TLDR

- Bitcoin price shows stability above $112,000 as short-term holders reduce profit-taking activity

- On-chain data reveals 70% of short-term holders remain profitable with balanced market conditions

- Technical analysis identifies critical resistance at $115,500 with key support levels at $112,000-$110,500

- Analysts including Tom Lee maintain $250,000 Bitcoin price targets for 2025 despite recent pullback

- Market metrics indicate relatively balanced position similar to previous Bitcoin bull market phases

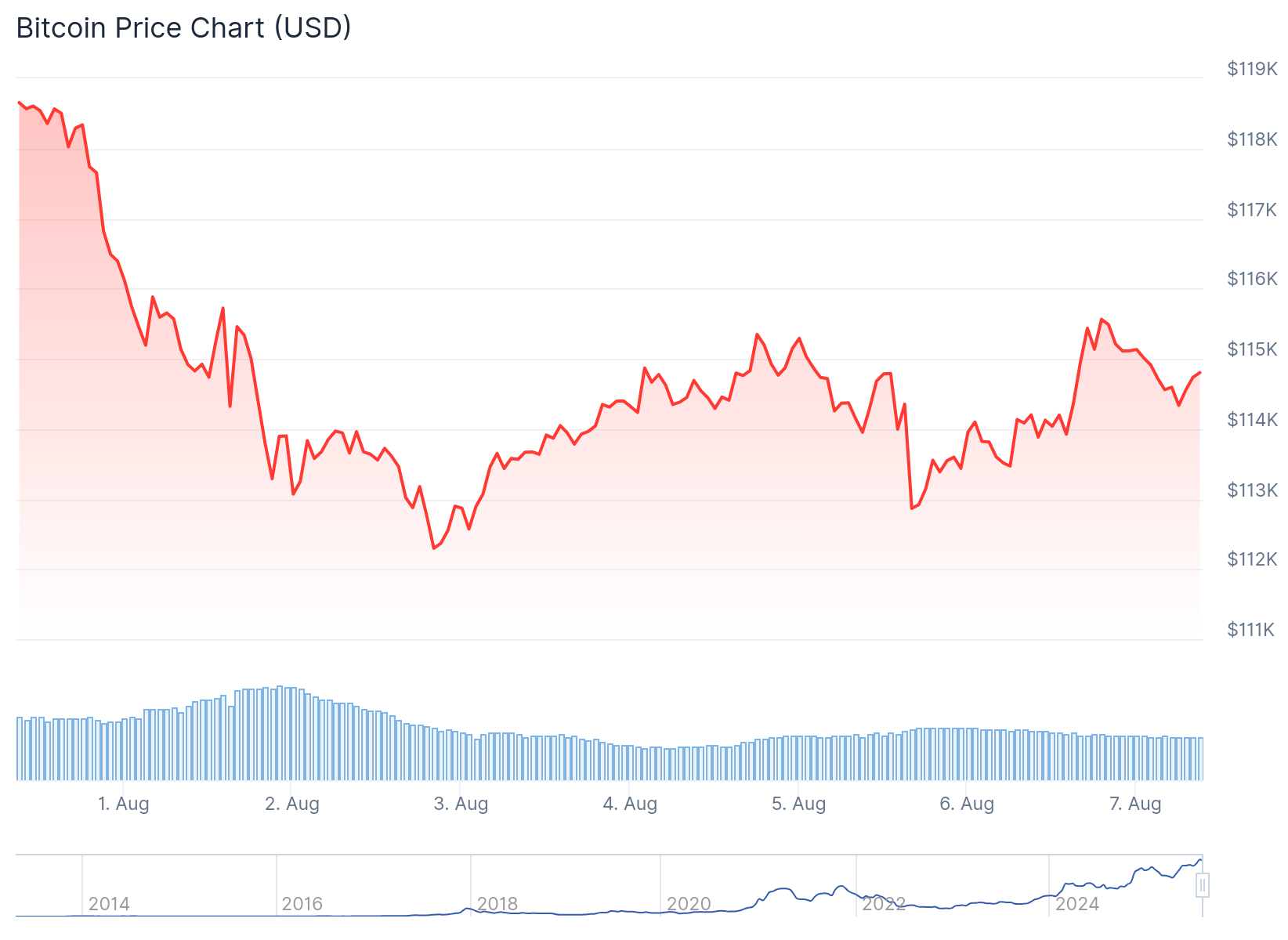

Bitcoin price action today shows the cryptocurrency navigating critical technical levels as market dynamics shift in favor of reduced selling pressure. The world’s largest cryptocurrency by market cap is currently trading around $114,766 following a recovery from weekend lows.

