

So much for the ultimate safe-haven being rock-solid.

All this market chaos has the crypto Fear & Greed Index flashing "Extreme Fear."

Stay cautious, $BTC may follow! pic.twitter.com/TRshuliRVv

— Tom Tucker (@WhatzTheTicker) October 22, 2025

The crypto Fear and Greed Index is showing extreme fear. Sentiment across digital assets is near panic levels.

CryptoMichNL, CIO and Founder of MNFund and MNCapital, observed that gold corrected by more than 8% in a single day. Bitcoin initially moved up but gave back most gains.

The volatility in gold stems from its status as a massive outlier after an incredible parabolic run. If gold has topped out, capital could rotate to other assets.

A soft Consumer Price Index print could trigger potential rate cuts. The end of the US government shutdown would also help.

That correction lasted roughly seven months with a 20% decline. During that period, Bitcoin consolidated below $10,000 before surging to new highs.

Van Straten believes Bitcoin’s current consolidation above $100,000 may extend mid-cycle. Strong parallels exist between now and the 2020 period with gold corrections and crypto liquidation events.