TLDR

- Bitcoin dropped 3.8% to around $104,000 after Trump threatened Iran’s Supreme Leader and called for unconditional surrender

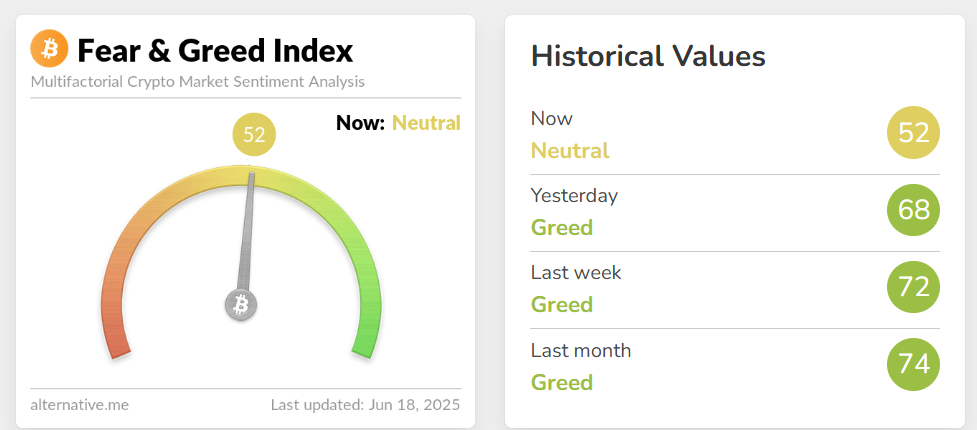

- Crypto market sentiment shifted from “Greed” to “Neutral” on the Fear & Greed Index for the first time in 11 days

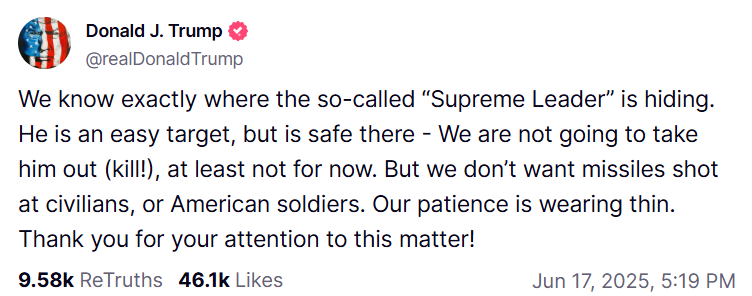

- Trump posted on Truth Social that he knows where Iran’s leader is hiding and called him an “easy target”

- Crypto stocks fell 2-7% including Coinbase, MicroStrategy, and major Bitcoin mining companies

- Polymarket odds of U.S. military action against Iran before July jumped to 65%

Bitcoin and the broader cryptocurrency market dropped sharply on Tuesday after President Donald Trump made threatening statements toward Iran’s Supreme Leader. The comments sparked fresh concerns about potential military conflict in the Middle East.

Trump posted on his Truth Social platform that he knows exactly where Iran’s leader Ali Khamenei is hiding. He called the Iranian leader an “easy target” but said the U.S. would not “take him out” for now.

The president also demanded Iran’s unconditional surrender and warned that American patience was wearing thin. He called for residents of Tehran to evacuate the city and convened the National Security Council.

Bitcoin fell from $104,310 to $103,553 within an hour of Trump’s post before recovering slightly. The cryptocurrency was trading around $104,000 at press time, down 3.8% over 24 hours.

Other major cryptocurrencies also declined. Ethereum dropped 7% to around $2,533 while Solana fell by the same percentage. XRP slipped 1.3% to $2.14 during the same period.

The broader crypto market reflected the uncertainty. The CoinDesk 20 index lost 6.1% as investors moved away from risk assets.

Market Sentiment Shifts

The Crypto Fear & Greed Index fell 16 points from “Greed” to “Neutral” territory. This marked the first neutral reading in 11 days, scoring 52 out of 100.

Crypto-related stocks also declined across the board. Coinbase, MicroStrategy, and Circle all dropped 2-3% during trading.

Bitcoin mining companies saw larger losses. Bitdeer, Riot Platforms, CleanSpark, HIVE, and Hut 8 all fell between 6-7%.

Geopolitical Risk Concerns

The market reaction came as tensions between Israel and Iran have escalated. Israel conducted dozens of airstrikes on Iran last Thursday night.

Iran retaliated with drone and missile strikes against Israel. Trump’s comments raised fears that the U.S. could become directly involved in the conflict.

Polymarket betting odds for U.S. military action against Iran before July jumped to 65%. The president cut short a G7 summit to focus on the Middle East situation.

Analysts warn that oil prices could spike if the conflict affects Iran’s production capacity. This could create new inflationary pressures for the U.S. economy.

Some crypto analysts believe Bitcoin may retest the psychological $100,000 level. Doctor Profit predicted the cryptocurrency could fall as low as $93,000 in coming days.

#Bitcoin will drop below $100,000 in the coming days. Targets set are 93-95k, Stock market SP500 will follow with a 7-10% drop as well. More red candles ahead of us!

We will see a massive bounce after all of this. Some necessary pain is needed now

— Doctor Profit 🇨🇭 (@DrProfitCrypto) June 17, 2025

Other traders remain optimistic about Bitcoin’s ability to maintain support above $100,000. They view recent price action as building a foundation for future gains.

Bitfinex analysts said Bitcoin remains at risk of further declines. They noted the cryptocurrency must hold above $102,000 to stay on track for a potential rebound.