On-chain analytics platform Glassnode reports that Bitcoin short-term holders have significantly reduced their profit-taking activities. These market participants, classified as holders maintaining positions for less than 155 days, represent a crucial segment for Bitcoin price movement analysis.

The latest Bitcoin market data shows short-term holder spent volume dropping to 45%, falling below neutral market thresholds. This metric measures the proportion of recent Bitcoin buyers who are selling their holdings while in profit.

Short Term Bitcoin holders have flipped from profit-taking mode to loss-taking mode.

Many recent top buyers and 'Weaker' hands are selling around their buy-in price and saying "get me out".

What we want to see from here is a short, sharp dip into the 🟥 zone (to flush out the… pic.twitter.com/9yczdG58G8

— _Checkonchain (@_checkonchain) August 7, 2025

Glassnode’s Bitcoin market analysis indicates the cryptocurrency has reached a “relatively balanced position” in current market conditions. The data shows 70% of short-term holder Bitcoin supply remains held in profit despite recent price volatility.

This market balance creates “an almost even split of profit and loss taking in coins which are on the move,” according to the analytics firm’s latest Bitcoin price report.

Historical Bitcoin price patterns suggest current market conditions align with typical behavior seen during previous bull market cycles. Glassnode emphasized these conditions represent normal market dynamics rather than unusual trading patterns.

Bitcoin Technical Analysis Shows Key Resistance Levels

Bitcoin price chart analysis reveals critical resistance around the $115,500 level that could determine the cryptocurrency’s next major move. This technical zone includes multiple bearish factors including a descending trendline and the 100-hour simple moving average.

Technical indicators show Bitcoin price structure maintaining a lower-high, lower-low pattern that keeps short-term momentum tilted bearish. The Relative Strength Index on shorter Bitcoin price timeframes continues trading below 50, indicating ongoing selling pressure among day traders.

The 50% Fibonacci retracement level from Bitcoin’s recent decline reinforces resistance in the $115,500 area. Bitcoin price analysis shows this confluence of technical factors creates a significant hurdle for bullish continuation.

Current Bitcoin support levels are identified at $112,500 and $110,500 based on recent trading activity. Bitcoin price action below $112,000 could trigger a test of broader support around $108,500 according to technical analysis.

Bitcoin Price Predictions Remain Bullish for 2025

Despite recent Bitcoin price consolidation, several prominent analysts maintain optimistic long-term Bitcoin price forecasts. Fundstrat co-founder Tom Lee recently reinforced his $250,000 Bitcoin price prediction for 2025.

During a recent interview on the Coin Stories podcast, Lee stated his Bitcoin price outlook: “I think Bitcoin should really build upon this $120K level before the end of the year. $200,000—maybe even $250,000—is still on the table.”

Watch this video! You will never worry about your $MSTR shares again.

Key points – Tom Lee:

Changing the reality of the stock market!

On track to become the largest company!

Only $BTC on the balance sheet? No problem! History has seen this before. pic.twitter.com/e4bRU1cYTZ— Romeo (@RomeoInvest) August 5, 2025

Lee’s Bitcoin price analysis points to increasing institutional Bitcoin demand and evolving market structure as key factors supporting higher Bitcoin prices. He suggests traditional four-year Bitcoin halving cycles may have less impact due to market maturation.

Alternative Bitcoin price predictions show more conservative targets from other market analysts. 10x Research analyst Markus Thielen forecasts Bitcoin reaching $160,000, while major financial institutions including Standard Chartered and Bernstein align their Bitcoin price targets around $200,000.

Some Bitcoin market researchers believe the current halving cycle may peak in late 2025 or early 2026, following traditional post-halving Bitcoin bull market patterns.

Bitcoin futures premiums have declined below 7%, indicating reduced speculative interest in near-term Bitcoin price movements. Recent whale Bitcoin deposits to exchanges have increased, typically viewed as bearish Bitcoin price signals reflecting potential selling pressure.

However, Bitcoin on-chain data shows long-term holders maintain profitable positions according to latest market analysis. Structural factors including upcoming Bitcoin halving events and continued institutional Bitcoin adoption support the long-term bullish Bitcoin price thesis.

Bitcoin price recovery from weekend lows near $112,044 demonstrates underlying market strength as the cryptocurrency works to establish higher support levels.