TLDR

- Bitcoin dominance has fallen from 64.5% to 60.9% over five days, marking a 4-month low

- Ethereum has gained 27% this week and posted four consecutive weekly gains against Bitcoin

- Altcoin market cap has surged 41% from $1.06 trillion in June to $1.5 trillion currently

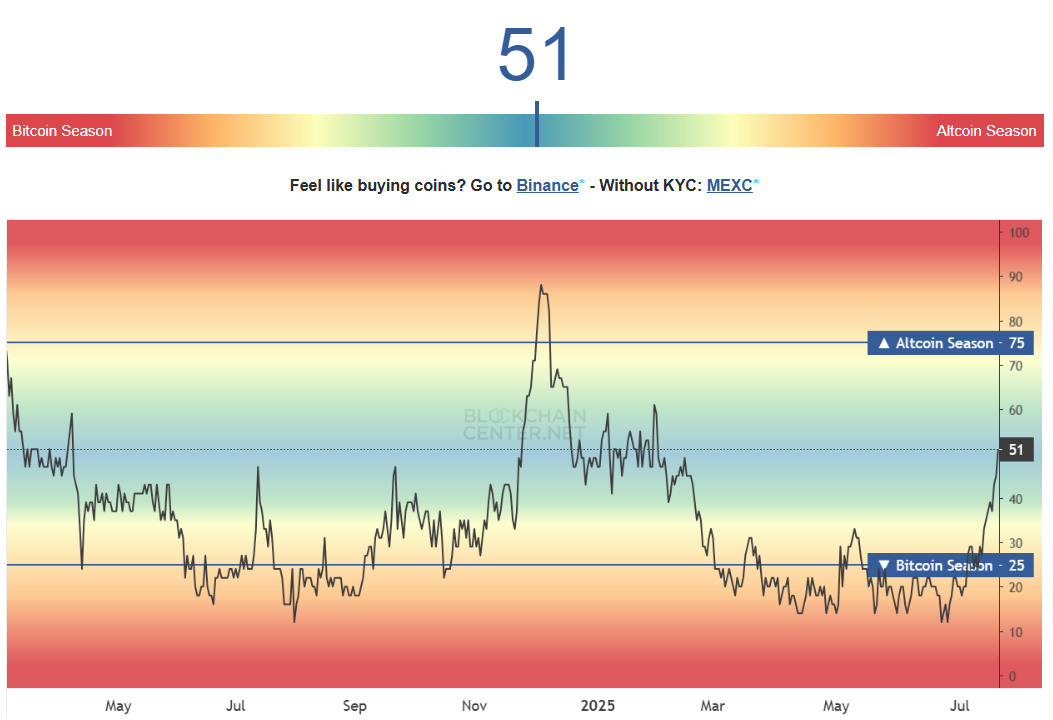

- The altcoin season index sits at 51, approaching but not yet reaching the 75 threshold for official altseason

- Capital flows shifted toward altcoins in early July for the first time in months

Bitcoin’s grip on the cryptocurrency market is loosening as altcoins gain momentum for the first time in months. The world’s largest cryptocurrency has seen its market dominance drop sharply to 60.9%, down from 64.5% just five days ago.

This decline represents the lowest point for Bitcoin dominance in four and a half months. The shift comes as investors begin rotating capital away from Bitcoin and into alternative cryptocurrencies.

Ethereum is leading this charge with impressive performance metrics. The second-largest cryptocurrency has posted four consecutive weeks of gains against Bitcoin, with a 27% surge this week alone.

The ETH/BTC trading pair has reached 0.03153, marking a clear breakout after months of consolidation. This strength has pushed Ethereum toward the $4,000 price level while Bitcoin remains relatively flat around $118,301.

Altcoin Market Cap Surges Over 40%

The broader altcoin market has experienced substantial growth since June. Total altcoin market capitalization has jumped from $1.06 trillion to approximately $1.5 trillion at current levels.

This represents a surge of more than 41% in just over a month. The growth indicates increasing investor confidence in alternative cryptocurrencies beyond Bitcoin.

Capital flow data from Glassnode shows that money started moving into altcoins in early July. Short-term averages rose above long-term ones for the first time in months, confirming the shift in investor sentiment.

The altcoin season index currently sits at 51, having crossed the halfway mark. While this shows progress, it remains below the critical threshold of 75 that would signal an official altcoin season.

Market Indicators Point to Potential Shift

An altcoin season is confirmed when 75% of the top 50 cryptocurrencies outperform Bitcoin over a 90-day period. Currently, only 50% of these altcoins have surpassed Bitcoin’s returns, leaving room for further growth.

The index tracks performance relative to Bitcoin and helps identify when the broader crypto market enters a phase favoring altcoins. Recent weeks have shown steady improvement in this metric.

Many altcoins have reached multi-month highs following Ethereum’s strong performance. If more tokens follow Ethereum’s lead and outperform Bitcoin in the coming weeks, the altseason threshold could be reached by early next month.

Trading data suggests this momentum shift began in early July when capital inflows first started favoring altcoins over Bitcoin. This timing coincides with Ethereum’s technical breakout against Bitcoin.

Despite Bitcoin’s loss in market share, its price has remained stable rather than declining. This indicates a healthy market rotation rather than a sell-off from the leading cryptocurrency.

However, caution remains warranted as many altcoins trade at multi-month highs. Any sharp profit-taking could reverse recent gains and delay the onset of a true altcoin season, potentially pushing it further into Q3 2025.